TL;DR

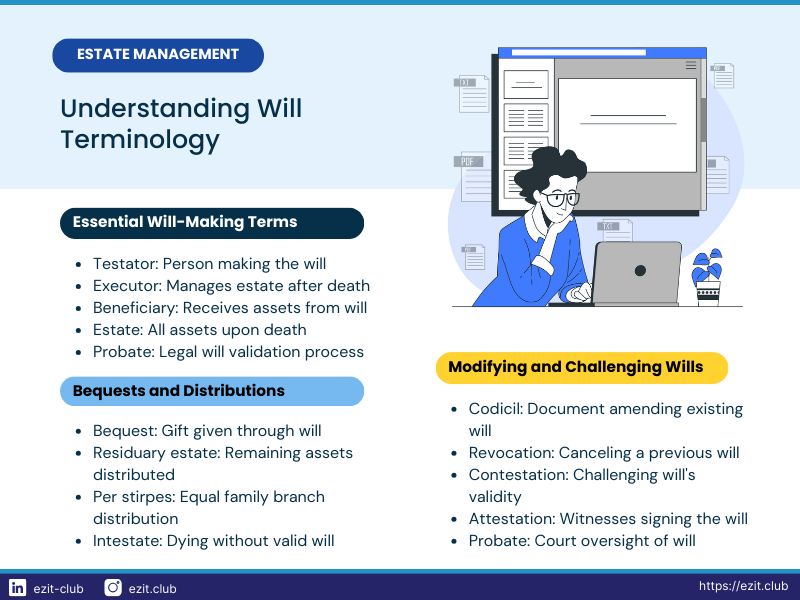

Wills use specific legal terms that can be confusing. This guide explains common will terminology in simple language, covering words like testator, executor, beneficiary, and probate. Understanding these terms helps you create a clear will and avoid misunderstandings.

Introduction

Creating a will involves legal language that can be difficult to understand. You don’t need a law degree to understand your will, though. This guide breaks down common will terminology into everyday language, helping you approach the will-making process with confidence.

Key Will Terminology Explained

1. Testator

What it means: The person who makes the will.

In simple terms: You, if you’re writing your own will.

A testator must be of legal age (usually 18) and of sound mind when creating the will. In legal terms, being of “sound mind” means you understand:

- What a will is and what it does

- What property you own

- Who your family members and potential beneficiaries are

- How your will distributes your property

2. Executor

What it means: The person named in the will to manage the estate and carry out the will’s instructions.

In simple terms: Your chosen representative who’ll handle your affairs after you’re gone.

An executor’s responsibilities include:

- Gathering and managing the deceased’s assets

- Paying debts and taxes

- Distributing assets to beneficiaries as specified in the will

- Representing the estate in legal matters

You can name more than one executor, and it’s wise to name an alternate in case your first choice can’t serve.

3. Beneficiary

What it means: A person or entity who receives something from the will.

In simple terms: Anyone you choose to inherit your assets.

Beneficiaries can be:

- Individuals (family members, friends)

- Organizations (charities, schools)

- Trusts set up to benefit others

You can name primary beneficiaries and contingent beneficiaries (who inherit if the primary beneficiaries can’t).

4. Estate

What it means: The total of all possessions, property, and debts left by a person at death.

In simple terms: Everything you own when you die.

An estate can include:

- Real estate (houses, land)

- Personal property (cars, jewelry, furniture)

- Financial assets (bank accounts, stocks, bonds)

- Digital assets (online accounts, cryptocurrencies)

- Debts owed to you

It’s important to regularly update your will to reflect changes in your estate.

5. Probate

What it means: The legal process of proving a will’s validity and administering the estate.

In simple terms: The court’s stamp of approval on your will and the process of sorting out your affairs.

The probate process typically involves:

- Validating the will

- Identifying and inventorying the deceased’s property

- Paying debts and taxes

- Distributing the remaining property as the will directs

In some places, small estates may qualify for simplified probate procedures.

6. Bequest

What it means: A gift of personal property by will.

In simple terms: Anything you leave to someone in your will.

Types of bequests include:

- Specific bequest: A particular item (e.g., “my diamond ring”)

- General bequest: A gift that can be satisfied out of general assets (e.g., “₹1 lakh”)

- Residuary bequest: A gift of what’s left after other bequests are made

7. Intestate

What it means: Dying without a valid will.

In simple terms: What happens if you don’t make a will or your will isn’t legally valid.

If you die intestate:

- State laws determine who inherits your property

- The court appoints an administrator to manage your estate

- Your assets might not go to the people you would have chosen

This underscores the importance of having a valid will.

8. Codicil

What it means: A document that amends, rather than replaces, a previously executed will.

In simple terms: An add-on to your existing will to make changes.

You might use a codicil to:

- Add or remove beneficiaries

- Change the executor

- Modify specific bequests

For major changes, it’s often better to create a new will rather than using multiple codicils.

9. Per Stirpes

What it means: A method of distributing estate assets where each branch of the family receives an equal share.

In simple terms: A way to make sure your grandchildren inherit their parent’s share if your child dies before you.

For example:

- You have two children, A and B

- A has two children, A1 and A2

- B has one child, B1

- If A dies before you, A’s share would be split equally between A1 and A2

10. Residuary Estate

What it means: The portion of the estate left after all specific bequests and debts are paid.

In simple terms: What’s left over after you’ve given away specific items and paid all debts.

The residuary estate often makes up the bulk of what you leave behind. It’s important to specify in your will who should receive this portion.

Why Understanding Will Terminology Matters

Knowing these terms helps you:

- Communicate clearly with your lawyer

- Understand your own will better

- Avoid misunderstandings and potential conflicts

- Make informed decisions about your estate

Clear understanding can prevent family disputes and ensure your wishes are carried out as you intend.

Common Misconceptions About Will Terminology

- Myth: Only lawyers can understand will terminology.

Fact: With a bit of explanation, anyone can grasp these terms. - Myth: “Heir” and “beneficiary” mean the same thing.

Fact: Heirs are related to you by blood, while beneficiaries can be anyone you choose. - Myth: The executor has to be a lawyer or financial expert.

Fact: Your executor can be any trusted person, though they might need professional help. - Myth: Probate is always a long, expensive process.

Fact: Simple estates can go through probate quickly and inexpensively. - Myth: A will can distribute all of your assets.

Fact: Some assets, like joint property or life insurance with named beneficiaries, pass outside of the will.

Legal Considerations in India

In India, will terminology often includes terms from the Indian Succession Act, 1925. Some key points:

- “Attestation” refers to witnesses signing the will. In India, a will must be attested by at least two witnesses.

- “Codicil” is recognized under Section 2(d) of the Act and must be executed with the same formalities as a will.

- “Probate” is mandatory in some areas, like Mumbai, Kolkata, and Chennai, but optional in others.

- The concept of “Hindu Undivided Family” (HUF) can affect inheritance and should be considered when making a will.

- Muslim personal law has different rules for wills and inheritance, allowing only up to one-third of the estate to be willed away.

Conclusion

Understanding will terminology doesn’t require legal expertise. By familiarizing yourself with these key terms, you can approach will-making with confidence. Remember, clear communication in your will helps ensure your wishes are carried out correctly.

Key takeaways:

- Learn basic will terminology to understand your own will better

- Don’t hesitate to ask for clarification on any terms you don’t understand

- Remember that different terms might apply in different legal systems

- Regular review of your will helps you stay familiar with its contents and terms

- Seek professional advice to ensure your will is legally sound and clearly expresses your wishes

How EZIT Guardian Can Assist

At EZIT Guardian, we simplify the will-making process:

- Our experts explain all legal terms in plain language

- Our team of experts guide you through each step of creating your will

- We offer regular will reviews to keep your document up-to-date

- Our experts can answer any questions about will terminology

Don’t let legal jargon stop you from securing your legacy. Contact EZIT Guardian today for clear, straightforward will-making assistance. Download the EZIT Guardian app from the Google Play Store & App Store today to schedule a consultation and take the first step to start creating your clear, legally sound will.