TL;DR

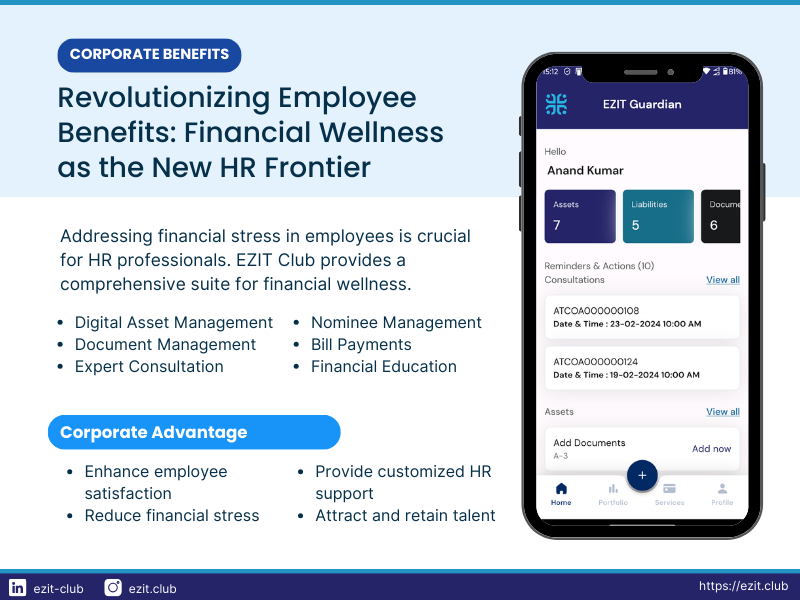

Financial stress is silently eroding your employees’ productivity and well-being. But what if you could transform this challenge into a powerful retention tool? Discover how EZIT Club’s comprehensive financial wellness platform is revolutionizing employee benefits in India. From digital asset management to expert consultations, learn how forward-thinking HR leaders are boosting satisfaction and slashing turnover rates. Ready to turn financial stress into your company’s competitive advantage? Read on to unlock the future of employee benefits.

Introduction

In the rapidly evolving landscape of corporate India, HR professionals face a challenge that extends beyond traditional employee management: addressing the financial stress of their workforce. This article delves into the growing importance of financial wellness programs and how EZIT Club offers a comprehensive solution to this pressing issue.

The Hidden Productivity Killer: Financial Stress

Recent studies have unveiled a concerning trend among employees in Indian workplaces:

1 - Based on a PwC survey, 2 - Money & Mental Health Institute study, 3 - According to IBEF

PwC’s 2022 Employee Financial Wellness Survey found that 63% of employees reported that their financial stress had increased since the start of the pandemic. Moreover, the same survey revealed that 72% of workers experiencing financial stress would be attracted to another company that cares more about their financial well-being.

These figures highlight a critical issue that HR departments can no longer ignore. Financial stress isn’t just a personal problem; it’s a significant factor affecting company performance, employee retention, and overall workplace morale.

The Real-World Impact: Ravi's Story

Consider the case of Ravi, a mid-level manager at a tech firm in Bangalore. When the pandemic hit, Ravi found himself unprepared for the financial strain. With a home loan, two school-going children, and elderly parents to support, Ravi’s lack of financial planning quickly became apparent. He had no emergency fund, his insurance coverage was inadequate, and he struggled to manage his taxes efficiently. The stress began to affect his work performance, leading to missed deadlines and strained relationships with colleagues.

Ravi’s story is not unique. Many Indian employees face similar challenges, often without the knowledge or tools to manage their finances effectively. A survey by the National Stock Exchange (NSE) found that only 20% of India’s population is financially literate, highlighting the widespread nature of this problem.

The EZIT Guardian Solution

This is where EZIT Club steps in, offering a comprehensive financial wellness platform designed for the Indian corporate environment. Here’s how EZIT Club addresses the key issues:

- Digital Asset Management:

- A secure digital vault for storing information about assets and liabilities

- Up to 100 records can be maintained, giving employees a clear picture of their financial health

- Helps in better financial decision-making and long-term planning

- Document Management:

- DocuVault feature allows secure storage of up to 200 documents

- Eliminates the hassle of searching for important papers during emergencies

- Ensures critical documents are always accessible, reducing stress during crucial times.

- Expert Consultation:

- Access to legal, taxation, and financial advice

- Helps employees navigate complex financial decisions with professional guidance

- Particularly valuable during tax season or when making major financial decisions

- Nominee Management:

- Simplifies the process of managing nominees for various assets

- Crucial for ensuring financial security for employees’ families

- Reduces legal complications in case of unforeseen events

- Bill Payments:

- Streamlines regular financial obligations

- Helps employees stay on top of their financial commitments

- Reduces the risk of missed payments and associated penalties

- Financial Education:

- Provides resources and tools to improve financial literacy

- Covers topics like budgeting, investing, and retirement planning

- Empowers employees to make informed financial decisions

The Corporate Advantage

By offering EZIT Guardian as part of their benefits package, companies can:

- Enhance Employee Satisfaction: Addressing personal financial and legal needs demonstrates a commitment to employee well-being. The MetLife Employee Benefit Trends Study 2022 found that 84% of employees consider financial wellness programs as a must-have or nice-to-have benefit.

- Reduce Financial Stress: Potentially improving productivity and reducing turnover. PwC’s survey found that 76% of employees reported that financial worries have impacted their productivity at work.

- Provide Customized HR Support: EZIT’s Corporate plan allows direct communication with EZIT’s team for efficient management of employee benefits. This personalized approach ensures that the financial wellness program aligns with the company’s specific needs and culture.

- Attract and Retain Talent: In a competitive job market, comprehensive financial wellness programs can be a key differentiator. A study by Mercer found that 78% of employees are more likely to stay with their employer because of their benefits program.

Implementation and ROI

Implementing EZIT Guardian is straightforward and cost-effective. At just ₹999 per year per employee, companies can provide a host of benefits that far outweigh the investment.

The return on investment (ROI) for financial wellness programs can be significant. A study by Financial Finesse found that for every $1 spent on financial wellness, the company received $3 in benefits through improved productivity and reduced turnover.

Case Study: RESKOM's Success Story

The Future of Financial Wellness in Corporate India

As we navigate the post-pandemic world, financial wellness has become a crucial aspect of employee well-being. The importance of these programs is likely to grow, with the global financial wellness benefits market expected to reach $1.56 billion by 2028.

By addressing this need, HR departments can play a pivotal role in enhancing employee satisfaction, productivity, and retention. Moreover, they can contribute to the overall financial literacy of the Indian workforce, creating a positive ripple effect that extends beyond the workplace.

EZIT Guardian offers a holistic solution to this complex problem, providing tools and resources that empower employees to take control of their financial lives. In doing so, it not only benefits the employees but also contributes to the overall health and productivity of the organization.

Conclusion

Financial wellness is no longer a luxury; it’s a necessity in the modern corporate world. As HR professionals, you have the opportunity to lead this change, creating a workforce that is not just professionally capable but also financially secure and confident.

EZIT Guardian offers the tools, expertise, and support you need to make this vision a reality. By implementing a comprehensive financial wellness program, you’re not just offering a benefit; you’re investing in the long-term success of your employees and your organization.

Secure Your Employees' Financial Well-being with EZIT

Ready to revolutionize your employee benefits package and set a new standard for employee care? Take the first step towards a financially empowered workforce today:

- Schedule a Demo: Experience firsthand how EZIT Guardian can transform your employees’ financial well-being. Book a personalized demo with our expert team.

- Request a Custom Proposal: Let us tailor a financial wellness program that fits your company’s unique needs and budget. Get a no-obligation proposal within 48 hours.

Don’t let financial stress hold your employees back. Start your journey towards a more productive, satisfied, and financially secure workforce.

Together, let’s build a future where financial wellness is a cornerstone of corporate success by downloading the EZIT app from the Google Play Store & App Store today.