TL;DR

Joint bank accounts in India often include an ‘Either or Survivor’ clause, allowing any account holder to operate the account independently. This clause simplifies access and transfer of funds, especially after one account holder’s death. However, it also poses potential risks and legal complexities that account holders should understand.

Introduction

Joint bank accounts are a common financial tool in India, offering convenience and flexibility for families, couples, and business partners. One key feature of many joint accounts is the ‘Either or Survivor’ clause. This article delves into the implications of this clause, its benefits, potential risks, and legal considerations for account holders in India.

What is a Joint Account?

A joint account is a bank account shared by two or more individuals. In India, these accounts are often used by:

- Married couples

- Parents and children

- Business partners

- Family members

Joint accounts allow multiple people to deposit, withdraw, and manage funds collectively.

Understanding the 'Either or Survivor' Clause

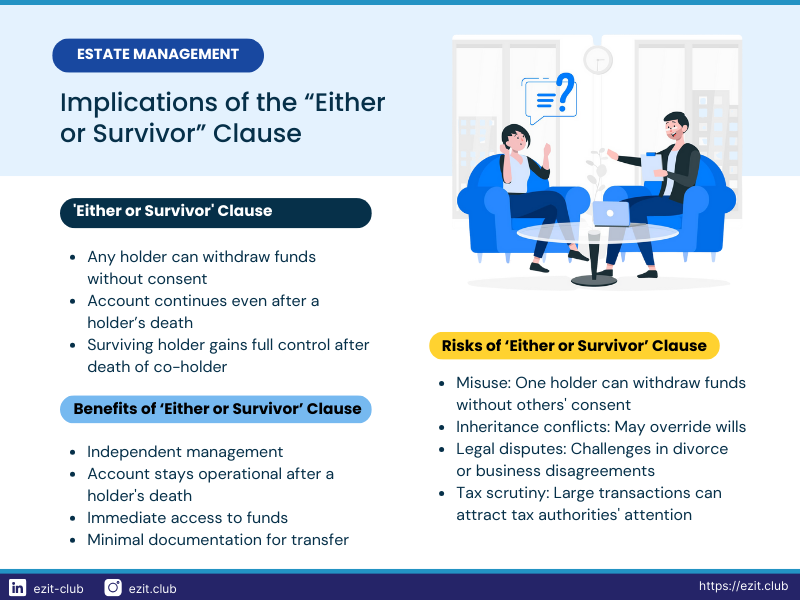

The ‘Either or Survivor’ clause is a provision in joint account agreements that allows any account holder to operate the account independently. Key points include:

- Any account holder can withdraw funds without the consent of others

- The account remains operational even if one account holder dies

- The surviving account holder(s) gain full control of the account upon the death of a co-holder

Benefits of the 'Either or Survivor' Clause

The ‘Either or Survivor’ clause offers several advantages:

- Convenience: Any account holder can manage the account without requiring signatures from others

- Continuity: The account remains functional even if one holder is unavailable or deceased

- Simplified inheritance: The surviving account holder can access funds immediately without waiting for legal processes

- Reduced paperwork: Banks typically require minimal documentation to transfer account ownership

Potential Risks and Concerns

While convenient, the ‘Either or Survivor’ clause comes with potential drawbacks:

- Misuse of funds: Any account holder can withdraw money without consent from others

- Inheritance disputes: The clause may conflict with a deceased account holder’s will

- Legal complications: In case of divorce or business disputes, determining fund ownership can be challenging

- Tax implications: Large transfers or withdrawals may attract scrutiny from tax authorities

Legal Implications

The ‘Either or Survivor’ clause intersects with several legal areas:

- Succession laws: The clause can override traditional inheritance laws

- Tax regulations: Surviving account holders may face gift tax implications

- Court rulings: Several Indian court cases have addressed disputes related to this clause

- Banking regulations: RBI guidelines govern the operation of joint accounts

Best Practices for Joint Account Holders

To maximize benefits and minimize risks, consider these practices:

- Choose co-holders carefully

- Maintain clear communication about account usage

- Keep accurate records of individual contributions

- Regularly review and update nominee details

- Consult a legal expert for personalized advice

Alternatives to 'Either or Survivor' Accounts

For those concerned about the implications, alternatives include:

- Joint accounts requiring all holders’ signatures for withdrawals

- Individual accounts with nominee provisions

- Trust accounts for more complex financial arrangements

The Role of Banks

Banks play a crucial role in managing ‘Either or Survivor’ accounts:

- Providing clear information about the clause to account holders

- Implementing security measures to prevent fraud

- Facilitating smooth transitions in case of a holder’s death

- Offering various joint account options to suit different needs

Impact on Estate Planning

The ‘Either or Survivor’ clause can significantly affect estate planning:

- It can simplify asset transfer for some families

- May conflict with wishes expressed in a will

- Can impact the overall distribution of assets among heirs

- Requires careful consideration when creating a comprehensive estate plan

Tax Considerations

Joint accounts with the ‘Either or Survivor’ clause have specific tax implications:

- Potential gift tax liability for large transfers

- Income tax obligations on interest earned

- Possible scrutiny of transactions by tax authorities

- Need for clear documentation of fund sources and ownership

Conclusion

The ‘Either or Survivor’ clause in joint accounts offers convenience and continuity but requires careful consideration. Account holders should weigh the benefits against potential risks, understand the legal implications, and make informed decisions based on their specific circumstances. Clear communication among account holders and regular reviews of financial arrangements are key to maximizing the benefits of joint accounts while minimizing potential conflicts.

The clause can have far-reaching implications in various life situations, from sudden deaths to business dissolutions and family disputes. It’s crucial for account holders to understand the full scope of this clause and consider how it aligns with their overall financial and estate planning goals.

How EZIT Guardian Can Assist

Start your 90-day free trial now and join thousands of Indians who have already secured their family’s financial future with EZIT Guardian. Don’t leave your family’s future to chance. Contact EZIT Guardian today to create a clear, legally sound will. Download the EZIT Guardian app from the Google Play Store & App Store today to schedule a consultation and take the first step to start securing your legacy.