TL;DR

To find assets of a deceased person, start with any available documents and gradually expand your search. Use the deceased’s personal information to access bank records, tax returns, and investment accounts. Professional help may be necessary for complex cases. Proper planning can simplify this process for your own family in the future.

Introduction

When a loved one passes away, one of the most challenging tasks for family members is to find assets of the deceased person. This process can be emotionally taxing and logistically complex, especially if the deceased didn’t leave clear records of their financial holdings. Whether you’re an executor, a beneficiary, or a family member trying to settle an estate, understanding how to find assets of a deceased person is crucial.

This comprehensive guide will walk you through the process of uncovering and managing a deceased person’s assets, from basic steps to more advanced techniques. We’ll explore various methods to find assets of a deceased person, discuss the documents you’ll need, and provide insights on overcoming common challenges in this process.

Step-by-Step Guide to Find Assets of a Deceased Person

The first steps in finding a deceased family member’s assets often involve physical searches and personal contacts:

Starting the Asset Tracing Process

1. Search for Physical Documents

- Look for bank statements, investment records, and tax documents in the deceased’s home.

- Check for any safe deposit box keys or records.

- Gather any insurance policies or pension documents.

2. Contact Financial Advisors

- Reach out to the deceased’s chartered accountant or tax advisor.

- These professionals may have valuable insights into investments and accounts.

- Request any financial records they might have on file.

3. Notify Financial Institutions

- Inform banks, credit card companies, and investment firms of the death.

- Request information on accounts and assets held by the deceased.

Leveraging Technology and Official Records

In our digital age, a significant amount of financial information is accessible online. Here’s how to use technology to find assets of a deceased person:

1. Access Income Tax Returns (ITR):

- You’ll need the deceased’s PAN (Permanent Account Number) and mobile number.

- Visit the Income Tax e-filing portal (https://www.incometax.gov.in/iec/foportal/).

- Log in using the deceased’s credentials.

- Download past ITRs for a comprehensive view of declared income and investments.

2. Retrieve the Annual Information Statement (AIS)

- The AIS provides a detailed overview of financial transactions.

- To access the AIS, you’ll need the deceased’s PAN and mobile number or email.

- For a step-by-step guide on accessing and using the AIS, refer to our detailed article: Understanding and Accessing the Annual Information Statement (AIS).

3. Check for Online Banking and Investment Accounts

- If you have access to the deceased’s email, search for financial notifications or statements.

- Look for apps on their mobile devices that might indicate financial accounts.

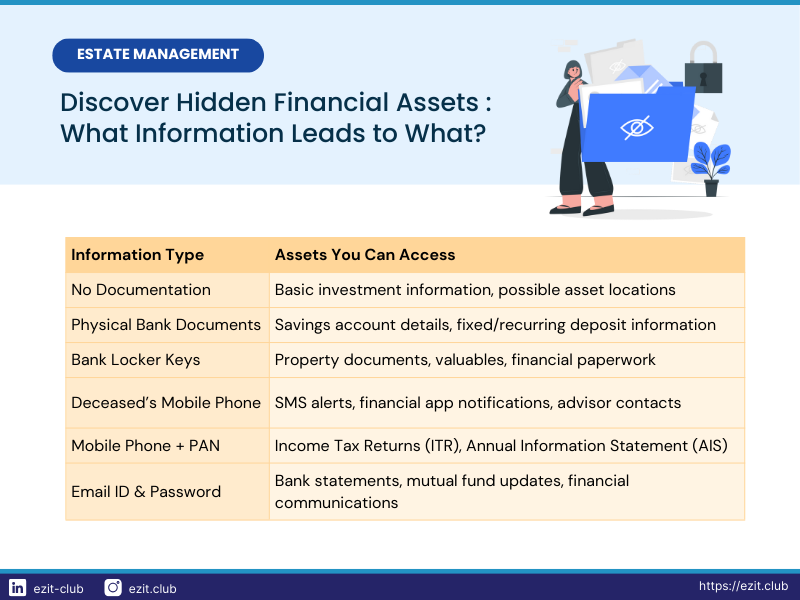

| Information Type | Assets You Can Access |

|---|---|

| No Documentation | Basic investment information, possible asset locations |

| Physical Bank Documents | Savings account details, fixed/recurring deposit information |

| Bank Locker Keys | Property documents, valuables, financial paperwork |

| Deceased’s Mobile Phone | SMS alerts, financial app notifications, advisor contacts |

| Mobile Phone + PAN | Income Tax Returns (ITR), Annual Information Statement (AIS) |

| Email ID & Password | Bank statements, mutual fund updates, financial communications |

Tracing Specific Types of Assets

Different types of assets require different approaches when tracing deceased assets:

1. Bank Accounts

- Physical bank documents can provide information on savings and fixed deposit accounts.

- Contact each bank where the deceased held an account to inquire about other products or services.

2. Property

- Check for property tax receipts or mortgage statements.

- Search local property records using the deceased’s name.

- Bank locker keys might lead to property documents and valuables.

3. Mutual Funds

- With the deceased’s PAN and folio numbers, legal heirs can claim mutual fund investments.

- If you have access to their email or phone, you can generate a Consolidated Account Statement (CAS) for mutual fund investments.

- Visit the CAMS website (https://www.camsonline.com) or KFintech (https://mfs.kfintech.com) to generate the CAS.

4. Shares and Securities

- Check for Demat account statements in physical documents.

- Contact the deceased’s broker for information on holdings.

- Search for any dividend warrants or share certificates.

5. Insurance Policies

- Look for policy documents or premium receipts.

- Contact insurance companies directly with the deceased’s details.

- Check bank statements for recurring premium payments to identify unknown policies.

Overcoming Challenges in Tracing Deceased Assets

Sometimes, the process of tracing deceased assets isn’t straightforward. Here are some challenges you might face when trying to find assets of a deceased person and how to overcome them

- No Will:

- If there’s no will and survivors lack access to financial advisors, tracing investments might take time and effort.

- Consider hiring a probate attorney to help navigate the legal aspects of asset distribution.

- Digital Assets:

- Look for digital wallets, cryptocurrency accounts, or online payment systems.

- Check emails for subscriptions to digital services that might hold value.

- Overseas Assets:

- If the deceased lived or worked abroad, they might have foreign bank accounts or investments.

- Contact embassies or consulates in relevant countries for guidance on tracing foreign assets.

- Unclaimed Assets:

- Check unclaimed asset databases. In India, visit the IEPF website (http://www.iepf.gov.in) to search for unclaimed shares, dividends, or matured deposits.

Take Professional Help to Find Assets of a Deceased Person

When the process becomes overwhelming, professional help is available:

- Registered Transfer Agents (RTAs):

- Companies like CAMS or KFintech can assist in tracing mutual fund holdings with the necessary documents.

- Visit their websites or local branches for assistance.

- Legal Advisors:

- Probate lawyers can help navigate complex legal issues in asset tracing and distribution.

- They can also assist in dealing with financial institutions and government bodies.

- Financial Forensics Experts:

- In cases of suspected hidden assets, financial forensics experts can conduct thorough investigations.

- They use specialized techniques to uncover assets that might not be immediately apparent.

The Power of the Annual Information Statement (AIS)

The AIS is a comprehensive document that can be a goldmine of information when tracing deceased assets. It reveals:

- Bank savings, recurring deposits, and fixed deposit accounts

- Other interest-bearing investments

- Property purchases

- Capital gains from the sale of securities

- Dividend income

- High-value transactions

For a detailed guide on accessing and interpreting the AIS, refer to our article: Unlocking Financial Insights: A Deep Dive into the Annual Information Statement (AIS).

Planning for the Future: Lessons from Asset Tracing

The process of tracing deceased assets and the effort to find assets of a deceased person highlight the importance of proper financial planning and organization. Here are some key takeaways:

- Maintain a clear record of all your assets and investments.

- Regularly update your will and inform your executor of its location.

- Consider setting up a digital vault for important documents and account information.

- Discuss your financial affairs with trusted family members or advisors.

- Regularly review and update beneficiary designations on insurance policies and retirement accounts.

Conclusion

Tracing deceased assets can be a complex and emotionally challenging process. However, with patience, persistence, and the right resources, you can successfully uncover and manage your loved one’s financial legacy. Remember, this process is not just about finding assets; it’s about honoring the deceased’s life work and ensuring their wishes are fulfilled.

As you navigate this journey, consider how you can make this process easier for your own loved ones in the future. Proper planning and organization of your financial information can provide peace of mind and ease the burden on your family during difficult times.

Take Action Today with EZIT Guardian

Don’t leave your family in the dark about your assets. EZIT Guardian offers a secure and comprehensive solution for organizing and storing your financial information. With features like a digital vault, nominee management, and expert support, EZIT Guardian ensures that your loved ones will have all the necessary information at their fingertips when they need it most.

Start your 90-day free trial with EZIT Guardian today and take the first step towards securing your family’s financial future. Download the EZIT Guardian app from the Google Play Store & App Store today to schedule a consultation and take the first step to start securing your legacy.