TL;DR

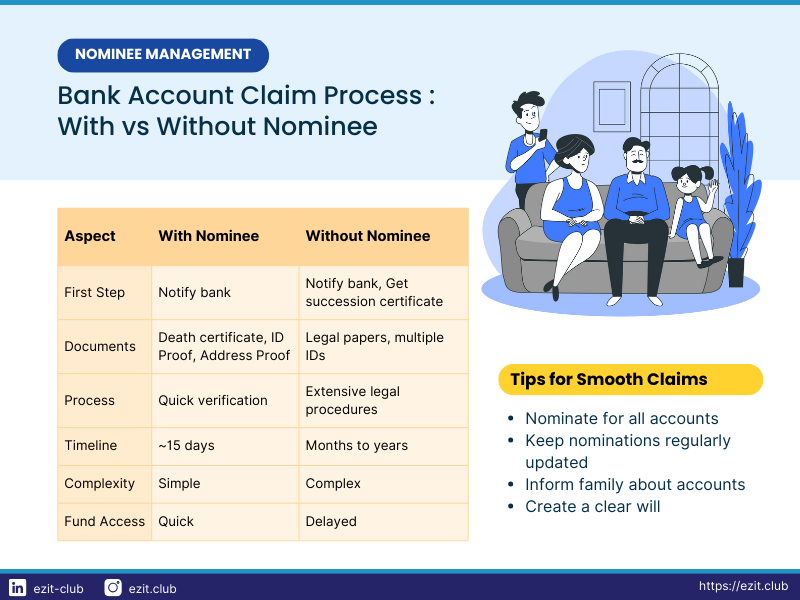

The bank account claim process varies significantly depending on whether there’s a nominee, multiple nominees, no nominee, or if it’s a joint account. With a nominee, the process is straightforward, typically taking around 15 days. Without a nominee, legal heirs must obtain succession certificates, which can be more time-consuming, often taking several months to years. Joint accounts and special cases like minor nominees have their own procedures. Understanding these processes is crucial for smooth fund transfer after an account holder’s death.

Introduction

When a bank account holder passes away, the process of claiming their account balance becomes a critical task for the family. The presence or absence of a nominee, the account type, and other factors significantly impact this process. This comprehensive guide explores the bank account claim process in various scenarios, highlighting the steps, documentation requirements, and timelines involved.

1. Bank Account Claim Process with Nominee

- First Steps : The process begins with the nominee notifying the bank of the account holder’s death and providing the death certificate.

- Documentation : The nominee typically needs to submit:

- Death certificate of the account holder

- Proof of identity of the nominee

- Proof of address of the nominee

- Filled claim form provided by the bank

- Process : The bank verifies the nominee’s identity and the authenticity of the death certificate. Once verified, the bank proceeds with the fund transfer to the nominee’s account.

- Timeline : This process is relatively quick, usually taking around 15 days to complete.

2. Bank Account Claim Process without Nominee

- First Steps : In the absence of a nominee, the legal heirs must first obtain a legal heir certificate or a succession certificate from the court.

- Documentation : The legal heirs need to provide:

- Death certificate of the account holder

- Legal heir/succession certificate

- Proof of identity of all legal heirs

- Proof of address of all legal heirs

- Indemnity bond (in some cases)

- Filled claim form provided by the bank

- Process : The bank conducts extensive verification of all documents and legal certificates. The process may involve multiple rounds of scrutiny and potentially require additional documentation or legal procedures.

- Timeline : This process can be lengthy, often taking several months to years, depending on the complexity of the case and the efficiency of the legal system.

Special Cases in Bank Account Claim Process

1. Joint Accounts

In the case of a joint account, if one account holder dies, the surviving account holder only needs to submit an application with the death certificate. The account automatically vests with the surviving holder, even if there’s a nominee. This process is typically quick, often completed within a few days to weeks.

2. Multiple Nominees

If there are multiple nominees, the bank will distribute the funds according to the percentage specified by the account holder. If no percentage is specified, the distribution is typically equal. The timeline remains similar to single nominee cases, around 15 days.

3. Deceased Nominee

If one of the nominees is deceased, the bank will distribute the funds among the surviving nominees. If there’s only one nominee and they’re deceased, the process reverts to that of an account without a nominee, potentially extending the timeline to several months.

4. Minor Nominee

When the nominee is a minor, the account holder must appoint a guardian to operate the account until the minor reaches adulthood. The guardian will be responsible for claiming and managing the funds on behalf of the minor. The claim process timeline remains similar to standard nominee cases, about 15 days, but the funds are typically held in trust until the minor comes of age.

Importance of Adding Nominees to Bank Accounts

Nominating a beneficiary for your bank account offers several advantages:

- Simplified Process: The claim process becomes significantly easier and faster for the nominee, typically completed in about 15 days.

- Avoiding Legal Complexities: It reduces the need for legal heir certificates or succession certificates.

- Faster Access to Funds: The nominee can access the funds quickly, which can be crucial in times of financial need following a death.

- Reducing Family Disputes: A clear nomination can prevent potential conflicts among family members over the account balance.

What Happens If There's No Nominee or Will?

If there’s no nominee and no will, the bank will require a succession certificate from the court to determine the rightful owner of the funds. The process is as follows:

- The bank will first look for a registered will from the deceased account holder.

- In the absence of a will, legal heirs must obtain a succession certificate from the court.

- If there are multiple claimants, they can approach the court for a legal resolution.

- The best approach is for legal heirs to reach an internal agreement and then approach the court with a registered copy of the family agreement.

- Each legal heir will need to provide a legal affidavit in this case.

This process can be significantly longer than cases with nominees, often taking several months to years.

Time Periods for Bank Account Death Claim Process

The time period for a bank account death claim process can vary depending on the circumstances:

| Scenario | Timeframe |

|---|---|

| With a nominee | Generally around 15 days |

| Without a nominee | Can take several months to years |

| Joint account | Usually quick, often within days to weeks, as it automatically vests with the surviving account holder |

Frequently Asked Questions

Yes, the account holder can change the nominee at any time by submitting a new nomination form to the bank.

In most cases, the nominee is considered a trustee and is expected to distribute the funds among legal heirs according to succession laws or the deceased’s will.

Yes, an account holder can nominate multiple individuals and specify the percentage of funds each should receive.

While it’s not mandatory, banks strongly recommend nominating a beneficiary for all accounts to simplify the claim process.

If there are multiple claimants or legal disputes, the matter may need to be resolved in court. The bank may freeze the account until a court order is provided, significantly extending the claim timeline.

Conclusion

The bank account claim process can vary significantly based on the presence of a nominee, the type of account, and other factors. While having a nominee generally simplifies the process, reducing it to about 15 days, it’s important to note that nomination doesn’t override the laws of succession. Legal heirs can still contest the claim in court if they believe they have a rightful claim to the funds.

To ensure a smooth transition of funds after your passing, consider these steps:

- Nominate a beneficiary for all your bank accounts and keep the nomination updated.

- If you have specific wishes for fund distribution, consider creating a will.

- Keep your family informed about your accounts and nominations.

- Regularly review and update your nominations and will as your life circumstances change.

By taking these proactive steps, you can significantly reduce the potential for complications and ensure that your hard-earned money reaches your intended beneficiaries with minimal delay and stress.

Ensure Your Will Reflects Your Wishes with EZIT

Navigate the complexities of bank account nominations and claims with confidence using EZIT’s expert services. Our team of expert advisors can guide you through:

- Setting up and updating nominations for all your accounts

- Creating a comprehensive will that aligns with your nominations

- Understanding the claim process for different scenarios

- Preparing the necessary documentation for smooth claim processing

Don’t leave your family’s financial future to chance. Take action today to ensure your assets are protected and easily accessible to your loved ones when they need them most. Download the EZIT Guardian app from the Google Play Store & App Store today to schedule your appointment now. Let’s work together to protect your legacy and give you peace of mind.