TL;DR

This article breaks down 10 complex inheritance scenarios in India, such as dividing ancestral property, the rights of adopted children, and what happens to inheritance in cases of multiple marriages or separations. It stresses the importance of having a valid will and explains some key legal terms in simple language. The insights are based on Indian laws, like the Hindu Succession Act and Indian Succession Act, to help you make sense of these tricky inheritance issues.

Introduction to Wills in India

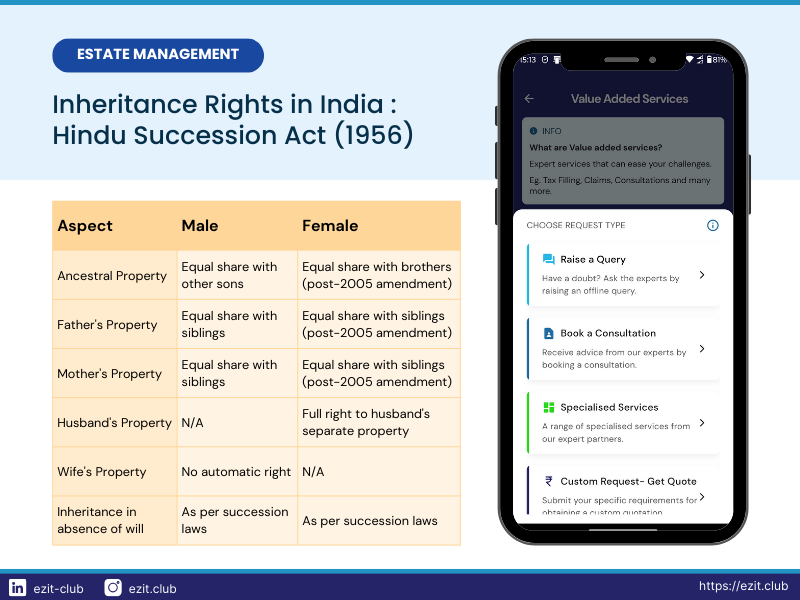

In India, inheritance laws are crucial in determining how property is distributed after someone’s death. A will is a legal document that specifies how a person’s assets should be allocated, and it’s especially important in complex inheritance scenarios in India. The laws governing these scenarios can vary depending on religion, with Hindus, Buddhists, Sikhs, and Jains being covered by the Hindu Succession Act of 1956, while others follow the Indian Succession Act of 1925.

Importance of Wills & Key Terms in Indian Inheritance

Creating a will is vital for ensuring that your assets are distributed according to your wishes, especially in complex scenarios. It helps prevent family disputes and ensures that your dependents are provided for.

To navigate different inheritance scenarios in India, understanding these key terms is essential:

- Probate: A court-certified copy of the will, confirming its validity. In India, probate is mandatory for wills in Kolkata, Mumbai, and Chennai.

- Executor: The person appointed to manage the estate and distribute assets. This role is crucial in complex inheritance scenarios in India.

- Intestate: Dying without a valid will. In such inheritance scenarios in India, property is distributed according to applicable succession laws.

- Testator: The person making the will. In India, a testator must be of sound mind, at least 18 years old, and acting voluntarily.

- Codicil: A supplement modifying or revoking part of a will. It’s useful for updating wills in changing inheritance scenarios in India.

- Bequest: A gift of personal property by will, common in many inheritance scenarios in India.

- Devise: A gift of real property by will, often seen in complex inheritance scenarios in India involving land or buildings.

- Per Stirpes: A method of distributing estate assets where each family branch receives an equal share, relevant in multi-generational inheritance scenarios in India.

10 Complex Inheritance Scenarios in India Explained

1. I inherited ancestral property from my father, who left it only to me in his will, excluding my siblings. Is this legally valid?

In inheritance scenarios in India involving ancestral property, whether the property is considered ancestral or self-acquired makes a big difference. According to the Hindu Succession Act, ancestral property is seen as joint family property, meaning all family members have a right to it. So, in these cases, your father can’t leave the entire property to you in his will, leaving out other legal heirs. But if the property is self-acquired, he has the freedom to decide who gets it.

2. My husband died without a will, leaving me and his siblings behind. We have no children. Who inherits his property?

Under the Hindu Succession Act, 1956, when a Hindu man dies intestate (without a will) and leaves behind his wife and siblings but no children:

- Separate or Self-Acquired Property:

- Under the Hindu Succession Act, the property of a male who dies intestate is first divided among his Class I heirs.

- Class I heirs include the wife, mother, and children. Siblings (brothers and sisters) are not Class I heirs; they are considered Class II heirs.

- If the deceased has no children but leaves behind a wife and mother, the property is divided equally between them. However, since there’s no mention of the mother in this scenario, the entire property would go to the wife, as the sole Class I heir.

- Ancestral Property:

- Ancestral property is considered joint family property, and all coparceners (sons, daughters, and wife) have a right to it.

- For ancestral property, husband’s share in the property would be inherited by his wife, along with any other Class I heirs.

- If there are no children and the husband’s father is deceased, the wife inherits the ancestral property as a Class I heir.

- The siblings, being Class II heirs, would only inherit if there were no surviving Class I heirs (e.g., no wife, children, or mother).

3. I inherited property from my parents. If I die without a will, how will the property be distributed between my husband and my parents?

Under the Hindu Succession Act, if a Hindu female dies without a will (intestate), her property is distributed in the following order:

- First to her children and husband

- If no children or husband, then to her husband’s heirs

- If no husband’s heirs, then to her father and mother

- If no parents, then to her father’s heirs

- If no father’s heirs, then to her mother’s heirs

Key Points:

- No Distinction in Property Type: For a Hindu woman, there is no distinction between ancestral and self-acquired property in terms of inheritance.

- Equal Rights: Sons and daughters have equal inheritance rights.

- Simultaneous Succession: If the woman has both children and a husband, they inherit simultaneously (as Class I heirs).

- Husband’s Priority: In the absence of children, the husband and his heirs have priority over the woman’s parents.

- Parents’ Succession: Parents only inherit if there are no children, husband, or husband’s heirs.

Important Notes:

- This order of succession applies specifically to Hindu females under the Hindu Succession Act.

- The Act applies to Hindus, Buddhists, Jains, and Sikhs.

- Different rules may apply for women of other religions or those married under the Special Marriage Act.

4. My father had two wives (married before 1956) and has now died without a will. How will his property be divided?

In multiple marriage inheritance scenarios in India, under Section 5 of the Hindu Succession Act, both wives would be considered Class I heirs and would inherit equally along with the children from both marriages.

5. My wife and I adopted a child. If I die without a will, does our adopted child have equal rights as a biological child would?

Yes, in adoption-related inheritance scenarios in India, under the Hindu Adoptions and Maintenance Act, 1956, a legally adopted child has the same rights as a biological child, including inheritance rights.

6. My grandfather left a will dividing his property among his children, but my father passed away before him. Do I have any claim to my father's share?

This involves per stirpes distribution in inheritance scenarios in India. If the will doesn’t specifically address this, you may have a claim to your father’s share under the principle of representation.

7. I jointly own a house with my brother. If I die, does my share automatically go to him or to my spouse and children?

In joint ownership inheritance scenarios in India, it depends on how the ownership is structured. In a joint tenancy with right of survivorship, your share passes to your brother. In a tenancy in common, it’s distributed according to your will or intestate succession laws.

8. My mother wrote a will leaving everything to me, her only child. My father is still alive. Does he have any claim to her property?

In such inheritance scenarios in India, if it’s your mother’s separate property and she made a valid will, your father wouldn’t have a legal claim. However, if it’s joint property or if the will was made under duress, he might have grounds to contest.

9. I'm separated from my spouse but not legally divorced. If I die without a will, what are my spouse's inheritance rights?

In separation inheritance scenarios in India, a separated spouse who is not legally divorced retains inheritance rights. They would be considered a Class I heir under the Hindu Succession Act (if applicable) and entitled to inherit along with your children or other Class I heirs.

10. My sibling has been missing for over seven years. How does this affect the distribution of our parents' property?

In missing person inheritance scenarios in India, under the Indian Evidence Act, 1872, a person not heard of for seven years can be presumed dead. Your sibling’s share would be distributed among remaining legal heirs, but they may have the right to claim their share if they reappear.

Conclusion

Inheritance scenarios in India can be complex, especially with unique family situations. While this article provides insights into various inheritance scenarios in India, each case can have its nuances. Having a clear, legally valid will is crucial to ensure your wishes are carried out and prevent disputes among heirs in inheritance scenarios in India.

Key takeaways for navigating inheritance scenarios in India:

- Create a valid will to express your wishes clearly.

- Understand the difference between ancestral and self-acquired property.

- Be aware of adopted children’s rights, equal to biological children.

- Consider joint ownership implications in estate planning.

- Remember that separation without divorce doesn’t negate inheritance rights.

- Familiarize yourself with key terms like probate, executor, and intestate succession.

Secure Your Legacy with EZIT

Navigating complex inheritance scenarios in India doesn’t have to be overwhelming. EZIT is here to help you create a comprehensive estate plan that aligns with your wishes and complies with Indian laws.

Don’t leave your family’s financial future to chance. Take action today to ensure your assets are protected and easily accessible to your loved ones when they need them most. Download the EZIT Guardian app from the Google Play Store & App Store today to schedule your appointment now. Let us help you provide clarity and peace of mind for your loved ones in various inheritance scenarios in India.