TL;DR

Claiming bank funds as a bank account nominee in India requires understanding RBI guidelines and having the correct documents. While banks may sometimes create unnecessary hurdles, knowing your rights regarding nominee claims and using digital tools like EZIT Guardian can make the process smoother. This guide walks you through the entire process of claiming bank accounts as a nominee, helping you protect your family’s financial future.

Introduction

The death of a loved one is a difficult time, and dealing with financial matters can add to the stress. In India, the Reserve Bank of India (RBI) has established guidelines to ensure the smooth transfer of assets upon the account holder’s demise. These guidelines, while intended to simplify the process, are not always strictly followed by banks, leading to difficulties for nominees. This guide aims to shed light on RBI Guidelines concerning nominee claims, particularly in the context of bank accounts, and empower nominees to navigate the process effectively.

What are Nominee Claims?

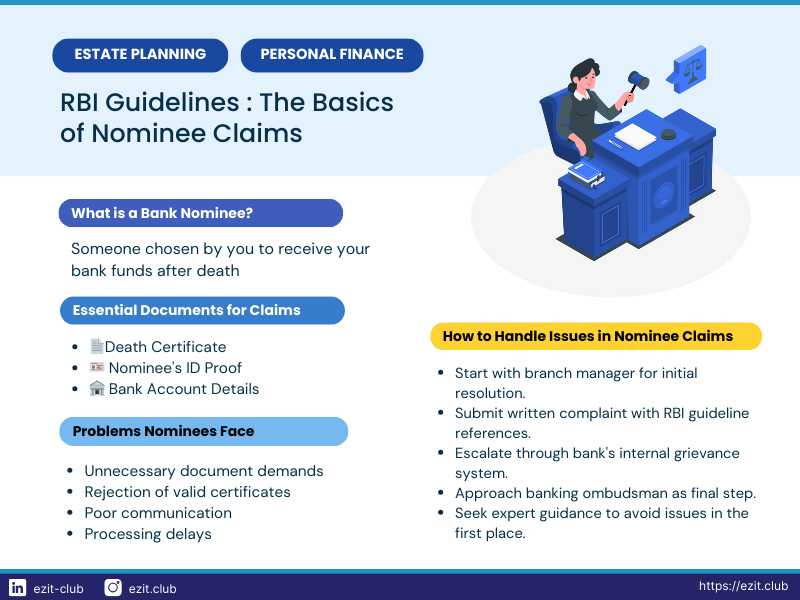

A nominee is an individual designated by the account holder to receive the proceeds of a bank account, such as a savings account or fixed deposit, in the event of the account holder’s death. Nominee claims refer to the process by which this designated individual files a claim to receive these funds.

RBI Guidelines: The Foundation of Nominee Rights

The RBI’s regulatory framework underscores the importance of nominee designations and their right to claim proceeds. These guidelines clearly state that the nominee of a bank account is entitled to receive the funds upon the account holder’s death. This provision is designed to ensure a straightforward and hassle-free transfer of assets to the intended beneficiary, requiring only essential documentation.

The basic requirements include a valid death certificate, the nominee’s identification proof, and relevant bank account details. These three documents should suffice for most situations, though specific cases might require minimal additional paperwork.

Understanding special cases can help prevent future complications. For instance, when dealing with foreign death certificates, banks should accept them without demanding excessive verification. A simple translation might be needed if the certificate isn’t in English. For business accounts, the process requires clear nominee designation and basic company documentation to establish the legitimacy of the claim.

Challenges and Violations: Where Banks Fall Short

Despite the clarity of the RBI Guidelines, many banks fail to implement them effectively, creating obstacles for nominees. Some of the common issues include:

- Demanding Irrelevant Documents: Banks may demand documents that are not stipulated by RBI guidelines, creating unnecessary delays and burdening the nominee.

- Rejecting Valid Death Certificates: Banks have been known to reject legitimate death certificates, even those issued by recognized authorities, further complicating the claim process.

- Lack of Transparency and Communication: Nominees often face difficulties in communicating with bank officials and obtaining clear information about the process.

These violations stem from various factors, including:

- Misinterpretation of Guidelines: Bank officials may misinterpret or misapply RBI guidelines, leading to incorrect demands and rejections.

- Internal Bureaucracy: Complex internal processes within banks can slow down the claim process and hinder effective communication.

- Lack of Accountability: The absence of robust accountability mechanisms and penalties for non-compliance allows these violations to persist.

Protecting Your Rights: What Nominees Can Do

If you find yourself facing challenges in claiming your rightful inheritance, here are some steps you can take:

- Thorough Documentation: Ensure you have all the necessary documents, including a valid death certificate, nominee proof, and any other documents specified by the bank.

- Know Your Rights: Familiarize yourself with RBI Guidelines related to nominee claims and the bank’s own policies. Refer to the official RBI website and the bank’s website for this information.

- Clear Communication: Communicate clearly with bank officials, providing all necessary information and documentation promptly.

- Escalation: If you encounter difficulties, don’t hesitate to escalate the matter within the bank. Contact the branch manager, zonal head, or the bank’s grievance redressal mechanism.

- RBI Ombudsman: If your grievance remains unresolved despite escalating it within the bank, you can approach the RBI Ombudsman. This independent authority investigates complaints against Regulated Entities and facilitates resolution.

Making the Claims Process Easier with Digital Tools

Modern digital tools have changed how we manage financial planning and keep important documents safe. EZIT Guardian leads this change, offering helpful tools for Indian families. With EZIT Guardian, you can securely store essential documents in a digital locker, making sure your nominees can access them when needed.

EZIT Guardian does more than just store documents—it allows you to control who can see each document and when they can see it. This organized system helps reduce the stress and confusion often involved in nominee claims. Plus, the platform connects you with legal and financial experts who can guide you through the details of nominee claims when you need help.

Taking Proactive Steps: Planning for the Future

The challenges faced by nominees highlight the importance of proactive estate planning. Here are some steps you can take:

- Appoint Nominees: Designate nominees for all your financial accounts, including bank accounts, insurance policies, and investments.

- Regular Updates: Keep your nominee information updated to reflect any changes in circumstances.

- Communicate Your Wishes: Discuss your estate plan with your nominees and family members to ensure they understand your intentions.

- Seek Professional Advice: Consult with a legal and financial advisor to create a comprehensive estate plan that meets your specific needs.

Conclusion

By taking these steps, you can help ensure that your loved ones receive their rightful inheritance smoothly and efficiently, minimizing stress and potential disputes during a difficult time.

Disclaimer

Please note that this blog post is for informational purposes only and does not constitute legal or financial advice. It is recommended to consult with qualified professionals for personalized guidance.

Take Action Today with EZIT Guardian

Don’t leave your family in the dark about your assets. EZIT Guardian offers a secure and comprehensive solution for organizing and storing your financial information. With features like a digital vault, nominee management, and expert support, EZIT Guardian ensures that your loved ones will have all the necessary information at their fingertips when they need it most.

Start your 90-day free trial with EZIT Guardian today and take the first step towards securing your family’s financial future. Download the EZIT Guardian app from the Google Play Store & App Store today to schedule a consultation and take the first step to start securing your legacy.