TL;DR;

The new tax regime in India offers lower tax rates and simplicity, but lacks deductions. The old regime has higher tax rates but provides users with various deductions. It’s crucial to compare your tax liability under both regimes to make an informed decision. Use our calculators to see how each tax regime impacts your taxes. For personalized advice, consult our tax advisors on the EZIT Guardian App. Continue reading to learn more about choosing the right tax regime for you.

Introduction - Should I Opt for the New Tax Regime?

Choosing the right tax regime can make a big difference in your financial planning and tax savings. With the introduction of the new tax regime in India, taxpayers now have an important decision to make: stick with the old regime or switch to the new one. This article will break down the pros and cons of each regime, helping you make an informed decision.

Understanding the New Tax Regime

Let us first begin by understanding the features of New Tax Regime. The new tax regime, introduced in the 2020 Union Budget, was designed to simplify the tax process. It offers lower tax rates across different income slabs but removes most deductions and exemptions. The idea is to make tax filing easier and reduce the paperwork.

Starting from the financial year 2023-24, the new tax regime will be the primary choice for taxpayers. If you wish to switch back to the old regime, you’ll have to submit Form 10-IEA while filing your return. How often you can switch between the old and new regimes depends on your income type. For those with business or professional income, switching is allowed only once in a lifetime. However, if your income comes from sources like salary, you can switch between the regimes every year.

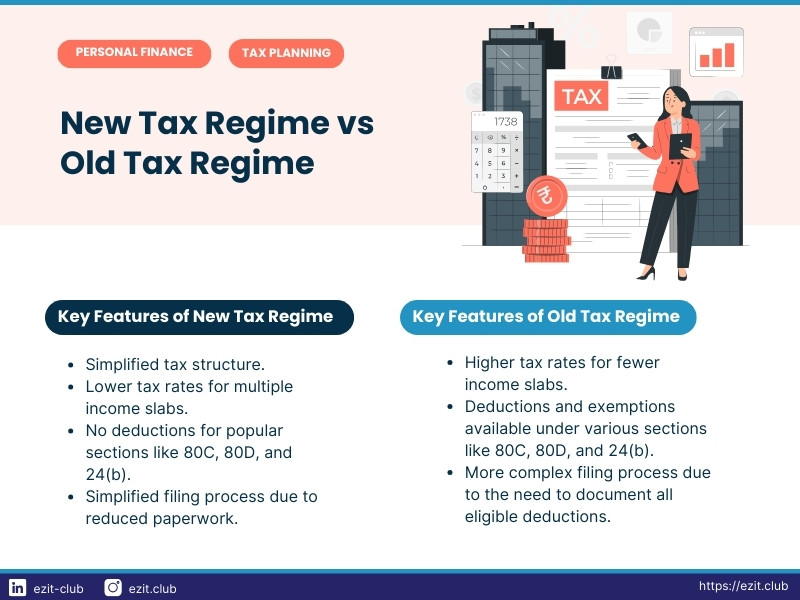

Key features:

- Lower tax rates for multiple income slabs.

- No deductions for popular sections like 80C, 80D, and 24(b).

- Simplified filing process due to reduced paperwork.

New Tax Regime : Tax Slab Rates and Rebates for FY 2023-24 (Effective from April 2023)

| Income Range (₹) | Tax Rate | Rebate (Section 87A) |

|---|---|---|

| 0 - 3,00,000 | Nil | - |

| 3,00,001 - 6,00,000 | 5% | - |

| 6,00,001 - 9,00,000 | 10% | 100% rebate on tax liability up to ₹25,000 |

| 9,00,001 - 12,00,000 | 15% | - |

| 12,00,001 - 15,00,000 | 20% | - |

| Above 15,00,000 | 30% | - |

Understanding the Old Tax Regime

The old tax regime features higher tax rates but allows for numerous deductions and exemptions. This can significantly reduce your taxable income if you invest in tax-saving instruments and have eligible expenses.

Key features:

- Higher tax rates for fewer income slabs.

- Deductions and exemptions available under various sections like 80C, 80D, and 24(b).

- More complex filing process due to the need to document all eligible deductions.

Old Tax Regime : Tax Slab Rates and Rebates for FY 2023-24

| Income Range (₹) | Tax Rate | Rebate (Section 87A) |

|---|---|---|

| 0 - 2,50,000 | Nil | - |

| 2,50,001 - 5,00,000 | 5% | 100% rebate on tax liability up to ₹12,500 |

| 5,00,001 - 10,00,000 | 20% | - |

| Above 10,00,000 | 30% | - |

Please note that there is an additonal Health & Education Cess of 4% on the taxable income in both Old & New tax regimes.

Comparison of Tax Rates and Deductions

Here’s a quick comparison to help you understand the key differences between the old and new tax regimes:

Old vs New Tax Regime Comparison

| Feature | Old Tax Regime | New Tax Regime |

|---|---|---|

| Lower Tax Rates | No | Yes |

| Rebate | ₹12,500 for income less than ₹5,00,000 | ₹25,000 for income less than ₹7,00,000 |

| Standard Deduction | Yes | Yes |

| Section 80C Deductions (EPF | LIC | ELSS | PPF | FD | Children's tuition fee etc) | Yes | No |

| Section 80D Deductions (Medical insurance premium) | Yes | No |

| Home Loan Interest Deduction (24(b)) (self occupied or vacant property) | Yes | No |

| Home Loan Interest Deduction (24(b)) (let-out property) | Yes | Yes |

| Section 80E Deductions (Interest on education loan) | Yes | No |

| Section 80G - Donations | Yes | No |

| Section 80TTA - Interest on savings bank account | Yes | No |

| Employee Contribution to NPS | Yes | No |

| Employer's Contribution to NPS | Yes | Yes |

| Deduction on Family Pension Income | Yes | Yes |

| Gifts upto ₹50,000 | Yes | Yes |

| Exemption on Gratuity -10(10) | Yes | Yes |

| Exemption on Leave encashment-10(10AA) | Yes | Yes |

| Transport allowance for Specially abled person | Yes | Yes |

| Health & Education Cess | Yes | Yes |

| Simplicity | No | Yes |

| Compliance Burden | Higher | Lower |

Example Scenario: Corporate Employee with ₹10 Lakhs Annual Package

Let’s take a practical example of a corporate employee earning ₹10 lakhs annually to see the impact of both regimes.

Old Tax Regime Calculation:

- Gross Income : ₹10,00,000

- Deductions (Section 80C, 80D, etc.) : ₹1,50,000

- Section 24(b) Deduction : ₹2,00,000

- Standard Deduction : ₹50,000

- Taxable Income : ₹6,00,000

- Tax Liability : ₹33,800

New Tax Regime Calculation:

- Gross Income : ₹10,00,000

- Deductions (Section 80C, 80D, etc.) : ₹0

- Section 24(b) Deduction : ₹0

- Standard Deduction : ₹50,000

- Taxable Income : ₹9,50,000

- Tax Liability: ₹54,600

In this scenario, the old tax regime allows the employee to reduce taxable income through deductions, potentially resulting in a lower tax bill compared to the new tax regime.

Factors to Consider When Choosing Between Regimes

Income Level

Your income bracket will significantly influence which regime is more beneficial. Higher earners might gain more from the old regime’s deductions.

Investment Habits

Regular investments in tax-saving instruments could make the old regime more advantageous.

Future Financial Planning

Consider your long-term goals and how each regime aligns with them. For example, the interest deduction on home loans in the old regime might be more beneficial if you plan to buy a house.

Complexity and Time

The new regime’s simplicity might appeal to those looking to save time and avoid the complexity of tracking deductions.

Impact on Different Income Groups

Low-Income Earners

May benefit from the new regime due to its lower tax rates and simplicity. They might not have significant deductions to claim under the old regime.

Middle-Income Earners

Need to evaluate deductions and effective tax rates under both regimes to determine the best option. They often have moderate to significant deductions, making the old regime potentially beneficial.

High-Income Earners

Likely to benefit more from the old regime’s deductions despite higher tax rates, as their investment and expenditure on eligible items are usually higher.

Using Tax Calculators

To assist in making an informed decision, use the following calculators to compare your tax liability under both regimes:

These tools provide a clear comparison based on your specific financial situation and help you understand the potential tax outlay under each regime.

Conclusion

Choosing between the old and new tax regimes should be based on a careful evaluation of your financial situation, income level, and future goals. Both regimes offer distinct advantages and disadvantages. Utilize the provided calculators to make an informed choice. For personalized tax planning and hassle-free filing, consult our tax advisors on the EZIT platform. Our experts can help optimize your financial health and ensure compliance with current regulations.

Simplify Your Tax Filing with EZIT

To ensure you maximize your tax savings and file your taxes accurately, consult our expert tax advisors on the EZIT Guardian App. Our personalized tax planning services help you navigate both old and new tax regimes, ensuring compliance and optimal financial health. Don’t miss out on potential savings and hassle-free filing—get started with EZIT today! You can download the app from Google Play Store.