TL;DR

Early ITR filing for FY 2024 is available from April, but CAs advise waiting until after June 15th. Early filing risks mismatches with AIS data reported by May 31st. Those expecting quick refunds may file early but should be prepared to revise if needed. Verify all information carefully before filing and consider professional advice for complex cases.

Introduction

As the tax season approaches in India, many taxpayers are eager to get their Income Tax Returns (ITR) filed as soon as possible. While the government has enabled ITR filing for FY 2024 as early as the first week of April, Chartered Accountants (CAs) are advising against filing before June 15th. This situation has created a dilemma for many taxpayers: should they file early or wait? In this blog post, we’ll dive deep into the intricacies of early ITR filing, its implications, and what taxpayers need to know to make an informed decision.

The Early Filing Scenario

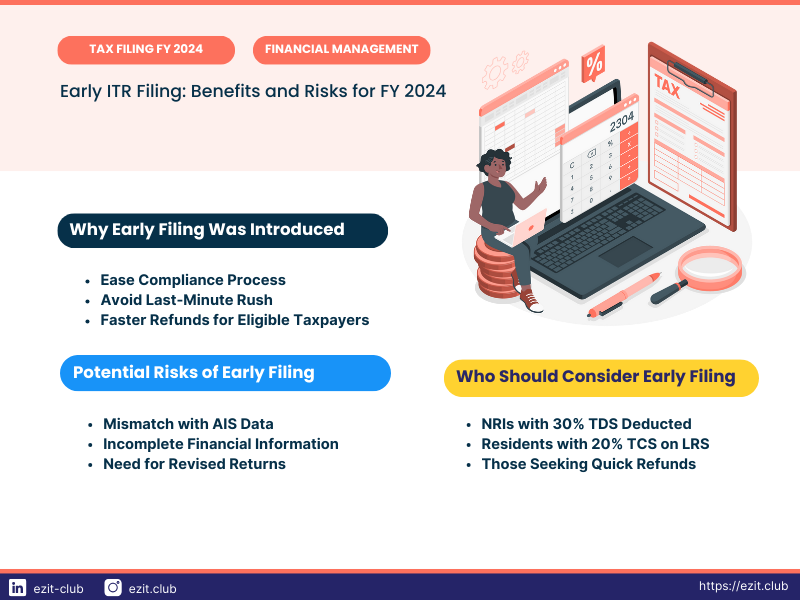

ITR forms for FY 2024 were enabled in the first week of April. This early enablement is part of the government’s initiative to ease compliance and avoid the last-minute rush that often occurs closer to the deadline. However, this well-intentioned move has sparked a debate among tax professionals and taxpayers alike.

Why Early Filing Was Introduced

- Ease of Compliance: By allowing early filing, the government aims to spread out the filing process over a longer period, reducing server loads and technical glitches that often plague the system during peak filing times.

- Avoiding Last-Minute Rush: Early filing encourages taxpayers to complete their tax obligations well before the deadline, reducing stress and potential errors associated with last-minute submissions.

- Faster Refunds: For those expecting tax refunds, early filing can mean receiving their money sooner, which can be a significant financial advantage.

The Cautionary Advice

Despite these apparent benefits, CAs are advising against filing before June 15th. This cautionary stance is rooted in several practical considerations that taxpayers need to be aware of.

Key Information Reported by May 31st

One of the primary reasons for the cautionary advice is that crucial financial information is typically reported by various entities to the Income Tax Department by May 31st. This information includes:

- Interest Income: Banks and financial institutions report interest earned on savings accounts, fixed deposits, and other interest-bearing instruments.

- High-Value Transactions: Significant financial transactions that could impact your tax liability are reported.

- TDS, TCS, and Capital Gains in the Last Quarter: Information about Tax Deducted at Source (TDS), Tax Collected at Source (TCS), and capital gains realized in the last quarter of the financial year is submitted.

- Tax Exemptions and Deductions: Details about various tax exemptions and deductions claimed are reported by employers and other relevant entities.

The Mismatch Risk

The crux of the issue lies in the potential mismatch between the information you provide in your ITR and the data that will be available in your Annual Information Statement (AIS) after May 31st. This mismatch can lead to several complications:

- Incorrect Tax Calculation: If you file your return without considering all the reported income or deductions, your tax calculation may be incorrect.

- Increased Scrutiny: Discrepancies between your filed ITR and the information in your AIS can trigger scrutiny from the tax department.

- Need for Revision: If mismatches are discovered after filing, you may need to file a revised return, which adds to the complexity and time involved in the tax filing process.

Who Can Still File Early?

Despite the general advice against early filing, there are certain categories of taxpayers who might still benefit from filing early:

- NRIs with 30% TDS Deducted: Non-Resident Indians (NRIs) who have had 30% TDS deducted from their income may file early if they’re confident about their income details and are seeking a quick refund.

- Residents with 20% TCS on Liberalised Remittance Scheme (LRS): Indian residents who have paid 20% Tax Collected at Source on foreign remittances under the LRS might also consider early filing if they’re expecting a significant refund.

What to Do If You Still File Early

If you decide to file your ITR early despite the cautionary advice, it’s crucial to be prepared for potential discrepancies. In case of a mismatch, you should file a revised return by December 31st. This provision allows taxpayers to correct any errors or include any information that was missed in the original filing.

| Aspect | Early Filing (Before June 15th) | Regular Filing (After June 15th) |

|---|---|---|

| Pros |

|

|

| Cons |

|

|

| Best For |

|

|

Understanding the Annual Information Statement (AIS)

The AIS is a comprehensive statement that contains all the tax-related information of a taxpayer, as reported by various entities to the Income Tax Department. When considering early filing, it’s crucial to pay attention to several aspects of your AIS:

- AIS Update Timing: Keep track of when your AIS was last updated. This information can give you an idea of how complete and current the data is.

- Income Verification: Cross-check the incomes listed in your AIS with the TDS certificates, interest income certificates, and Form 26AS that you have received.

- Raising Queries: If you notice any discrepancies or have doubts about the information in your AIS, don’t hesitate to raise a query through the official portal.

- Capital Gains Considerations: Pay special attention to capital gains calculations. The price as per the T+1 cycle (transaction date plus one day) in place of the actual transaction price can cause capital gains discrepancies.

The Implications of Early Filing

While early filing can seem attractive, especially for those expecting refunds, it’s important to weigh the potential risks:

- Incomplete Information: Filing before all your financial information is reported can lead to underreporting of income or overclaiming of deductions.

- Compliance Issues: Inaccuracies in your ITR can lead to notices from the tax department, requiring explanations or corrections.

- Penalties: In severe cases of misreporting, you may face penalties or legal consequences.

- Multiple Revisions: If you discover multiple discrepancies after filing, you may need to file multiple revised returns, which can be time-consuming and stressful.

Best Practices for Tax Filing

Regardless of when you choose to file your ITR, following these best practices can help ensure accuracy and compliance:

- Gather All Documents: Collect all relevant financial documents, including Form 16, bank statements, investment proofs, and loan statements before starting the filing process.

- Verify AIS Information: Once your AIS is updated (typically by early June), carefully review all the information it contains.

- Reconcile Discrepancies: If you notice any differences between your records and the AIS, reconcile these before filing your ITR.

- Seek Professional Help: If you’re unsure about any aspect of your taxes, consider consulting a qualified tax professional.

- Stay Informed: Keep yourself updated on any changes in tax laws or filing procedures that might affect your return.

Conclusion

The option to file ITR early for FY 2024 presents both opportunities and challenges for Indian taxpayers. While the government’s intention to ease the filing process is commendable, the practical realities of information reporting and the potential for mismatches make early filing a risky proposition for many.

For most taxpayers, the prudent approach would be to wait until after June 15th to file their ITR. This allows time for all relevant financial information to be reported and reflected in the AIS, reducing the risk of discrepancies and the need for revised returns.

However, if you do choose to file early, perhaps due to an expected large refund or other pressing reasons, it’s crucial to be extra diligent in verifying your financial information and be prepared to file a revised return if necessary.

Protect Yourself with Expert Guidance

Remember, tax compliance is not just about meeting deadlines; it’s about ensuring accuracy and completeness in your filings. By taking a careful and informed approach to your tax obligations, you can navigate the complexities of the Indian tax system with confidence and peace of mind.

Get started with EZIT today for personalized tax advice by downloading the EZIT app from the Google Play Store & App Store today.