TL;DR

In India, the transfer of assets after death follows two distinct paths: testamentary succession through a valid will, or intestate succession when no will exists. This choice significantly impacts how quickly your family can access assets, the costs they incur, and whether your wishes are fulfilled. Digital solutions like EZIT Guardian now make it easier to plan and protect your family’s inheritance through secure document storage and nominee management.

Introduction

Estate planning is an essential aspect of securing your family’s financial future. It involves deciding how your assets will be managed and distributed after your passing. Two key concepts in estate planning are testamentary succession and intestate succession. Understanding the differences between these two types of succession is crucial in ensuring your wishes are carried out and your loved ones are protected.

What is Testamentary Succession?

Testamentary succession is the process of distributing a person’s assets according to their last will and testament. When you create a will, you have full control over choosing your beneficiaries and specifying how your assets should be allocated. This type of succession requires the probate of the will, which is generally a smoother legal process when the will is clearly written and properly executed.

Advantages of Testamentary Succession

- Control over asset distribution: You can specify exactly how you want your assets to be divided among your chosen beneficiaries.

- Flexibility in beneficiary selection: You can include anyone you choose as a beneficiary, not just legal heirs.

- Ability to add conditions: You can stipulate certain conditions that must be met for beneficiaries to receive their inheritance, such as reaching a certain age or achieving specific milestones.

What is Intestate Succession?

Intestate succession occurs when a person passes away without leaving a valid will. In this case, the distribution of assets is determined by applicable succession laws, which vary by jurisdiction. The deceased has no control over how their assets are allocated, and the legal process to establish rightful heirs can be more complex compared to probating a will.

Drawbacks of Intestate Succession

- Lack of control: The deceased has no say in how their assets are distributed.

- Limited beneficiaries: Only legal heirs, as defined by succession laws, can inherit the assets.

- Inflexibility: The distribution of assets must follow fixed legal formulas, which may not align with the deceased’s wishes or family dynamics.

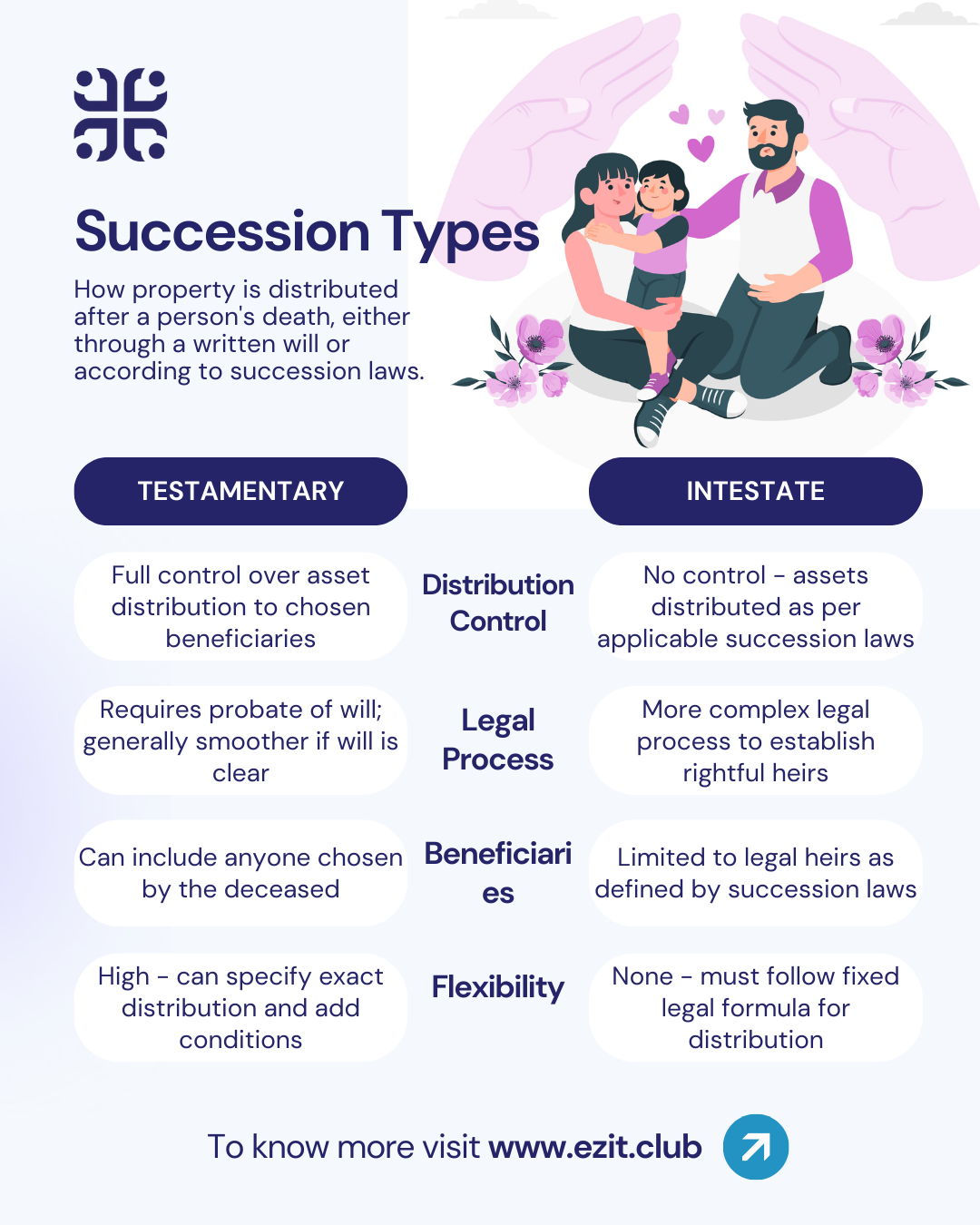

Testamentary vs Inestate Succession

| Feature | Testamentary Succession | Intestate Succession |

|---|---|---|

| Distribution Control | Full control by the deceased through a will | No control – follows legal succession laws |

| Legal Process | Requires probate of the will; smoother if the will is clear | More complex process to establish rightful heirs |

| Beneficiaries | Can include anyone chosen by the deceased | Limited to legal heirs defined by succession laws |

| Flexibility | High – can specify distribution and add conditions | None – must follow fixed legal formulas |

| Family Dynamics | Can account for unique family situations and relationships | May not consider complex family dynamics |

| Asset Protection | Can include provisions to protect assets from creditors or misuse | No built-in asset protection measures |

The Importance of Estate Planning

Creating a comprehensive estate plan is crucial for ensuring your family’s financial security and avoiding potential conflicts. Key components of an effective estate plan include:

- Creating a legally valid will: Ensure your will is properly witnessed, signed, and clearly states your wishes.

- Keeping your will updated: Review and update your will after major life events or changes in your assets.

- Communicating with your family: Discuss your plans with your loved ones to minimize confusion and disputes.

- Considering trusts: For more complex estates, a trust can provide additional control and protection.

- Seeking professional advice: Consult with estate planning professionals for personalized guidance.

Tips for Navigating the Estate Planning Process

- Start early: Don’t wait until it’s too late to begin planning for your family’s financial future.

- Be thorough: Include all of your assets in your estate plan, including property, investments, and sentimental items.

- Choose executors and trustees wisely: Select individuals you trust to carry out your wishes and manage your assets responsibly.

- Consider tax implications: Work with a financial advisor or tax professional to minimize the tax burden on your estate and beneficiaries.

- Store documents securely: Keep your will and other important documents in a safe place and inform your executor of their location.

Frequently Asked Questions about Succession Types & Planning

If you pass away without a valid will, your assets will be distributed according to intestate succession laws, which may not align with your preferences.

Yes, you can update or amend your will at any time, as long as you have the mental capacity to do so and follow the proper legal procedures.

To create a legally binding will, ensure it is properly witnessed and signed, clearly states your wishes, and complies with your state’s legal requirements. Consider having it reviewed by a legal professional.

An executor is responsible for managing and distributing your assets according to your will, while a trustee manages assets placed in a trust for the benefit of your chosen beneficiaries.

It’s recommended to review your estate plan every 3-5 years or after significant life events such as marriage, divorce, the birth of a child, or major changes in your assets.

Conclusion

Understanding the differences between testamentary and intestate succession is crucial for creating a comprehensive estate plan that protects your family’s financial future. By taking control of your asset distribution through a well-drafted will and seeking professional guidance, you can ensure your wishes are carried out and minimize potential conflicts among your loved ones.

EZIT Guardian: Your Partner in Securing Your Family's Financial Well-being

At EZIT Guardian, we understand the importance of estate planning in providing financial security for your family. Our comprehensive suite of services is designed to simplify the estate planning process and give you peace of mind. With our secure document storage, nominee management, and access to expert legal and financial advice, you can feel confident that your family’s future is protected.

Start your 90-day free trial with EZIT Guardian today and take the first step towards securing your family’s financial future. Download the EZIT Guardian app from the Google Play Store & App Store today to schedule a consultation and take the first step to start securing your legacy.