TL;DR

Solo mutual fund holdings with nomination offer superior benefits over joint or either/survivor options. Key advantages include clearer ownership, simplified tax handling, easier online transactions, and reduced legal risks. While joint holdings can complicate matters with shared ownership and potential disputes, nomination provides a streamlined approach to fund management and inheritance, making it the preferred choice for many investors.

Introduction: Navigating Mutual Fund Ownership Structures

In the dynamic world of mutual fund investments, the way you choose to hold your assets can significantly impact their management, taxation, and eventual transfer. While joint holding and either/survivor options are common, solo mutual fund holding with nomination often emerges as the superior choice for many investors. This comprehensive guide explores the nuances of different holding types, with a particular focus on why nomination in solo holdings tends to score higher than other options.

Mutual funds have become a cornerstone of modern investment portfolios, offering diversification and professional management to investors of all sizes. However, the benefits of these investments can be maximized or hindered by the ownership structure you choose. Whether you’re a seasoned investor or just starting your financial journey, understanding the implications of solo mutual fund holdings with nomination versus joint or either/survivor options is crucial for optimizing your investment strategy.

Understanding the Options: Solo, Joint, and Either/Survivor Mutual Fund Holdings

Before delving into the advantages of nomination, it’s essential to clearly define and understand the different holding options available for mutual fund investments:

Solo Holding with Nomination

- Definition: In this structure, an individual investor (the sole holder) owns the mutual fund units and designates a nominee to receive the assets in case of the holder’s demise.

- Key Feature: The nominee acts as a custodian for the legal heirs, providing a clear path for asset transfer without immediately transferring ownership rights.

- Ownership: Clear and undisputed, resting solely with the individual investor.

Joint Holding

- Definition: Two or more individuals jointly own the mutual fund units, typically with equal rights and responsibilities.

- Key Feature: All joint holders usually need to agree on and sign off on transactions, which can add complexity to fund management.

- Ownership: Shared among the joint holders, which can lead to potential conflicts or complications.

Either/Survivor Option

- Definition: Similar to joint holding, but with the added feature that either holder can operate the account independently.

- Key Feature: Ownership automatically transfers to the survivor(s) upon the death of one holder, without immediate need for legal procedures.

- Ownership: Shared, but with more operational flexibility than standard joint holding.

Understanding these options is crucial for investors to make informed decisions about how to structure their mutual fund investments. Each option has its own set of implications for day-to-day management, tax handling, and eventual transfer of assets.

The Compelling Advantages of Solo Mutual Fund Holding with Nomination

Solo holding with nomination offers a range of benefits that often make it the preferred choice for mutual fund investors. Let’s explore these advantages in detail:

Crystal Clear Ownership

One of the primary benefits of solo holding with nomination is the unambiguous nature of ownership. Unlike joint holdings where ownership is shared and can lead to disputes, solo holding ensures that:

- There’s a single, clear owner of the mutual fund units.

- Decision-making power rests solely with the individual investor.

- The potential for ownership-related conflicts is virtually eliminated.

This clarity not only simplifies the investment process but also provides peace of mind to the investor.

Streamlined Tax Applicability

Tax implications are a crucial consideration in any investment strategy. Solo holding with nomination offers significant advantages in this area:

- Tax liability is clear and applies only to the sole holder.

- There’s no risk of tax disputes arising from multiple names appearing in the Annual Information Statement (AIS).

- The chance of facing tax-related inquiries or audits is reduced due to the straightforward ownership structure.

This simplification can lead to more efficient tax planning and potentially lower the administrative burden on the investor.

Effortless Online Transactions

In our digital age, the ability to manage investments online is increasingly important. Solo holding excels in this aspect:

- The sole holder can easily conduct purchases and redemptions online without needing approval from other parties.

- There’s no need to coordinate multiple One Time Passwords (OTPs) or signatures for transactions.

- The investor can quickly respond to market opportunities or personal financial needs without procedural delays.

This ease of transaction can be particularly valuable in volatile market conditions where timing can be crucial.

No Requirement for Joint Bank Accounts

Unlike what some might assume, solo holding with nomination aligns perfectly with individual bank account usage:

- There’s no need to open or maintain a joint bank account for investment purposes.

- The investor can use their personal bank account for all mutual fund-related transactions.

- This separation can help in maintaining clearer personal financial records.

Smooth Inheritance Process

One of the most significant advantages of nomination in solo holding is the streamlined process for asset transfer in case of the investor’s demise:

- The nominee can claim the assets, acting as a custodian for the legal heirs.

- This process is generally smoother and faster than the alternatives.

- It provides a clear direction for asset transfer, potentially reducing family disputes.

While it’s important to note that the nominee is not the ultimate owner and acts as a custodian, this arrangement often facilitates a more efficient transfer of assets compared to joint holding scenarios.

Minimal Legal Risks

Solo holding with nomination carries substantially lower legal risks compared to other holding types:

- There’s virtually no risk of disputes arising from divorce or disagreements between holders.

- The clear ownership structure reduces the likelihood of legal challenges to the investment.

- In case of any legal issues, resolution is typically simpler due to the straightforward ownership.

This reduction in legal risks can provide significant peace of mind to investors, allowing them to focus on their investment strategy rather than potential legal complications.

Challenges with Joint Holding and Either/Survivor Options

While joint holding and either/survivor options can seem attractive, especially for families or couples, they come with their own set of challenges that investors should be aware of:

Practical Hurdles in Fund Management

Joint holdings can create practical difficulties in day-to-day fund management:

- Many investment platforms and Asset Management Company (AMC) websites are not designed to handle multiple One Time Passwords (OTPs), making online transactions cumbersome or impossible for joint holdings.

- All joint holders typically need to sign off on transactions physically, which can be inconvenient and time-consuming.

- Coordinating decisions between multiple holders can lead to missed investment opportunities due to delays.

Potential for Legal Complications

Shared ownership in joint or either/survivor holdings can lead to legal challenges:

- Disputes can arise in cases of divorce or disagreements between holders.

- Legal intervention may be required to resolve conflicts, potentially limiting access to funds during the resolution process.

- The automatic transfer to survivors in either/survivor options can be overridden by a will or succession laws, leading to potential legal battles.

Tax-Related Complexities

Multiple names on an account can create tax-related issues:

- There’s a risk of AIS mismatches due to the PAN of the second holder being captured.

- Tax queries or disputes can arise when multiple individuals are associated with the same investment.

- Determining the appropriate taxpayer for gains or income from the investment can become complicated.

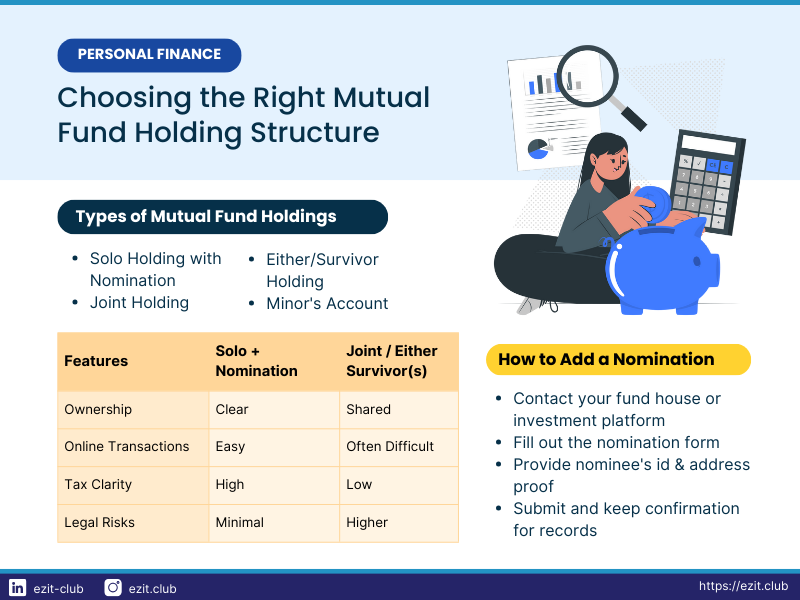

Comparative Analysis: Solo vs. Joint vs. Either/Survivor

To provide a clear overview of the differences between these holding types, let’s examine them side by side:

| Feature | Solo holder + nominee | Joint holding | Either or survivor |

|---|---|---|---|

| Ownership | Clear, sole holder | Shared, equal rights | Shared, equal rights |

| Who can be joint holder/nominee | Anyone | Anyone | Anyone |

| Tax applicability | Sole holder | First holder | First holder |

| Tax disputes | Not applicable | Can arise due to both names in AIS | Can arise due to both names in AIS |

| Joint bank account needed? | No | No | No |

| Purchase/redemption online | Yes. Sole holder can transact online | No. All holders must sign physically | Yes. Either party can transact online |

| Inheritance | Nominee can claim | Transfers to second holder | Transfers to survivor(s) |

| Legal risks | Minimal | Potential disputes, divorce complications | Potential disputes, divorce complications |

This comparison clearly illustrates the advantages of solo holding with nomination, particularly in areas of ownership clarity, tax simplicity, and ease of management.

Legal and Regulatory Aspects of Mutual Fund Holdings

Understanding the legal framework surrounding different holding types is crucial for investors:

Mutual Funds Nomination in Solo Holdings

- Provides a clear legal pathway for asset transfer.

- The nominee acts as a custodian, facilitating smoother transition of assets to legal heirs.

- Nomination details can be easily updated by the sole holder as needed.

Joint and Either/Survivor Holdings

- May be overridden by will or succession laws, potentially leading to legal disputes.

- In case of conflicts, legal intervention may be required, which can freeze access to funds.

- Changes to the holding structure often require consent from all parties involved.

Tax Implications Across Holding Types

Tax considerations play a significant role in investment decisions. Here’s how different holding types fare:

Solo Holding with Nomination

- Tax applicability is straightforward, applying only to the sole holder.

- Clear records make it easier to report gains and losses accurately.

- Simplified tax planning and potentially easier compliance with tax laws.

Joint and Either/Survivor Holdings

- Tax liability typically falls on the first holder, but exceptions can complicate matters.

- Risk of tax disputes due to multiple names appearing in financial records.

- Potential for confusion in tax reporting, especially if contributions come from multiple holders.

Steps to Set Up or Change Nomination in Mutual Funds

For investors looking to establish or modify a nomination for their mutual fund investments, here’s a step-by-step guide:

- Contact your fund house or investment platform.

- Request and fill out the nomination form with the nominee’s details.

- Provide necessary identification and address proof for the nominee.

- If changing an existing nomination, fill out the change request form.

- Submit the completed form(s) and wait for confirmation from the fund house.

- Keep a copy of the confirmation for your records.

Remember, you can change your nomination at any time, and it’s wise to review and update it periodically or after significant life events.

Conclusion: Making the Right Choice for Your Mutual Fund Investments

While solo holding with nomination offers numerous advantages in terms of clarity, simplicity, and ease of management, the choice of holding type ultimately depends on individual circumstances. It scores higher for those prioritizing sole control, easy online management, and a straightforward inheritance process.

However, investors should consider their personal financial goals, family situation, and estate planning needs when deciding on the best holding structure for their mutual fund investments. In some cases, joint or either/survivor options might be more suitable, especially in business partnerships or specific family situations.

Regardless of the chosen structure, it’s always advisable to:

- Regularly review and update your investment holdings and nominations.

- Keep clear records of all investment decisions and changes.

- Consult with a financial advisor or legal professional to ensure your choice aligns with your overall financial and estate planning strategy.

🚀 Ready to optimize your mutual fund strategy?

By reaching out to EZIT, you’re taking a crucial step towards securing your financial future. Our experts are ready to guide you through the intricacies of mutual fund investments, ensuring you choose the holding structure that best suits your needs.

Remember, the right decision today can lead to significant benefits in the long run. Don’t wait – let EZIT help you take control of your mutual fund investments now! Download the EZIT Guardian app from the Google Play Store & App Store today