TL;DR

Deeds and wills are distinct legal instruments for property transfer in India, each with unique characteristics and applications. Key deed vs will differences include timing of transfer (immediate vs. after death), revocability, legal formalities, and tax implications. Deeds offer immediate property transfer but are generally irrevocable, while wills provide flexibility for estate planning but only take effect after death. Understanding these deed vs will differences is crucial for effective property management and succession planning in India.

Introduction

In India, property transfer is a critical aspect of financial planning and wealth management. Understanding the available methods for transferring property is essential for making informed decisions about your assets. Two primary instruments for property transfer are deeds and wills. While both serve the purpose of transferring property, there are significant deed vs will differences that can impact your choice between them.

This article will explore the key deed vs will differences, helping you understand when and how to use each instrument effectively. We’ll delve into their definitions, characteristics, legal requirements, and optimal usage scenarios to provide a comprehensive understanding of these crucial property transfer tools.

Definition and Characteristics of a Deed

A deed is a legal document that transfers ownership or interest in a property from one party (the grantor) to another (the grantee). In India, deeds are governed by the Transfer of Property Act, 1882, which outlines the legal framework for property transactions.

Key characteristics of deeds include:

- Immediate Transfer: Unlike wills, deeds facilitate the immediate transfer of property ownership or rights from the grantor to the grantee.

- Irrevocability: Once executed and registered, deeds are generally irrevocable, meaning the grantor cannot easily undo the transfer.

- Written Format: Deeds must be in writing to be legally valid. Oral agreements for property transfer are not recognized under Indian law for transactions covered by deeds.

- Registration Requirement: Under the Registration Act, 1908, deeds for properties valued over ₹100 must be registered with the appropriate sub-registrar of assurances.

- Consideration: While some deeds (like gift deeds) may not involve monetary exchange, many deeds involve consideration, which is the price paid for the property.

Common types of deeds in India include:

- Sale Deed: Used for the sale and purchase of property.

- Gift Deed: Transfers property without consideration, often between family members.

- Exchange Deed: Used when two parties exchange their respective properties.

- Partition Deed: Divides property among co-owners or family members.

Definition and Characteristics of a Will

A will is a legal document that specifies how a person’s property should be distributed after their death. In India, wills are governed by the Indian Succession Act, 1925 for non-Hindus, and the Hindu Succession Act, 1956 for Hindus, Buddhists, Sikhs, and Jains.

Key characteristics of wills include:

- Posthumous Effect: Unlike deeds, wills only take effect after the testator’s death, allowing the testator to retain control of their property during their lifetime.

- Revocability: Wills can be revoked or altered at any time during the testator’s lifetime, providing flexibility in estate planning.

- Written Format: While oral wills are recognized in certain circumstances (such as for soldiers in active wartime), wills concerning immovable property must be in writing.

- Optional Registration: Unlike deeds, registration of wills is optional under Indian law. However, registration is recommended as it provides stronger legal standing and can help prevent disputes.

- Appointment of Executors: Wills allow the testator to appoint executors who will manage the estate and distribute assets according to the will’s provisions.

Types of wills in India include:

- Privileged Wills: Made by soldiers in expedition or actual warfare, with relaxed formal requirements.

- Unprivileged Wills: Standard wills made by civilians, requiring more formal execution.

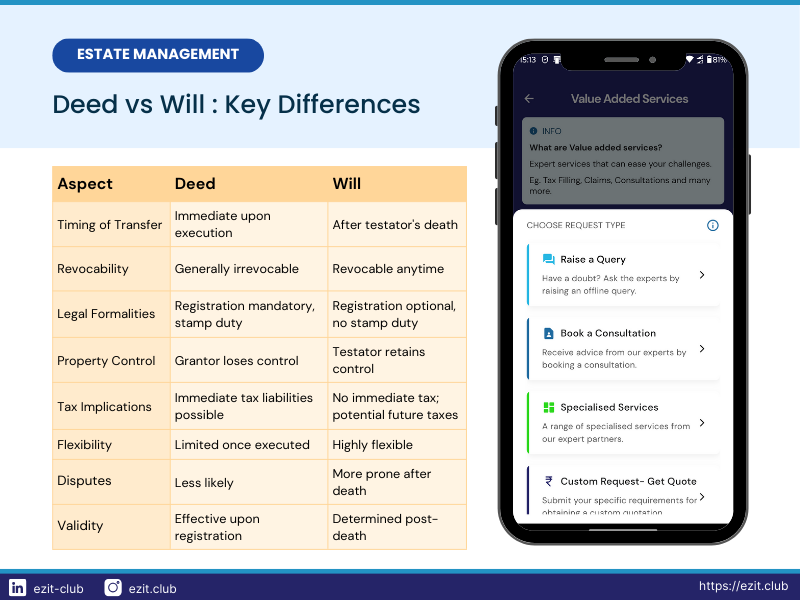

Deed vs Will Differences

| Aspect | Deed | Will |

|---|---|---|

| Timing of Transfer | Immediate upon execution and registration | Takes effect only after the testator’s death |

| Revocability | Generally irrevocable once executed and registered | Can be revoked or altered anytime during the testator’s lifetime |

| Legal Formalities | Registration mandatory for properties valued over ₹100; incurs stamp duty | Registration optional but recommended; no stamp duty required |

| Property Control | Grantor loses control over the property once transferred | Testator retains full control of the property until death |

| Tax Implications | May incur immediate tax liabilities (stamp duty, capital gains tax) | No immediate tax; potential future liabilities for beneficiaries |

| Flexibility | Limited flexibility once executed | Highly flexible, can be changed as circumstances evolve |

| Disputes | Less likely to be disputed due to immediate transfer | More prone to disputes among beneficiaries after testator’s death |

| Validity | Takes effect immediately upon registration | Validity determined after testator’s death during probate |

When to Use a Deed

Consider using a deed in the following scenarios:

- Immediate Transfer Necessity: When there’s a need to transfer property ownership immediately, such as in sales transactions or urgent family settlements.

- Gifting to Family: For transferring property to family members as gifts, potentially taking advantage of tax benefits for gifts to specified relatives.

- Settling Disputes: To resolve family property disputes through clear and immediate division of assets.

- Creating Trusts: When establishing trusts for specific purposes, where immediate transfer of property to the trust is required.

- Business Transactions: For property transfers related to business dealings, where immediate effect and legal certainty are crucial.

Advantages of using deeds:

- Provides immediate and clear legal title to the grantee.

- Offers potential tax benefits in certain situations (e.g., gifts to specified relatives).

- Provides finality in property ownership, reducing future disputes.

- Can be used to create specific legal arrangements (e.g., easements, rights of way).

When to Use a Will

A will is preferable in these situations:

- Estate Planning: For comprehensive planning of how all assets should be distributed after death.

- Retaining Lifetime Control: When you want to maintain full control and use of your properties during your lifetime.

- Complex Distributions: For making detailed and potentially complex arrangements for property distribution, including conditional bequests.

- Guardianship Appointments: To designate guardians for minor children, a provision not possible with deeds.

- Charitable Giving: To leave bequests to charitable organizations or causes.

Advantages of using wills:

- Allows for changes to property distribution plans as circumstances change.

- Enables the testator to retain control of assets throughout their lifetime.

- Can include non-property related wishes (e.g., funeral arrangements, digital asset management).

- Provides a comprehensive overview of asset distribution, potentially reducing family disputes.

Legal and Financial Considerations

When weighing the deed vs will differences, it’s crucial to understand the legal and financial implications of each:

Legal requirements for deeds in India:

- Must be in writing and clearly state the transfer of property.

- Requires registration for properties valued over ₹100.

- Must be signed by the grantor and attested by at least two witnesses.

- Should clearly identify the property being transferred and the parties involved.

Legal requirements for wills in India:

- Must be in writing for immovable property.

- Must be signed by the testator and attested by at least two witnesses.

- Should clearly identify the testator, beneficiaries, and properties being bequeathed.

- Optional registration under the Registration Act, 1908, but recommended for stronger legal standing.

Tax considerations:

- Deeds may incur immediate tax liabilities such as stamp duty, registration fees, and potential capital gains tax for the grantor.

- Wills don’t incur immediate taxes, but transferred property may be subject to income tax for the beneficiary upon inheritance.

- Gift deeds to certain relatives may offer tax exemptions under the Income Tax Act.

Common Misconceptions

There are several misconceptions about the deed vs will differences:

- Misconception: Deeds always involve the sale of property.

Reality: While sale deeds are common, many deeds (like gift deeds or partition deeds) transfer property without a sale. - Misconception: Wills are only necessary for the wealthy.

Reality: Wills are important for anyone with assets or dependents, regardless of the value of their estate. - Misconception: Registered wills cannot be challenged.

Reality: While registration provides stronger evidence of authenticity, wills can still be challenged on grounds like undue influence or lack of testamentary capacity. - Misconception: Oral wills are always valid in India

Reality: Oral wills are only valid in specific circumstances under Indian law, such as for soldiers in active service. - Misconception: A deed automatically overrides a will

Reality: While a valid deed takes immediate effect and can transfer property mentioned in a will, it doesn’t invalidate the entire will.

Conclusion

Understanding the key deed vs will differences is crucial for effective property transfer and estate planning in India. While deeds offer immediate transfer and finality, wills provide flexibility and control during the testator’s lifetime. The choice between a deed and a will depends on individual circumstances, financial goals, and family situations.

Deeds are optimal for immediate property transfers, settling disputes, or creating specific legal arrangements. Wills, on the other hand, are ideal for comprehensive estate planning, maintaining lifetime control of assets, and making complex distribution arrangements.

Given the complexities of Indian property laws and the significant deed vs will differences, it’s advisable to seek professional legal and financial advice when making decisions about property transfer. This ensures that your choices align with your intentions and comply with relevant laws.

Secure Your Legacy with EZIT

Navigating the deed vs will differences and making the right choice for your property transfer needs can be challenging. EZIT Guardian is here to help you make informed decisions and execute your property transfer plans effectively.

Our experts can help in:

- Choosing between deeds and wills based on your specific situation.

- Assistance in drafting and registering deeds for immediate property transfers.

- Will creation and registration support for comprehensive estate planning.

- Guidance on tax implications and potential benefits of different transfer methods.

Don’t leave your property transfer decisions to chance. Contact EZIT Guardian today to ensure your assets are managed and transferred according to your wishes while complying with Indian laws. Download the EZIT Guardian app from the Google Play Store & App Store today to schedule your appointment now. Let EZIT Guardian help you secure your legacy and provide peace of mind for you and your loved ones.