TL;DR

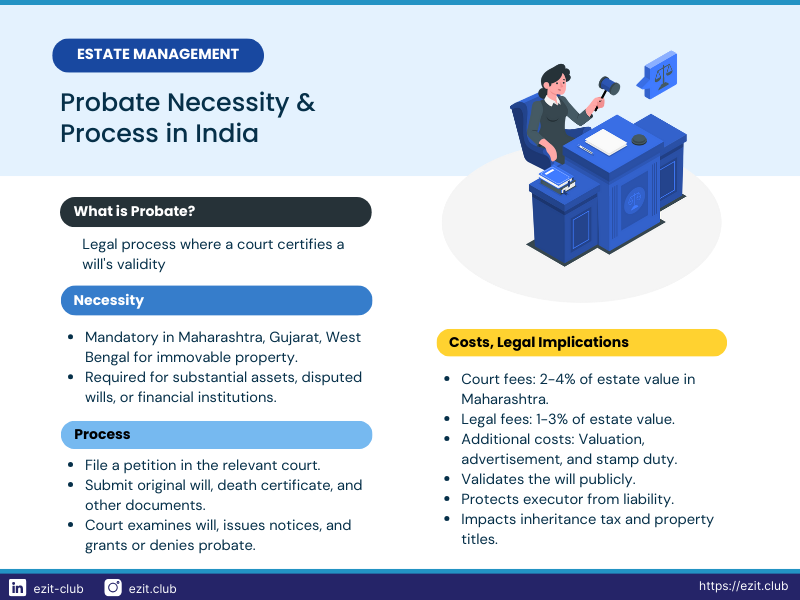

Probate in India is a legal process to validate a will and authorize an executor to distribute the deceased’s assets. It’s mandatory for wills in Maharashtra, Gujarat, and West Bengal, and for immovable property in other states. The process involves filing a petition, providing necessary documents, and obtaining court approval, which can take several months to years. Understanding the relevant laws and procedures is crucial for a smooth probate process.

Introduction

The probate process in India is a crucial legal procedure that validates a will and authorizes the executor to manage and distribute the deceased’s assets. Understanding when probate is necessary and how to obtain it is essential for anyone involved in estate planning or execution. This article delves into the intricacies of the probate process in India, outlining its necessity, procedures, legal framework, and implications.

What is Probate?

Probate is a legal process where a court certifies that a will is valid and genuine. It grants the executor the legal right to execute the will and manage the deceased’s estate. Key points about probate include:

- It’s a court-issued document

- It confirms the authenticity of the will

- It authorizes the executor to act on behalf of the estate

- It provides legal protection to the executor and beneficiaries

Legal Framework Governing Probate in India

The probate process in India is primarily governed by the Indian Succession Act, 1925. Key legal aspects include:

Indian Succession Act, 1925:

- Section 213: Requires probate to be obtained for certain wills and estates to be legally recognized.

- Section 57: Specifies conditions under which probate is mandatory, especially in cases involving wills.

- Section 276: Details the procedure for applying for and granting probate.

High Court Rules:

- Bombay High Court Rules: Provide specific procedural guidelines for probate in Maharashtra.

- Calcutta High Court Rules: Outline the probate procedures for West Bengal.

When is Probate Necessary in India?

The necessity of probate in India varies depending on the location and type of property involved:

- Mandatory in certain states:

- Maharashtra

- Gujarat

- West Bengal

- Required for immovable property in other states

- Generally necessary when:

- The will involves substantial assets

- There are disputes among beneficiaries

- Financial institutions or property registrars demand it

- Specific scenarios requiring probate:

- Transferring shares or securities of the deceased

- Claiming insurance benefits where the policy is bequeathed through a will

- Selling or transferring immovable property mentioned in the will

Exceptions to Probate Requirement

Some situations where probate may not be necessary include:

- Small estates with limited assets

- When all beneficiaries agree on the will’s validity

- For certain types of jointly held properties

- In states where probate is not mandatory, for movable property

The Probate Process in India

Obtaining probate involves several steps:

- Filing a petition in the relevant court (District Court or High Court, depending on the value of the estate)

- Submitting necessary documents

- Court examination of the will

- Issuing notices to interested parties (as per Section 283 of the Indian Succession Act)

- Addressing any objections

- Court’s decision to grant or deny probate

- Issuance of the probate certificate

Required Documents for Probate

To initiate the probate process, you typically need:

- Original will

- Death certificate of the testator

- List of legal heirs and beneficiaries

- Affidavits from witnesses to the will

- Details of the deceased’s assets and liabilities

- No Objection Certificates (NOCs) from other legal heirs, if available

- Proof of relationship with the deceased

- PAN card of the executor and the deceased

Timeline for Obtaining Probate

The duration of the probate process can vary:

- Uncontested cases: 6-12 months

- Contested or complex cases: Several years

- Factors affecting timeline:

- Court backlog

- Complexity of the estate

- Presence of disputes

- Completeness of documentation

Legal Implications of Probate

Probate has several legal implications:

- Validates the will publicly

- Protects the executor from future liability

- Allows for legal transfer of property titles

- Can impact inheritance tax obligations

- Provides a forum for contesting the will (Section 284 of the Indian Succession Act)

- Establishes the executor’s authority to deal with third parties

Challenges in the Probate Process

Common challenges include:

- Will contests by disgruntled heirs

- Difficulty in locating all beneficiaries

- Complexity in valuing and distributing assets

- Delays due to court procedures

- Dealing with cross-border assets for Non-Resident Indians (NRIs)

- Interpreting ambiguous clauses in the will

Alternatives to Probate

In some cases, alternatives to probate may be considered:

- Creating a living trust

- Joint ownership of property with right of survivorship

- Nomination in financial instruments (as per various financial regulations)

- Gift deeds during the testator’s lifetime

- Family settlements (recognized under Hindu law)

Role of an Executor in the Probate Process

The executor, appointed by the will or the court, has several responsibilities:

- Initiating the probate process

- Managing the deceased’s assets

- Paying off debts and taxes

- Distributing assets to beneficiaries

- Maintaining accurate records

- Representing the estate in legal proceedings

- Filing necessary tax returns on behalf of the estate

Cost of Probate in India

Expenses associated with probate include:

- Court fees (varies by state and estate value)

- For example, in Maharashtra, it’s 2-4% of the estate value

- Legal fees for lawyers (typically 1-3% of the estate value)

- Valuation costs for assets

- Advertisement expenses for legal notices

- Stamp duty on the probate document (varies by state)

Tips for a Smooth Probate Process

To facilitate a smoother probate process:

- Ensure the will is properly drafted and witnessed

- Keep an updated list of assets and beneficiaries

- Inform the executor and beneficiaries about the will

- Seek professional legal advice

- Maintain clear records of all financial transactions

- Consider creating a Letter of Instructions to supplement the will

- Regularly review and update the will

Probate for Non-Resident Indians (NRIs)

NRIs face unique challenges in the probate process:

- Requirement for an Indian Death Certificate

- Need for repatriation approval from the Reserve Bank of India (RBI) for transferring assets abroad

- Potential double taxation issues

- Complexity in dealing with assets in multiple countries

- Need for an Indian representative or attorney

Conclusion

The probate process in India, while sometimes complex and time-consuming, is a necessary legal procedure to ensure the proper execution of a will. It provides legal validity to the will and protects the interests of beneficiaries and executors. Understanding when probate is required, the relevant laws, and how to navigate the process can significantly ease the burden on families during an already difficult time. Proper estate planning, awareness of legal requirements, and seeking professional legal advice can help streamline the probate process and ensure that the deceased’s wishes are carried out effectively and legally.

How EZIT Guardian Can Assist

Start your 90-day free trial now and join thousands of Indians who have already secured their family’s financial future with EZIT Guardian. Don’t leave your family’s future to chance. Contact EZIT Guardian today to create a clear, legally sound will. Download the EZIT Guardian app from the Google Play Store & App Store today to schedule a consultation and take the first step to start securing your legacy.