TL;DR

Dying without a will in India triggers intestate succession laws. These laws vary based on religion and gender. For Hindus, Buddhists, Sikhs, and Jains, the Hindu Succession Act applies. Muslims follow Sharia law, while others fall under the Indian Succession Act. Property distribution depends on the deceased’s family structure. Creating a will ensures your wishes are followed and can prevent family disputes.

Introduction

What happens to your property if you die without a will in India? This question bothers many, yet few take action. Dying without a will, known as dying intestate, can lead to unexpected outcomes in property distribution. This article explains how Indian laws handle such situations.

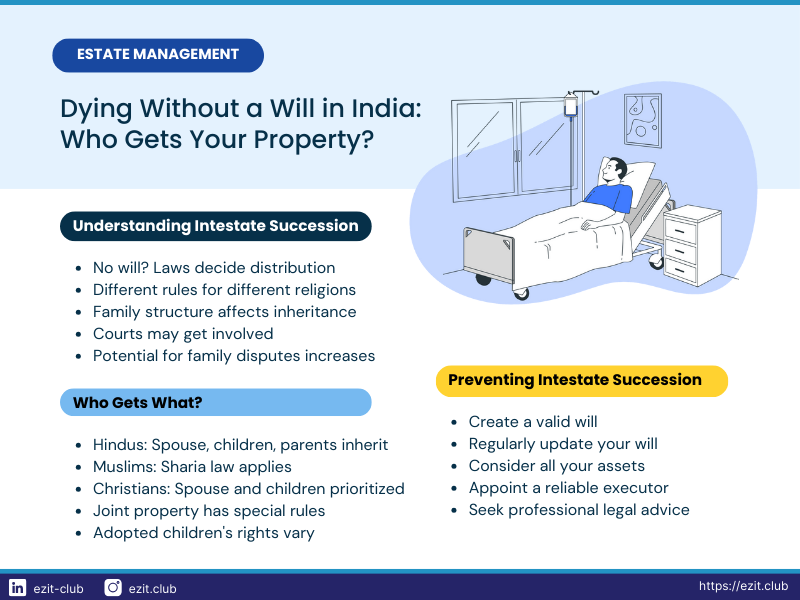

Understanding Intestate Succession

Intestate succession refers to the process of distributing a deceased person’s property when they die without a valid will. In India, these laws vary based on the deceased’s religion.

Religious Laws Governing Intestate Succession

This act applies to Hindus, Buddhists, Sikhs, and Jains. Key points:

- Property is divided equally among Class I heirs. This ensures fair distribution among the closest family members.

- Class I heirs include spouse, children, and parents. Both sons and daughters have equal rights to inheritance.

- If no Class I heirs exist, property goes to Class II heirs. These include siblings, grandparents, and other extended family members.

- The act was amended in 2005 to give daughters equal rights in ancestral property.

Muslim Personal Law

Muslims in India follow Sharia law for inheritance. Main features:

- Sunni and Shia Muslims have slightly different rules. This reflects the diverse interpretations within Islamic jurisprudence.

- Male heirs generally receive twice the share of female heirs. This principle is derived from Islamic texts.

- Up to one-third of the property can be willed away. This allows for some flexibility in estate planning within Islamic law.

- The law recognizes various classes of heirs with different entitlements.

Indian Succession Act, 1925

This act applies to Christians, Parsis, and others not covered by Hindu or Muslim laws. Notable aspects:

- Spouse and children are primary heirs. They have the first claim on the deceased’s property.

- Parents inherit if there’s no spouse or children. This ensures that the older generation is not left without support.

- Siblings inherit in the absence of closer relatives. This extends the inheritance to the wider family circle.

- The act provides for equal distribution among heirs of the same class.

Property Distribution When Dying Without a Will

For Hindus, Buddhists, Sikhs, and Jains

- With spouse and children:

- Property divided equally among spouse and children. This includes both sons and daughters.

- Deceased’s mother also gets an equal share. This provision ensures that the older generation is cared for.

- With spouse but no children:

- Half goes to the spouse. This recognizes the spouse’s contribution to the family.

- Half divided among the deceased’s heirs. This could include parents, siblings, or other relatives.

- Unmarried with no children:

- Property goes to parents. Both father and mother have equal rights.

- If parents are deceased, siblings inherit. This includes both brothers and sisters equally.

For Muslims

- Sunni Law:

- Spouse, parents, and children are primary heirs. Their shares are predetermined by Sharia law.

- Spouse gets 1/4th if there are children, 1/2 if no children. This ensures the spouse’s financial security.

- Remaining property divided among other heirs. This includes more distant relatives in a set order.

- Shia Law:

- Spouse, parents, and children are primary heirs. Their shares may differ slightly from Sunni law.

- Closer relatives exclude more distant ones. This principle can lead to some relatives being completely excluded from inheritance.

For Christians and Others

- With spouse and children:

- One-third to spouse, two-thirds to children. This balance aims to provide for both the current and next generation.

- Children’s share is divided equally among them, regardless of gender.

- With spouse but no children:

- Half to spouse, half to deceased’s relatives. This could include parents, siblings, or more distant relatives.

- The deceased’s relatives inherit according to a prescribed order of priority.

- Unmarried with no children:

- Property goes to parents. Both father and mother inherit equally.

- If parents are deceased, siblings inherit. This includes both brothers and sisters, sharing equally.

Complications in Intestate Succession

- Blended Families

- Step-children may not inherit unless adopted. This can lead to unintended exclusions in inheritance.

- Multiple marriages can complicate distribution. Each spouse and their children may have different rights depending on the specific circumstances.

- The law may not recognize relationships that the deceased considered important, such as long-term partners or close friends.

- Adopted Children

- Have equal rights as biological children under Hindu law. This includes rights to both self-acquired and ancestral property.

- May have different rights under other personal laws. For example, in Muslim law, adoption is not recognized in the same way as in Hindu law.

- The date of adoption can affect inheritance rights, especially in relation to ancestral property.

- Property Outside India

- May be subject to laws of the country where it’s located. This can result in different distribution rules for different assets.

- International inheritance can involve complex tax implications. Estate taxes in foreign countries may need to be considered.

- Claiming foreign assets may require legal processes in multiple countries, increasing complexity and cost.

- Joint Property

- Survivorship principle may apply in some cases. This means the property automatically passes to the surviving owner(s).

- Different types of joint ownership (e.g., joint tenancy vs. tenancy in common) can affect how property is inherited.

- Disputes can arise over whether property was intended to be joint or separate.

Impact on Family Business

Dying without a will can significantly impact family businesses:

- No clear succession plan can lead to disputes. Family members may disagree on who should take control of the business.

- Business operations may suffer during property division. Uncertainty can affect employee morale, customer relationships, and overall productivity.

- Uninvolved heirs might gain control, affecting business decisions. This can lead to conflicts between active and passive owners.

- The business might need to be sold or divided to satisfy all heirs’ claims. This can potentially destroy the value built over years.

- Lack of liquidity to pay off heirs can force asset sales at inopportune times. This might include selling crucial business assets.

- Obtain a death certificate

- This is the first official step in the inheritance process.

- Multiple copies may be needed for different legal and financial procedures.

- In some cases, especially sudden deaths, obtaining this certificate can be complicated.

- Apply for a succession certificate or letter of administration

- A succession certificate is required to transfer certain types of assets, like bank deposits or debt securities.

- A letter of administration is needed for broader estate management when there’s no will.

- The appropriate court (usually the district court) issues these documents.

- Provide proof of relationship to the deceased

- This can include birth certificates, marriage certificates, or other official documents.

- In some cases, especially for distant relatives, establishing the relationship can be challenging.

- Affidavits from family members or community leaders might be required in certain situations.

- Navigate any challenges from other potential heirs

- Disputes can arise over who qualifies as a legal heir.

- Mediation or legal proceedings may be necessary to resolve conflicts.

- This process can be time-consuming and may delay the distribution of assets.

Preventing Intestate Succession

is the best way to avoid intestate succession. Benefits include:

- Ensuring your wishes are followed. You can specify exactly how you want your assets distributed.

- Providing for dependents as you see fit. This includes the ability to make special provisions for minors or family members with special needs.

- Potentially reducing family conflicts. Clear instructions can prevent misunderstandings and disputes among family members.

- Allowing for charitable bequests. You can leave part of your estate to causes you care about.

- Faster asset distribution. A will can streamline the probate process, allowing heirs to receive their inheritance more quickly.

- Tax planning opportunities. Proper estate planning can help minimize estate taxes and other financial burdens on your heirs.

- Appointing a guardian for minor children. This ensures your children are cared for by someone you trust.

Common Myths About Dying Without a Will

- Myth: The eldest son always inherits everything.

Fact: Laws ensure fair distribution among legal heirs. - Myth: Common law partners have the same rights as spouses.

Fact: Unmarried partners have no inheritance rights under intestate laws. - Myth: The government takes everything if there are no relatives.

Fact: Only if no legal heirs can be found after extensive searching.

Conclusion

Dying without a will in India can lead to unexpected property distribution. While intestate succession laws provide a framework, they may not align with your wishes. Creating a will gives you control over your property’s future and can prevent family disputes.

Key takeaways:

- Intestate succession laws vary by religion in India

- Property distribution depends on the deceased’s family structure

- Creating a will is the best way to ensure your wishes are followed

- Seek legal advice to understand how intestate laws might affect your estate

How EZIT Guardian Can Assist

At EZIT Guardian, we simplify the will-making process:

- Our experts explain all legal terms in plain language

- Our team of experts guide you through each step of creating your will

- We offer regular will reviews to keep your document up-to-date

- Our experts can answer any questions about will terminology

Don’t leave your family’s future to chance. Contact EZIT Guardian today to create a clear, legally sound will. Download the EZIT Guardian app from the Google Play Store & App Store today to schedule a consultation and take the first step to start securing your legacy.