TL;DR

Understanding your Annual Information Statement (AIS) is crucial for hassle free tax filing. Reviewing your AIS ensures your tax return is accurate and compliant with tax regulations, helping you avoid errors and simplifying the filing process. For expert AIS assistance, connect with our team on EZIT. Keep reading for insights on maximizing your tax efficiency.

Introduction to AIS for Hassle Free Tax Filing

The Annual Information Statement (AIS) is an essential tool for hassle free income tax filing. It consolidates data from various financial sources such as banks and mutual funds, giving you a comprehensive overview of your financial activities. The AIS displays both reported values (data provided by entities) and modified values (after considering your feedback), ensuring your financial information is accurately represented for tax purposes.

How AIS Ensures Hassle Free Tax Filing

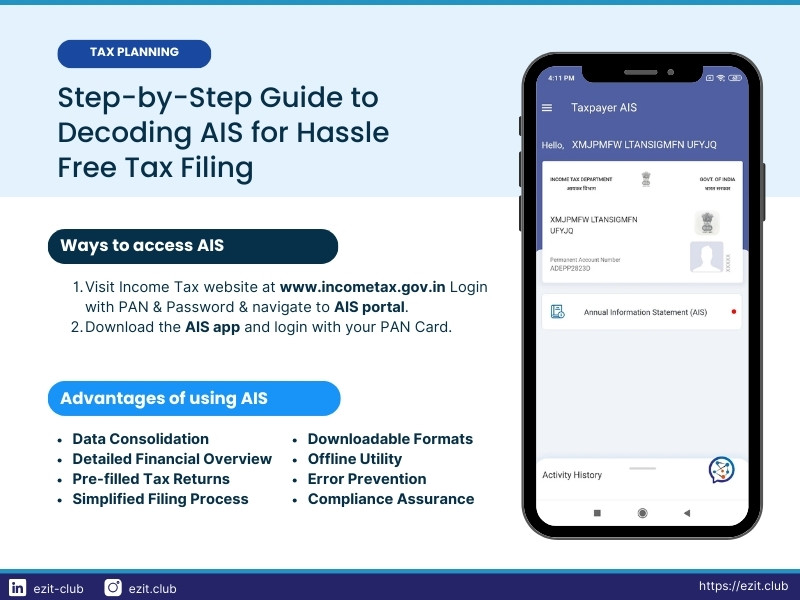

- Data Consolidation: AIS gathers information from multiple financial sources, providing a single view of your financial transactions.

- Detailed Financial Overview: It includes details on interest, dividends, securities transactions, mutual fund transactions, and foreign remittances.

- Pre-filled Tax Returns: AIS helps pre-fill your tax return with accurate data, reducing manual entry and potential errors.

- Simplified Filing Process: Ensures all necessary information is available, making tax filing more straightforward and efficient.

- Feedback Mechanism: Allows you to provide feedback on AIS information online, ensuring any discrepancies are addressed.

- Downloadable Formats: Available for download in PDF, JSON, and CSV formats for easy access and review.

- Offline Utility: The AIS Utility enables offline viewing and feedback submission, adding convenience to the process.

- Error Prevention: Displays reported and modified values to verify and correct financial data, minimizing mistakes.

- Compliance Assurance: Helps you comply with tax regulations and avoid discrepancies in your filings, ensuring a hassle-free experience.

Components of AIS

The AIS is divided into two parts: Part A and Part B.

PART A: General Information

This section includes your PAN, masked Aadhaar number, name, date of birth/incorporation/formation, and contact details.

PART B: Detailed Information

- TDS/TCS Information: Displays your details of Tax Deducted at Source (TDS) and Tax Collected at Source (TCS), including codes, descriptions, and values.

- SFT Information: Shows your data from reporting entities under the Statement of Financial Transaction (SFT), with codes, descriptions, and values.

- Payment of Taxes: Lists information on taxes you have paid, such as advance tax and self-assessment tax.

- Demand and Refund: Provides details of demands raised and refunds initiated for you, including the assessment year and amount.

- Other Information: Contains additional data related to you, such as salary details, interest on refunds, foreign remittances, and currency purchases.

How to Access AIS for Hassle Free Tax Filing

- Visit the Income Tax Department of India’s website at www.incometax.gov.in.

- Log in using your PAN and password, or register if you don’t have an account.

- Navigate to the ‘Annual Information Statement (AIS)’ section.

- Click ‘Proceed’ to access the AIS portal.

- Click on the ‘AIS’ tile to view your statement.

- Select the relevant financial year.

- Download your AIS by clicking on the download icon and choosing the desired format (PDF, JSON, or CSV).

How to Open AIS PDF Using the Correct AIS Password Format

To open the password-protected AIS PDF, use your PAN (in lowercase) followed by your date of birth or incorporation/formation in DDMMYYYY format. For example, if your PAN is AAAAA1234A and your date of birth is 29th July 1999, your AIS password would be ‘aaaaa1234a29071999’.

CBDT's List of 57 Income and Expense Types

The AIS includes details on 57 types of income and expenses, such as salary, rent received, dividends, interest from savings banks, and virtual digital assets transfer receipts.

| S.No | Particulars |

| 1 | Salary |

| 2 | Rent Received |

| 3 | Dividend |

| 4 | Interest from savings bank |

| 5 | Interest from deposits |

| 6 | Interest from others |

| 7 | Interest from Income Tax refund |

| 8 | Rent on plant & machinery |

| 9 | Lottery/Crossword winnings u/s 1158B |

| 10 | Horse race winnings u/s 115BB |

| 11 | PF balance from employer u/s 111 |

| 12 | Infrastructure debt fund interest u/s 115A(1)(a)(ia) |

| 13 | Interest from specified company (non-resident) u/s 115A(1)(a)(aa) |

| 14 | Bonds/government securities interest |

| 15 | Units of non-resident income u/s 115A(1)(a)(ab) |

| 16 | Offshore fund income/long-term capital gain u/s 115AB(1)(b) |

| 17 | Foreign currency bonds/shares income u/s 115AC |

| 18 | Foreign institutional investors’ securities income u/s 115AD(1)(1) |

| 19 | Specified Fund securities income u/s 115AD(1)(1) |

| 20 | Insurance commission |

| 21 | Life insurance policy receipts |

| 22 | Online Games winnings u/s 115BBJ |

| 23 | National savings scheme withdrawal |

| 24 | Lottery ticket sales commission |

| 25 | Securitization trust investment income |

| 26 | Repurchase of units by MF/UTI |

| 27 | Government payable sums |

| 28 | Specified senior citizen income |

| 29 | Land/building sale |

| 30 | Immovable property transfer receipts |

| 31 | Vehicle sale |

| 32 | Securities/mutual fund units sale |

| 33 | Off market debit transactions |

| 34 | Off market credit transactions |

| 35 | Business receipts |

| 36 | GST turnover |

| 37 | GST purchases |

| 38 | Business expenses |

| 39 | Rent payment |

| 40 | Miscellaneous payment |

| 41 | Cash deposits |

| 42 | Cash withdrawals |

| 43 | Cash payments |

| 44 | Foreign remittance/foreign currency purchase |

| 45 | Foreign remittance receipt |

| 46 | Non-resident sportsmen/sports association payment u/s 1158BA |

| 47 | Foreign travel |

| 48 | Immovable property purchase |

| 49 | Vehicle purchase |

| 50 | Time deposits purchase |

| 51 | Securities/mutual funds purchase |

| 52 | Credit/Debit card transactions |

| 53 | Account balance |

| 54 | Business trust distributed income |

| 55 | Investment fund distributed income |

| 56 | Donations received |

| 57 | Virtual Digital Assets transfer receipt |

Understanding Taxpayer Information Summary (TIS) in AIS

Taxpayer Information Summary (TIS) provides a summarized view of your information across different categories. It displays values processed by the system and those accepted by you after considering your feedback. This summary includes details like salary, interest, and dividends. The accepted values are used for pre-filling your tax return, if applicable.

Within the Taxpayer Information Summary, you will find:

- Information Category

- Value processed by the system

- Value accepted by you

Furthermore, within each Information Category, the following details are shown:

- Part through which information is received

- Information Description

- Information Source

- Amount Description

- Amount (Reported by Source, Processed by System, Accepted by Taxpayer)

Difference Between AIS and Form 26AS

AIS expands upon Form 26AS, offering a more comprehensive view of your financial transactions. While Form 26AS primarily covers property purchases, high-value investments, and TDS/TCS transactions, AIS includes additional details such as savings account interest, dividend income, rent received, securities/immovable property transactions, foreign remittances, interest on deposits, and GST turnover.

Moreover, AIS allows you, as the taxpayer, to provide feedback on the reported transactions. Additionally, it aggregates transactions on an information source level, providing a detailed summary in the Taxpayer Information Summary (TIS).

How to Submit Feedback in AIS

You can easily provide feedback on the information displayed under TDS/TCS Information, SFT Information, or Other Information by following these simple steps:

- Click the ‘Optional’ button in the Feedback column next to the relevant information.

- Select the appropriate feedback option and enter details.

- Click ‘Submit’ to provide feedback.

AIS Correction Status Update

The CBDT has introduced a new functionality from 13th May, 2024, that displays the status of AIS correction or feedback for taxpayers. It will show you whether the feedback or correction you provided has been accepted partially, fully, or rejected by the source (the person responsible for uploading information in AIS).

Here are the options you will see for the status of feedback confirmation from the source:

- Whether Feedback is Shared for Confirmation: Indicates if your feedback has been shared with the Reporting Source for confirmation.

- Feedback Shared On: Displays the date on which your feedback was shared with the Reporting Source for confirmation.

- Source Responded On: Shows the date on which the Reporting Source responded to your feedback.

- Source Response: Provides information on the response given by the Source regarding your feedback (whether any correction is required or not).

How to Address Errors in AIS

If you feel that the information reflected in AIS for a given assessment year is inaccurate, you can submit a corrected response. You can review all entries, including personal information and financial transactions.

Steps to correct an error in the Annual Information Statement:

- Log in to the Income Tax e-filing portal at www.incometax.gov.in.

- Select ‘Annual Information Statement (AIS)’ under the ‘Services’ tab.

- Click on the ‘AIS’ option.

- Identify the incorrect information in Part A or Part B of the AIS.

- Click the ‘Optional’ button to submit feedback.

- Choose the appropriate feedback option.

- Click ‘Submit’.

Frequently Asked Questions : AIS for Hassle free Tax Filing

Both Form 26AS and AIS are crucial for tax filing but serve different purposes. Form 26AS primarily provides details on tax deducted at source (TDS), advance tax, and high-value transactions. AIS, on the other hand, offers a comprehensive view of all financial transactions, including interest, dividends, and more. AIS provides a broader spectrum of information, making it more detailed and useful for ensuring complete and accurate tax reporting.

To open your AIS PDF, use the password format which combines your PAN in lowercase letters and your date of birth in DDMMYYYY format. For example, if your PAN is AAAAA1234A and your date of birth is 29th July 1999, your AIS password will be ‘aaaaa1234a29071999’.

The Annual Information Statement (AIS) is available in multiple formats including PDF, JSON, and CSV. The AIS is structured into Part A (general information like PAN, Aadhaar, name) and Part B (detailed financial transactions including TDS/TCS, SFT, and other income or expenditure details).

Section 143 of the Income Tax Act refers to the assessment of income tax returns. There are two key subsections: 143(1), which deals with the summary assessment without calling for additional information, and 143(2), which involves a detailed scrutiny assessment where the tax authorities may request additional information or clarification.

A TDS message typically refers to a notification sent by the Income Tax Department or financial institutions indicating that tax has been deducted at source from your income. It includes details such as the amount deducted, the deductor’s information, and the section under which TDS has been applied.

You can download your AIS from the Income Tax Department’s official website. After logging in at www.incometax.gov.in, navigate to the ‘Annual Information Statement (AIS)’ section, select the relevant financial year, and download the statement in your preferred format (PDF, JSON, or CSV).

AIS does not provide a “balance” per se. It consolidates your financial transactions for a comprehensive review. To check the information included in your AIS, log in to the Income Tax Department’s website, access the AIS section, and review your transactions and financial data listed there.

There is no separate activation process for AIS. Once you log in to the Income Tax Department’s portal at www.incometax.gov.in using your PAN and password, you can access your AIS. Simply navigate to the ‘Annual Information Statement (AIS)’ section to view or download your AIS for the relevant financial year.

Conclusion

Reviewing your AIS thoroughly ensures your tax return is accurate, helping you avoid errors and comply with tax regulations, leading to a hassle free tax filing experience. For expert AIS assistance, connect with our team on EZIT.

File Your Taxes Seamlessly with EZIT

Consult our tax advisors on the EZIT Guardian App to review and correct your AIS. Achieve hassle-free and accurate tax reporting. Start your journey to making the best choice for your future by downloading the EZIT app from the Google Play Store & App Store today.