TL;DR

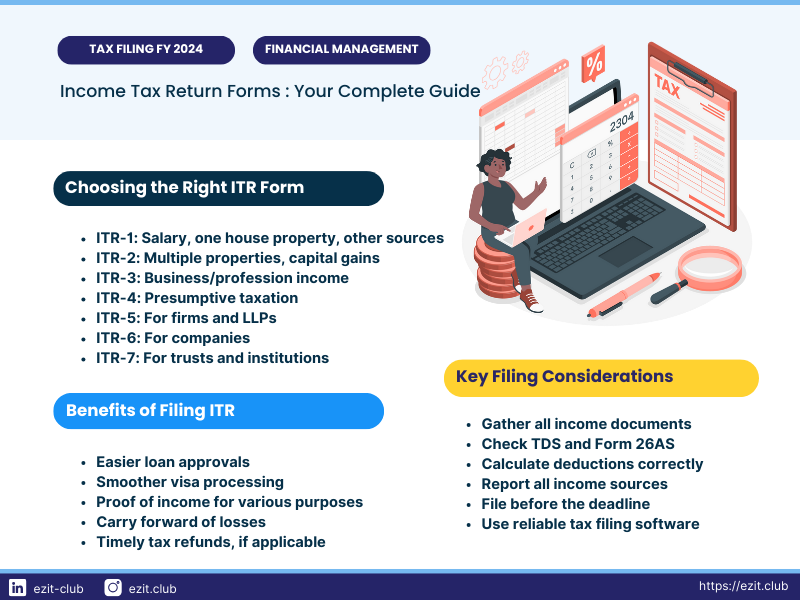

Selecting the correct Income Tax Return (ITR) form is crucial for accurate and compliant tax filing in India. This comprehensive guide covers all 7 ITR forms, their applicability, and key considerations for different professions. Learn about penalties for non-filing, rectification processes, exemptions, and the benefits of voluntary filing. Leverage the EZIT App for hassle-free tax planning and filing to ensure you’re always on top of your tax obligations.

Introduction

Filing Income Tax Returns (ITR) is not just a legal obligation for Indian taxpayers; it’s a crucial step in maintaining financial health and transparency. With the Indian tax system evolving rapidly and multiple ITR forms available, selecting the right one can be a daunting task. This comprehensive guide aims to demystify the ITR filing process, help you avoid common pitfalls, and understand the implications of your choices.

Whether you’re a salaried professional, a business owner, or fall into any other taxpayer category, this guide will provide you with the knowledge to navigate the complex world of Indian income tax returns confidently. Let’s dive into the intricacies of ITR filing and explore how you can make this annual task smoother and more beneficial for you.

Understanding Income Tax Return Forms / ITR Forms

The Income Tax Department of India has designed various ITR forms to cater to different categories of taxpayers. Let’s explore each form in detail:

ITR-1 (Sahaj)

Applicability:

- Individuals with income up to ₹50 lakhs from • Salary • One house property • Other sources (interest, etc.)

- Indian residents or Non-Resident Indians (NRIs)

Who should use ITR-1:

- Salaried employees with no other income sources

- Pensioners

- Small investors with interest income

Key Points:

- Simplest form, ideal for most salaried individuals

- Cannot be used if you have income from capital gains or more than one house property

- Not applicable for directors of companies or those holding foreign assets

ITR-2

Applicability:

- Individuals and Hindu Undivided Families (HUFs) not eligible for ITR-1 or ITR-4

- Income from: • Salary • House property • Capital gains • Other sources

Who should use ITR-2:

- Individuals with more than one house property

- Those with capital gains from selling property or investments

- Directors of companies

- Individuals holding foreign assets

Key Points:

- More complex than ITR-1, catering to a wider range of income sources

- Mandatory for individuals with foreign income or assets

- Suitable for those with capital gains from property or investments

ITR-3

Applicability:

- Individuals and HUFs having income from:

• Profits and gains of business or profession

• Other sources covered in ITR-1 and ITR-2

Who should use ITR-3:

- Self-employed professionals

- Freelancers

- Small business owners

- Partners in firms

Key Points:

- Comprehensive form for business owners and professionals

- Includes sections for detailed profit and loss accounts and balance sheets

- Suitable for those with multiple income sources including business income

ITR-4 (Sugam)

Applicability:

- Individuals, HUFs, and firms (other than LLPs) with income up to ₹50 lakhs from:

• Business or profession under presumptive taxation schemes

• Other sources covered in ITR-1

Who should use ITR-4:

- Small retailers

- Traders

- Freelancers opting for presumptive taxation

Key Points:

- Designed for small businesses opting for presumptive taxation

- Simplified form requiring fewer details compared to ITR-3

- Not applicable for those with capital gains or foreign income

ITR-5

Applicability:

- Firms, LLPs, AOPs (Association of Persons), BOIs (Body of Individuals)

- Artificial Juridical Persons

Who should use ITR-5:

- Partnership firms

- Limited Liability Partnerships (LLPs)

- Cooperative societies

Key Points:

- Specific form for entities that are not individuals, HUFs, or companies

- Includes detailed schedules for partnership details and profit allocation

ITR-6

Applicability:

- Companies other than those claiming exemption under section 11

Who should use ITR-6:

- All registered companies, whether public or private

Key Points:

- Comprehensive form for all registered companies

- Includes detailed schedules for financial statements, tax computations, and various disclosures

ITR-7

Applicability:

- Persons including companies required to furnish return under:

• Section 139(4A) – Charitable or religious trusts

• Section 139(4B) – Political parties

• Section 139(4C) – Scientific research associations, news agencies, etc.

• Section 139(4D) – Universities, colleges, other institutions

Who should use ITR-7:

- Charitable trusts

- Political parties

- Scientific research institutions

Key Points:

- Specific form for non-profit organizations and trusts

- Includes detailed schedules for application of funds and compliance with tax exemption conditions

What are the Consequences of Not Filing ITR?

Failing to file your ITR can have several serious consequences:

- Monetary Penalties:

– Up to ₹5,000 if filed by December 31st of the assessment year

– Up to ₹10,000 if filed after December 31st - Interest Charges:

– 1% simple interest per month on unpaid tax under section 234A - Loss of Benefits:

– Inability to carry forward certain losses to future years

– Loss of certain deductions and exemptions - Practical Difficulties:

– Challenges in obtaining loans from banks and financial institutions

– Complications in visa processing for international travel - Legal Implications:

– Potential scrutiny from the Income Tax Department

– Risk of prosecution in cases of substantial tax evasion

What Happens if you File a Wrong ITR Form?

Mistakes happen, but it’s crucial to rectify them promptly. Here’s what you need to know:

- Revised Return:

– If you realize you’ve filed the wrong form before the end of the assessment year, file a revised return using the correct form.

– You can file a revised return multiple times within the stipulated time limit. - Rectification Under Section 154:

– If the mistake is discovered after the assessment year has ended, file a rectification request under Section 154.

– This process allows for correction of mistakes apparent from the record.

Example Scenario:

Amit, a salaried individual, filed ITR-1 but later realized he had capital gains from selling some shares. He should file a revised return using ITR-2 before the deadline to ensure compliance and avoid potential scrutiny.

Exemptions from ITR Filing

While filing ITR is generally advisable, there are some scenarios where it may not be mandatory:

- Income Below Basic Exemption Limit:

– If your gross total income doesn’t exceed the basic exemption limit (₹2.5 lakhs for FY 2023-24 for individuals under 60 years), you’re not obligated to file ITR. - Senior Citizens with Limited Income Sources:

– Senior citizens (60+ years) with only pension income and interest from the same bank where pension is deposited may be exempt from filing. - Specified Persons with Interest Income:

– Eligible specified persons (usually super senior citizens aged 80+) with only interest income up to ₹40,000 may not need to file ITR.

Important Note: These exemptions come with specific conditions and limitations. It’s always advisable to verify your eligibility and consider the benefits of voluntary filing even if you fall under these categories

Benefits of Voluntary ITR Filing

Even if you’re not mandatorily required to file ITR, there are several advantages to voluntary filing:

- Loan Approvals:

– ITR serves as a reliable proof of income, making loan applications smoother. - Visa Processing:

– Many countries require ITR records for visa applications, especially for business or long-term visas. - Income Proof:

– ITR can be used as an official income proof for various purposes, including property rentals and credit card applications. - Carry Forward of Losses:

– Certain losses can be carried forward to set off against future income, but only if you’ve filed your ITR. - Timely Tax Refunds:

– If you’re eligible for a tax refund, filing ITR ensures you receive it promptly. - Building Financial Credibility:

– Regular ITR filing helps establish a strong financial record, which can be beneficial in various financial dealings.

Common Mistakes to Avoid in ITR Filing

- Using Incorrect ITR Form:

– Ensure you choose the right form based on your income sources and taxpayer category. - Incomplete Income Reporting:

– Report all sources of income, including interest, dividends, and capital gains. - Overlooking Foreign Asset Disclosure:

– If you hold foreign assets, they must be disclosed in the appropriate schedule. - Misusing Presumptive Taxation Schemes:

– Ensure you meet all criteria before opting for presumptive taxation under sections like 44AD or 44ADA. - Incorrect Claim of Deductions:

– Verify your eligibility and limits for various deductions under sections 80C, 80D, etc. - Mismatching TDS Credits:

– Ensure that the TDS claimed in your return matches Form 26AS.

Conclusion

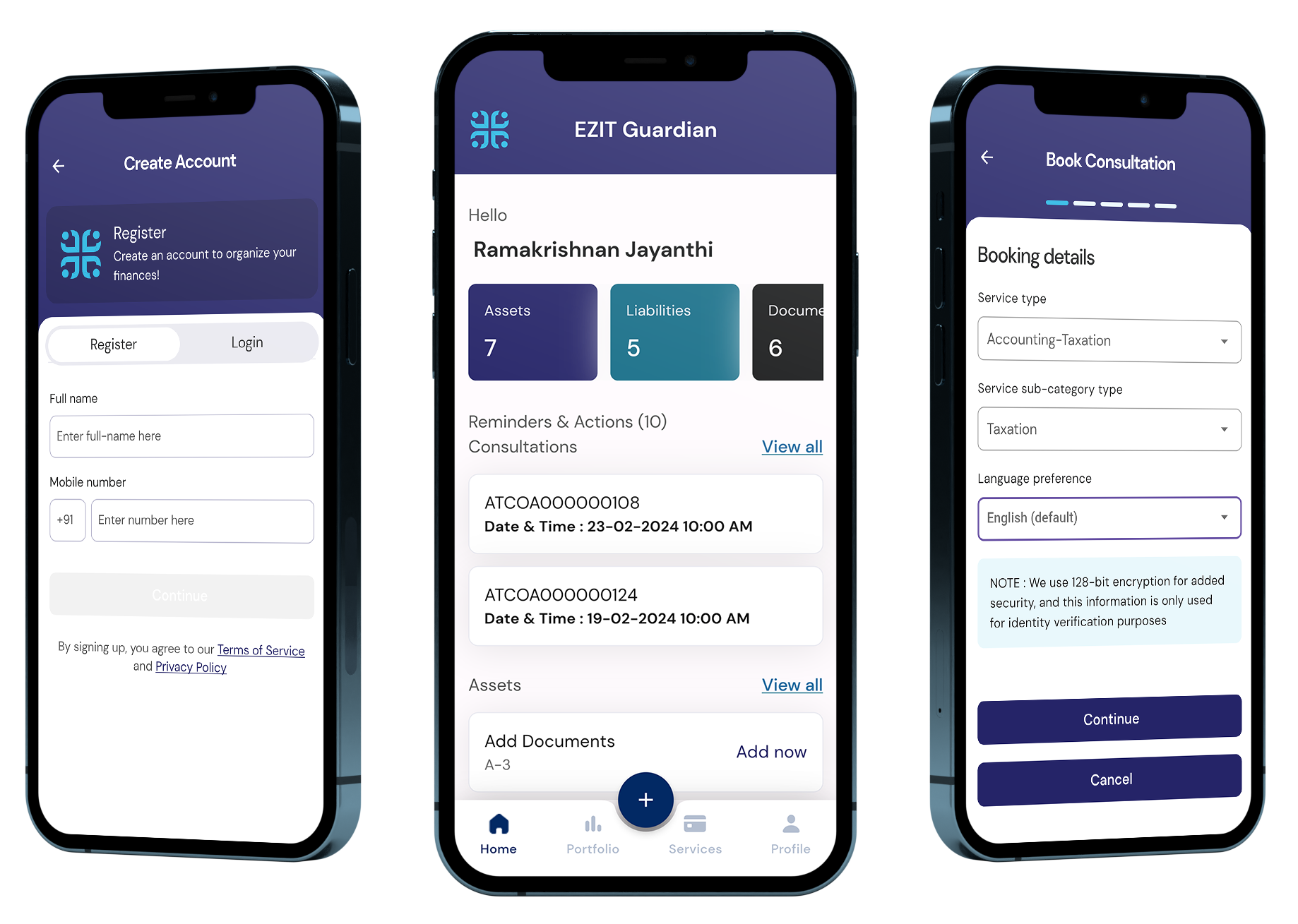

Choosing the right ITR form and filing your taxes accurately is crucial for financial compliance and peace of mind. By understanding the nuances of different ITR forms, being aware of key deadlines, and leveraging tools like the EZIT Guardian App, you can navigate the complex world of Indian taxation with confidence.

Simplify Your ITR Filing with EZIT

Remember, while this guide provides comprehensive information, tax laws are subject to change, and individual circumstances can vary. When in doubt, it’s always advisable to consult with a qualified tax professional or use reliable tax filing assistance like the EZIT Guardian App to ensure you’re making the best decisions for your financial health.

Get started with EZIT today for personalized tax advice by downloading the EZIT app from the Google Play Store & App Store today.