TL;DR

Gift Deed Registration in India is a crucial process for transferring property without monetary consideration. It involves specific document preparation, stamp duty payment, and mandatory registration for immovable property. The process includes verification of parties, property details, and legal compliance. Understanding Gift Deed Registration is essential for ensuring the legal validity of property gifts in India.

Introduction

Gift Deed Registration in India is a legal process that formalizes the transfer of property without monetary consideration. This process is governed by the Transfer of Property Act, 1882, and the Registration Act, 1908. Gift Deed Registration is mandatory for immovable property and plays a crucial role in estate planning and wealth distribution.

This guide will explain the key aspects of Gift Deed Registration in India, including its requirements, process, and implications.

Understanding the Gift Deed Format in India

A gift deed registration in India must follow a specific format to ensure its legal validity. The document should include the following components:

- Title: The document should be clearly titled “Gift Deed.”

- Date and place of execution: This establishes when and where the deed was created.

- Donor details: Full name, age, and address of the person gifting the property.

- Donee details: Full name, age, and address of the person receiving the gift.

- Property description: A detailed description of the property being gifted.

- Donor’s right to gift: A statement confirming the donor’s legal right to gift the property.

- Donor’s intention: A clear expression of the donor’s intention to gift the property.

- Donee’s acceptance: A statement indicating the donee’s acceptance of the gift.

- No consideration: A clause stating that the transfer is made without any monetary consideration.

- Possession transfer: Details of when and how possession will be transferred to the donee.

- Signatures: The deed must be signed by the donor, donee, and at least two witnesses.

Legal requirements for a valid gift deed in India include:

- The deed must be in writing and signed by the donor.

- It must be attested by at least two witnesses.

- The donor must have the legal right to gift the property.

- The donee must accept the gift during the donor’s lifetime.

Key Clauses in a Gift Deed

To ensure the legal validity of a gift deed in India, certain key clauses must be included:

- Donor’s Declaration: This clause clearly states the donor’s intention to gift the property voluntarily and without any coercion.

- Property Description: A detailed description of the property being gifted, including its location, boundaries, and any identifying features.

- Title and Ownership: A statement affirming the donor’s clear title and ownership rights over the property.

- Consideration Clause: An explicit mention that the transfer is being made without any monetary consideration.

- Delivery of Possession: Details of when and how the possession of the property will be transferred to the donee.

- Rights and Responsibilities: Clarification of any rights or responsibilities that may be transferred along with the property.

- Irrevocability Clause: A statement that the gift is irrevocable once the deed is executed and registered.

- Acceptance Clause: A clear indication of the donee’s acceptance of the gift.

Parties Involved in a Gift Deed Registration

The primary parties involved in a gift deed registration in India are:

- Donor: The person who owns the property and intends to gift it. The donor must be of sound mind, over 18 years of age, and have the legal right to transfer the property.

- Donee: The person receiving the gift. The donee must be in existence at the time of the gift and capable of accepting it.

- Witnesses: At least two witnesses are required to attest the gift deed. They should be adults of sound mind and not direct beneficiaries of the deed.

- Registrar: The government official responsible for registering the gift deed.

- Legal Professionals: Lawyers or legal advisors who may assist in drafting and executing the deed.

Properties that can be Gifted

A gift deed in India can be used to transfer various types of properties:

Immovable Property

- Residential properties such as houses and apartments

- Commercial properties

- Agricultural land

- Vacant plots

Movable Property

- Vehicles

- Jewellery

- Artworks

- Financial instruments such as stocks and bonds

Intangible Property

- Intellectual property rights

- Goodwill of a business

It’s important to note that certain properties may have restrictions on gifting, such as ancestral property under Hindu law or properties with legal encumbrances.

How to Create a Gift Deed for Property

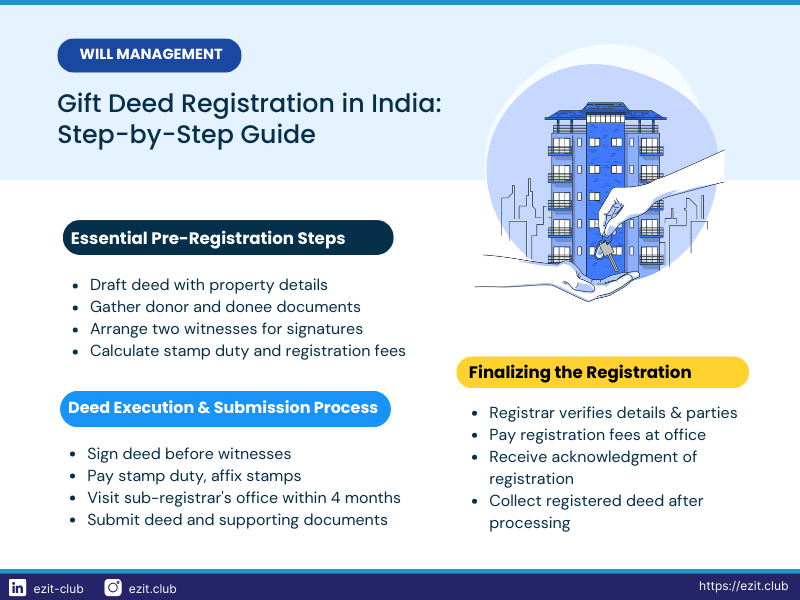

Creating a gift deed in India involves several steps:

- Verify Property Ownership: Ensure the donor has clear title to the property.

- Draft the Deed: Prepare the gift deed with all necessary clauses and details. It’s advisable to seek legal assistance for this step.

- Arrange Witnesses: Identify at least two witnesses who will attest the deed.

- Pay Stamp Duty: Pay the required stamp duty and get the deed stamped.

- Execute the Deed: The donor and donee should sign the deed in the presence of witnesses.

- Register the Deed: Present the deed for registration at the sub-registrar’s office.

- Update Property Records: Ensure relevant property records are updated to reflect the new ownership.

Registration Process & Documents Needed for Gift Deed

Registration of a gift deed is mandatory in India for immovable property. The process involves:

- Visit the Sub-Registrar’s Office: Present the deed for registration within four months of execution.

- Required Documents:

- Original gift deed (stamped and executed)

- Proof of identity of donor, donee, and witnesses

- Recent photographs of all parties

- Property documents (title deeds, tax receipts)

- NOC from housing society (if applicable)

- Pay Registration Fees: As per the state’s prescribed rates.

- Biometric Verification: Parties may need to provide thumbprints or signatures.

- Collect Registered Deed: The registered deed is typically returned after a few days.

Tax Implications of a Gift Deed

The tax implications of a gift deed in India vary based on different scenarios:

- Gifts to Relatives:

- Gifts to specified relatives (spouse, siblings, parents, etc.) are exempt from tax for the donee.

- The donor faces no tax liability.

- Gifts to Non-Relatives:

- If the value exceeds ₹50,000 in a year, it’s taxable for the donee under “Income from Other Sources.”

- The donor still faces no tax liability.

- Stamp Duty:

- Stamp duty is payable on the market value of the property.

- Rates vary by state but are generally lower than for sale deeds.

- Capital Gains for Donee:

- When the donee later sells the gifted property, capital gains tax may apply.

- The cost of acquisition is considered as the cost to the previous owner (donor).

Gift Deed Registration Charges

Executing a gift deed in India involves several charges:

- Stamp Duty: This varies by state, typically 2-5% of the property’s market value.

- Registration Fees: Usually a small percentage of the property value, capped in most states.

- Legal Fees: If engaging a lawyer for drafting and execution.

- Miscellaneous Charges: For obtaining necessary documents, photocopies, etc.

These charges are generally lower than those for sale deeds, but they can still be substantial for high-value properties.

Common Misconceptions about Gift Deeds

- Misconception: Gift deeds are always tax-free.

Reality: Tax implications depend on the relationship between donor and donee. - Misconception: Oral gifts of immovable property are valid.

Reality: Gifts of immovable property must be in writing, signed, and registered. - Misconception: A gift deed can be easily revoked.

Reality: Once registered, a gift deed is generally irrevocable. - Misconception: Gift deeds don’t require registration.

Reality: Registration is mandatory for gifting immovable property.

Conclusion

Gift deeds in India serve as a valuable tool for transferring property, especially within families. They offer a way to distribute assets during one’s lifetime, potentially reducing future disputes. However, the process involves legal complexities and potential tax implications that must be carefully considered.

Key points to remember:

- Ensure proper format and essential clauses in the deed.

- Understand the tax implications based on the donor-donee relationship.

- Don’t overlook the gift deed registration process and associated costs.

- Seek professional advice to navigate legal and financial complexities.

By understanding these aspects of gift deeds, individuals can make informed decisions about property gifting, ensuring their intentions are legally executed and their interests are protected.

Secure Your Legacy with EZIT

Navigating the intricacies of gift deeds in India can be challenging. EZIT Guardian is here to simplify the process and ensure your property gifting is executed smoothly and legally.

Our experts can help in:

- Expert consultation on gift deed implications and alternatives.

- Assistance in drafting legally sound gift deeds.

- Guidance through the gift deed registration process.

- Advice on tax implications and potential benefits.

- Support in updating property records post-gifting.

Don’t let the complexities of gift deeds deter you from your property transfer goals. Contact EZIT Guardian today for comprehensive support in executing your gift deed. Download the EZIT Guardian app from the Google Play Store & App Store today to schedule your appointment now. Let EZIT Guardian help you navigate the gift deed registration process with confidence and peace of mind.