TL;DR

Insurance mis-selling in India is a widespread problem causing significant financial losses. This comprehensive guide helps you identify, prevent, and address mis-selling across various insurance types. Learn about recent regulatory changes, digital fraud tactics, and steps to protect yourself. Use expert tips to make informed decisions and seek help if you’ve been mis-sold a policy.

What is Insurance Mis-Selling?

Insurance mis-selling occurs when an agent or company sells you a policy through false information, incomplete details, or high-pressure tactics. In India, this unethical practice affects millions of consumers, leading to the purchase of unsuitable policies, substantial financial losses, and unnecessary stress. According to a 2023 IRDAI report, an estimated 15% of insurance policies sold in India may involve some form of mis-selling, highlighting the scale of this issue.

Mis-selling can happen across all insurance types:

- Life Insurance: Agents may aggressively push expensive whole life policies to young individuals who only require term insurance, resulting in higher premiums for unnecessary coverage.

- Health Insurance: Critical illness exclusions or waiting periods might be hidden or downplayed, leaving policyholders vulnerable when they need coverage the most.

- Motor Insurance: Unnecessary add-ons may be included without proper explanation, inflating the premium without providing meaningful additional protection.

- Property Insurance: Coverage limits or exclusions might be misrepresented, leading to inadequate protection in case of significant damage or loss.

Importance of Recognizing Mis-Selling

- Financial Protection: By recognizing mis-selling, you can avoid unnecessary policies and potential financial losses that could impact your long-term financial health.

- Empowerment: Understanding mis-selling tactics empowers you to ask the right questions and demand complete information, putting you in control of your insurance decisions.

- Informed Decisions: Recognizing mis-selling enables you to make educated choices about your insurance needs, ensuring you get the coverage that truly suits your situation.

- Right Coverage: By avoiding mis-sold policies, you can ensure that your insurance truly meets your requirements, providing protection when you need it most.

- Peace of Mind: Gaining the ability to spot mis-selling gives you confidence in your insurance decisions, reducing stress and anxiety about your coverage.

Potential Losses from Mis-Sold Policies

- Financial Loss: Mis-sold policies often result in wasting money on unsuitable premiums, which can accumulate to significant amounts over time.

- Lack of Coverage: When mis-sold a policy, you might find yourself missing essential protection precisely when you need it most, leaving you vulnerable to financial shocks.

- Opportunity Cost: The funds tied up in inappropriate insurance policies could be better invested elsewhere, potentially yielding higher returns or providing more relevant protection.

- Emotional Stress: Dealing with the aftermath of a mis-sold policy causes anxiety and frustration, especially when facing claim rejections or inadequate coverage.

- Difficulty in Claiming Benefits: Mis-sold policies often lead to challenges in receiving expected payouts, as the actual terms may differ significantly from what was initially presented.

Types of Mis-Selling and Common Tactics

- Inadequate Disclosure: Agents may not fully explain policy terms or exclusions, leaving you unaware of critical aspects of your coverage.

- Pressure Tactics: You might be rushed to buy a policy without proper consideration, often under the guise of limited-time offers or impending premium increases.

- Incomplete Information: Agents may provide only partial details about coverage, highlighting benefits while glossing over limitations or drawbacks.

- Misleading Claims: False or exaggerated statements about policy benefits or returns are sometimes used to make a sale, setting unrealistic expectations.

- Misrepresentation of Benefits: Agents might overstate policy features or potential returns, particularly in investment-linked insurance products.

- Digital Deception: Misleading online advertisements or targeted social media campaigns can lure unsuspecting consumers into inappropriate policies.

- Exploiting Financial Illiteracy: Some agents take advantage of customers who don’t understand complex financial products, selling them policies they don’t need or can’t afford.

Case Study: The ULIPs Controversy

In 2010, India witnessed a major mis-selling scandal involving Unit Linked Insurance Plans (ULIPs). Insurance agents sold these complex products as short-term high-return investments, often hiding their long-term nature and high charges. This widespread mis-selling led to significant losses for many investors and prompted stricter IRDAI regulations to protect consumers.

Differences Between Genuine Sales and Mis-Selling

| Aspect | Genuine Sales | Mis-Selling |

| Sales Approach | Transparent and informative | High-pressure and coercive |

| Disclosure of Terms | Full disclosure of policy terms and conditions | Incomplete or misleading disclosure |

| Claims about Benefits | Realistic and truthful claims | Exaggerated or false claims |

| Suitability of Products | Products tailored to customer’s needs and profile | Selling unsuitable products to vulnerable or uninformed customers |

| Customer Understanding | Customer fully understands the policy | Customer confused or unaware of important policy details |

| Intent of Agent/Company | Focus on customer welfare and satisfaction | Focus primarily on sales targets and commissions |

Recent Regulatory Changes

In 2023, IRDAI introduced new guidelines to combat insurance mis-selling:

- Mandatory video recording of policy sales for high-value policies has been implemented to ensure transparency and accountability in the sales process.

- The cooling-off period for life insurance policies has been increased from 15 to 30 days, giving consumers more time to review and cancel policies if needed.

- Stricter penalties have been introduced for companies and agents involved in mis-selling, including hefty fines and license cancellations.

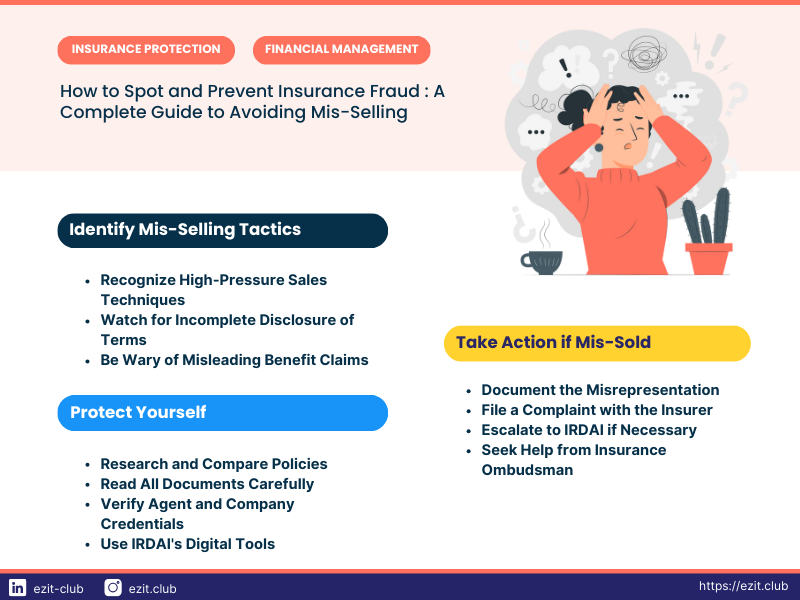

How to Ensure You Are Not Mis-Sold

- Research and Compare: Before purchasing any insurance policy, thoroughly research different options available in the market and compare their features, benefits, and terms to find the best fit for your needs.

- Ask for Complete Information: Request detailed explanations about coverage, exclusions, premiums, and any associated costs, ensuring you have a comprehensive understanding of the policy.

- Read the Fine Print: Carefully review the entire policy document, paying special attention to limitations, exclusions, and claim procedures to avoid future surprises.

- Verify Agent Credibility: Always check the insurance agent’s IRDAI license and track record to ensure you’re dealing with a legitimate and reputable professional.

- Seek Independent Advice: Consult a financial advisor who is not affiliated with the insurer for unbiased recommendations based on your financial situation and needs.

- Leverage Digital Tools: Utilize IRDAI’s online premium calculators and policy comparison tools to make informed decisions based on objective data.

- Understand Your Needs: Clearly define your insurance requirements before engaging with agents to avoid being swayed by unnecessary coverage.

- Be Wary of Pressure: Take your time to decide, and be cautious of agents pushing for immediate decisions, as rushed choices often lead to regrets.

What to Do If You Are a Victim of Insurance Mis-Selling

- Identify the Issue: Clearly document how the policy was misrepresented, gathering all relevant communications and policy documents.

- Contact the Insurance Company: File a formal complaint with the insurer’s Grievance Redressal Officer (GRO), providing detailed information about the mis-selling incident.

- Escalate the Complaint: If unsatisfied with the insurer’s response, approach IRDAI’s Integrated Grievance Management System (IGMS) for further assistance.

- Seek Legal Advice: Consult a lawyer specializing in insurance law if the issue remains unresolved, especially for cases involving significant financial loss.

- Approach the Insurance Ombudsman: Submit a formal complaint to the Insurance Ombudsman for an independent review and resolution of your case.

- Use Social Media Responsibly: While sharing your experience online can create awareness, be cautious not to make defamatory statements that could lead to legal issues.

Digital Literacy and Insurance Mis-Selling Prevention

As insurance sales increasingly move online, digital literacy is crucial for preventing mis-selling:

- Verify the authenticity of insurance websites and apps before providing any personal or financial information.

- Be cautious of policies sold exclusively through social media or messaging apps, as these channels are often used for scams.

- Use official IRDAI channels to verify policy and agent information, ensuring you’re dealing with legitimate entities.

- Be wary of unsolicited insurance offers via email or SMS, as these are often phishing attempts or mis-selling tactics.

Conclusion

Understanding and recognizing insurance mis-selling is vital for your financial well-being in today’s complex insurance landscape. Stay informed about different insurance types, evaluate policies carefully, and don’t hesitate to seek expert advice when needed. Remember, a well-informed consumer is the best defense against mis-selling and financial fraud.

Protect Yourself with Expert Guidance

Remember, your financial security is paramount. Stay vigilant, ask questions, and don’t let pressure tactics rush you into decisions. With the right knowledge and approach, you can secure the insurance coverage you truly need and deserve, safeguarding your financial future against the risks of mis-selling.

To protect yourself from insurance mis-selling and ensure you make informed decisions, consult our expert advisors on the EZIT Guardian App. Our personalized guidance helps you understand your insurance policies, recognize signs of mis-selling, and take necessary actions. Don’t let mis-selling disrupt your peace of mind—get started with EZIT today by downloading the EZIT app from the Google Play Store & App Store today.