TL;DR;

Deciding between ULIP vs Term Insurance? ULIPs blend investment opportunities with insurance coverage, whereas Term Insurance provides straightforward, affordable protection. Evaluate your financial objectives to make an informed choice. Consult with an expert on the EZIT Guardian App for tailored advice.

Introduction

In India, where economic stability can be influenced by numerous factors, having an appropriate insurance plan ensures that you are prepared for life’s uncertainties—whether that’s securing your family’s financial future, saving for long-term goals, or managing unexpected expenses.

Understanding Life Insurance

Life insurance in India ensures financial security by providing a lump sum (sum assured) to your nominee(s) if you pass away. This encompasses term insurance for pure protection, endowment plans for savings plus insurance, ULIPs which combine insurance with investment, and whole life insurance for lifelong coverage. Premiums vary based on age, health, and the sum assured, with tax savings under Section 80C and tax-free death benefits under Section 10(10D).

Features of Life Insurance Plans

- Premium Payment: Various options such as annual, semi-annual, or monthly, allowing flexibility in managing finances.

- Sum Assured: Guaranteed amount that your beneficiary will receive in the event of your death, providing them with financial security.

- Policy Tenure: Option to select how long the insurance coverage lasts, matching your coverage needs to your life stages and financial plans.

- Nomination: Designate one or more persons as nominees, ensuring that death benefits are distributed according to your wishes.

- Maturity Benefit: Some insurance plans offer a lump sum payment upon the maturity of the policy.

- Claim Settlement: Streamlined process for your beneficiaries to claim the death benefit, reducing the administrative burden during a difficult time.

- Optional Riders: Enhance your insurance coverage with additional benefits such as critical illness cover, accidental death cover, and disability cover, for an extra premium.

Understanding Term Insurance

Term insurance is a straightforward, economical way to provide significant coverage for a specific period, paying a death benefit if you pass away during that period. It’s ideal for those who need financial security at a low cost, without a savings component.

Features of Term Insurance Plans

- Pure Protection: Provides a death benefit intended to secure your family’s financial needs without any investment components.

- Affordability: Offers higher coverage for lower premiums, making it an economical choice for substantial financial protection.

- Death Benefit: The sum assured is paid to the nominee if the policyholder dies within the term of the policy.

- Policy Terms: Flexibility to choose the term length that fits your needs, ranging from 5 to 30 years or more.

- No Maturity Benefits: Focuses exclusively on offering a death benefit, without any payouts upon policy expiration.

- Additional Riders: Option to add features such as critical illness rider or accidental death rider.

- Tax Benefits: Premiums paid are eligible for tax deductions under Section 80C, and the death benefit is tax-free under Section 10(10D).

- Claim Process: Straightforward and hassle-free, ensuring beneficiaries receive the death benefit promptly.

- Online Accessibility: Many term plans can be purchased and managed online.

Comparison Table: Life Insurance vs. Term Insurance

| Parameter | Life Insurance | Term Insurance |

|---|---|---|

| Premium | Higher due to investment components | Lower, more affordable |

| Death Benefit | Payable for all policies | Payable only if the policyholder dies within the term |

| Maturity Benefit | Commonly available | Not available |

| Coverage | On death and some plans at maturity | Only on death |

| Policy Tenure | 5-40 years | 5-35 years |

| Flexibility | More flexible | Less flexible due to focus on protection |

| Loan Benefit | Generally available | Not available |

| Surrender Value | Available after a set period | Not applicable |

Introduction to ULIPs

Unit Linked Insurance Plans (ULIPs) combine insurance and investment into one integrated plan. They allow investment in various funds like equity, debt, or balanced funds while providing life coverage. Popular in India for their dual benefits, they offer flexibility and potential for higher returns.

Features of ULIPs

- Dual Benefit: Combines life insurance coverage with opportunities to invest in a variety of funds.

- Investment Options: Includes a range of fund options from conservative to aggressive.

- Flexibility: Provides the option to switch between different investment funds.

- Transparency: Charges and fund performances are clearly disclosed.

- Lock-in Period: A mandatory lock-in period that encourages long-term investment.

- Partial Withdrawal: Permits withdrawals from the fund after the lock-in period.

- Tax Benefits: Contributions are tax-deductible and returns are tax-free under specific conditions.

- Market-Linked Returns: Returns on investments are linked to market performance.

- Premium Allocation Charges: A portion of the initial premiums goes towards administrative and distribution costs.

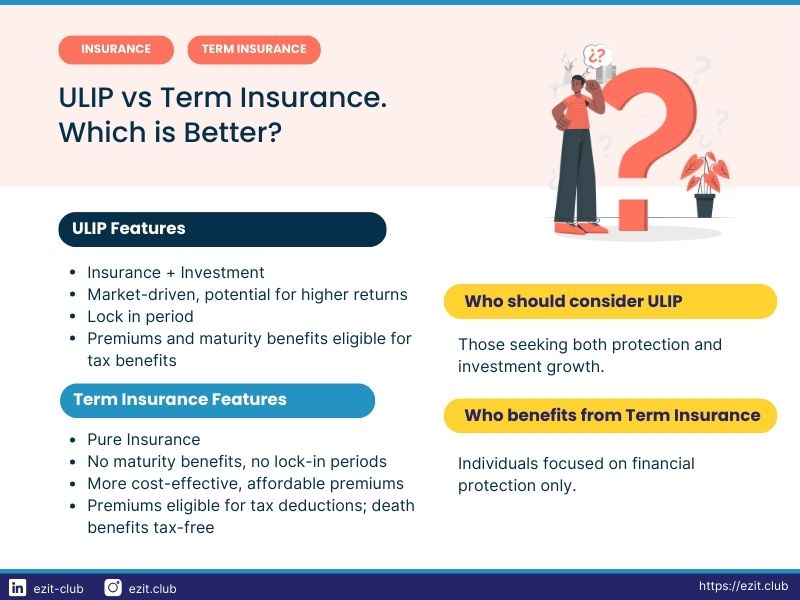

ULIP vs Term Insurance : Which is better?

Understanding the Context

Choosing between ULIP vs Term Insurance requires an understanding of your financial goals and risk tolerance. ULIPs are suitable for individuals looking to integrate insurance with investment, allowing for potential wealth accumulation. Conversely, Term Insurance is ideal for those who prioritize affordable, pure protection.

Financial Goals and Risk Tolerance

- Wealth Accumulation: ULIPs can be appealing for long-term investors willing to endure market fluctuations for potentially higher returns. The dual benefit of investment and insurance allows for wealth growth over time while providing a safety net.

- Protection Priority: If your primary goal is to secure your family’s financial future without the complexity of investments, Term Insurance offers substantial coverage at a lower cost.

Impact of Market Conditions

ULIPs are directly tied to market performance. While this can lead to higher returns in a bullish market, it also exposes policyholders to the risk of losing capital during downturns. It is crucial to assess your risk tolerance and investment horizon before opting for a ULIP. On the other hand, Term Insurance is unaffected by market volatility, ensuring consistent coverage and death benefits.

Long-Term Commitment

- ULIP: The mandatory lock-in period of five years encourages a long-term approach. This is beneficial for disciplined investors but may be restrictive for those needing flexibility or early access to funds.

- Term Insurance: Offers greater flexibility with no lock-in period, making it easier to adapt to changing financial circumstances.

Risk Considerations : ULIP vs Term Insurance

Market Risk in ULIPs

- Volatility: The performance of ULIPs is subject to market volatility, which can affect the value of the investment component. Policyholders must be prepared for fluctuations and potential losses.

- Fund Management: The success of a ULIP heavily depends on the performance of the chosen funds. Ineffective fund management can lead to suboptimal returns, emphasizing the importance of regular fund performance reviews and adjustments.

Cost Implications : ULIP vs Term Insurance

- ULIPs: Premium allocation charges, fund management fees, and mortality charges can erode returns. These costs are higher compared to Term Insurance due to the dual nature of ULIPs.

- Term Insurance: Primarily involves mortality charges, making it a cost-effective solution for pure protection.

Liquidity and Flexibility

- ULIPs: The lock-in period restricts access to funds, which could be a disadvantage in emergencies. Partial withdrawals are possible post lock-in but may incur charges or penalties.

- Term Insurance: Provides no investment component or liquidity, but its simplicity and low cost make it easier to switch or modify coverage as needed.

Comparison Table: ULIP vs. Term Insurance

| Parameter | ULIP | Term Insurance |

|---|---|---|

| Type | Insurance + Investment | Pure Insurance |

| Ideal For | Those seeking both protection and investment growth | Individuals focused on financial protection only |

| Investment | Market-linked with various fund options | No investment component |

| Insurance | Yes, with a life cover | Yes, providing life coverage |

| Returns (if any) | Market-driven, potential for higher returns | No maturity benefits |

| Cost-Effectiveness | Relatively higher due to the investment element | More cost-effective, affordable premiums |

| When to Buy? | When looking for combined insurance and investment benefits | When prioritizing financial protection with minimal premium cost |

| Charges | Premium allocation, fund management, and mortality charges | Primarily covers mortality charges |

| The Ideal Time to Buy | When seeking a long-term financial plan with flexibility | As early as possible for maximum coverage at lower premiums |

| Lock-in Period | 5 years; encouraging long-term commitment | No lock-in period; offers flexibility |

| Security | Subject to market fluctuations, but includes life coverage | Provides financial security to beneficiaries in case of your demise |

| Maturity Benefits | Maturity amount based on fund performance | No maturity benefits |

| Tax-Savings | Premiums and maturity benefits eligible for tax benefits | Premiums eligible for tax deductions; death benefits tax-free |

| Switching Options | Allows switching between funds based on market conditions | There are no switching options, as it is a straight forward insurance plan |

| Tenure | Flexible policy term based on financial goals | Fixed term chosen at the time of policy purchase |

| Returns | Market-dependent, potentially higher returns | No returns; focus on financial protection |

Frequently Asked Questions : ULIP vs Term Insurance

ULIPs have a mandatory lock-in period of five years, during which policyholders cannot withdraw their funds. This period is designed to promote long-term investment and ensure that policyholders stay invested for a significant duration.

No, you cannot surrender a ULIP policy before the five-year lock-in period. Surrendering a ULIP after the lock-in period is possible, but it might incur charges, and the amount received may be less than the invested amount depending on the policy terms and market performance.

The maturity proceeds from ULIPs are generally tax-free under Section 10(10D) of the Income Tax Act, provided the annual premium does not exceed 10% of the sum assured for policies issued after April 1, 2012. If the premium exceeds this limit, the proceeds are taxable.

Yes, some ULIP policies allow you to take a loan against the policy after the lock-in period. The loan amount is typically a percentage of the policy’s surrender value, but it varies based on the insurer’s terms and conditions.

ULIPs come with several charges, including premium allocation charges, policy administration charges, fund management fees, and mortality charges. These charges are deducted from the premiums paid and can affect the overall returns of the policy.

No, Term Insurance does not offer any maturity benefits. It is a pure protection plan designed to provide a death benefit to the nominee if the policyholder passes away during the term of the policy. If the policyholder survives the term, there are no payouts.

Yes, ULIPs offer the flexibility to switch between different investment funds, such as equity, debt, or balanced funds. This allows policyholders to adjust their investment strategy based on market conditions or changing financial goals. Some policies may limit the number of free switches per year.

Yes, many insurance companies offer the option to purchase Term Insurance online. This process is usually straightforward and allows for easy comparison of policies, quick application, and often results in lower premiums compared to offline policies due to reduced administrative costs.

Conclusion

Both ULIPs and Term Insurance serve distinct financial needs. ULIPs offer a blend of insurance and investment, which can be appealing for those seeking growth alongside coverage. However, they come with market risks and higher costs. Term Insurance provides a straightforward, affordable solution for those prioritizing financial security without investment complexity. Understanding their differences helps in making an informed choice that aligns with your financial goals and risk profile.

Find Your Ideal Life Insurance Plan with EZIT's Expert Guidance

Ensure the best decision for your life insurance needs with EZIT’s expert advisors. Download the EZIT app from the Google Play Store & App Store and secure your future today.