TL;DR

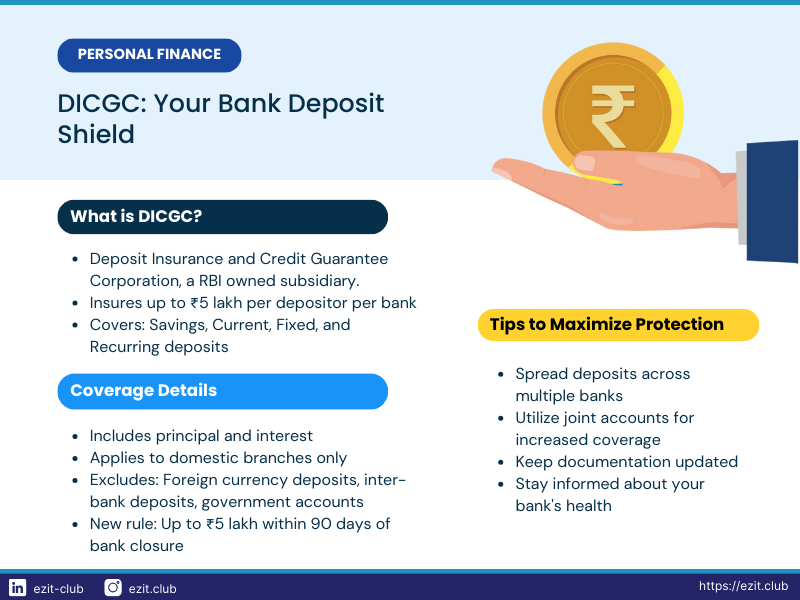

The Deposit Insurance and Credit Guarantee Corporation (DICGC) insures bank deposits up to ₹5 lakh per depositor per bank in India. It provides a safety net for depositors in case of bank failures. This article explains the DICGC’s role, coverage, claim process, and importance in maintaining financial stability.

Introduction: The Guardian of Your Savings

The Deposit Insurance and Credit Guarantee Corporation (DICGC) protects the savings of millions of bank customers in India. This organization maintains stability in the banking sector and safeguards depositors’ interests.

This guide will explain five key aspects of the DICGC and its role in protecting your money. Understanding the DICGC is essential for your financial security, whether you’re an experienced investor or new to banking.

Step 1: Understanding the DICGC - Your Financial Safety Net

What is the DICGC?

The DICGC is a subsidiary of the Reserve Bank of India (RBI), established in 1978. Its main purpose is to protect bank depositors if a bank fails.

History of Deposit Insurance in India

Deposit insurance in India began in 1961 with the creation of the Deposit Insurance Corporation (DIC). This followed the failure of two banks in the 1960s. In 1978, the DIC merged with the Credit Guarantee Corporation of India Ltd. to form the DICGC.

DICGC's Functions

- Deposit Insurance: The DICGC insures bank deposits to protect account holders.

- Credit Guarantee: It provides credit guarantees to lending institutions, supporting credit flow to priority sectors.

Importance of the DICGC

The DICGC:

- Protects small depositors

- Prevents bank runs during financial stress

- Contributes to financial stability

- Allows banks to lend with more confidence

Step 2: DICGC Coverage - What's Protected and What's Not

Coverage Limit: ₹5 Lakh

As of 2024, the DICGC provides insurance coverage of up to ₹5 lakh per depositor per bank.

Types of Deposits Covered

The DICGC covers:

- Savings Account Deposits

- Current Account Deposits

- Fixed Deposits

- Recurring Deposits

This coverage includes both principal and interest, up to the insurance limit.

Exclusions from Coverage

While the DICGC provides extensive protection for most bank deposits, it’s crucial to understand that certain types of deposits fall outside its purview. The DICGC does not cover:

- Deposits of foreign governments: Any funds deposited by foreign governmental entities are not protected under the DICGC scheme, as these are typically governed by international agreements and diplomatic protocols.

- Deposits of central and state governments: Funds belonging to the Indian central government or any state governments are excluded from DICGC coverage, as these are managed under separate governmental financial systems.

- Inter-bank deposits: Deposits made by one bank into another are not covered, as these are considered part of normal banking operations rather than consumer deposits.

- Deposits of State Land Development Banks with State co-operative banks: These specialized financial transactions between development banks and co-operative banks are excluded due to their unique nature and existing regulatory frameworks.

- Deposits received outside India: Any funds deposited in overseas branches of Indian banks or in foreign currency accounts within India are not covered by the DICGC, as its mandate is limited to domestic deposits.

- Amounts exempted by the corporation with RBI approval: In certain special cases, the DICGC, with the approval of the Reserve Bank of India, may exempt specific deposits from coverage, though this is relatively rare and typically applies to unique financial instruments or situations.

Understanding these exclusions is vital for comprehensive financial planning, especially for individuals or entities dealing with large sums or diverse financial instruments.

Maximizing Your Coverage

To make the most of DICGC protection, depositors can employ several strategies:

- Per-bank coverage: The DICGC’s ₹5 lakh limit applies separately to each bank where you hold accounts. This means that if you have accounts in multiple banks, each account is insured up to ₹5 lakh independently. For instance, if you have ₹5 lakh in Bank A and ₹5 lakh in Bank B, you’re fully covered for the entire ₹10 lakh.

- Joint accounts for additional protection: Joint accounts offer an opportunity to increase your coverage within a single bank. Each joint account holder is treated as a separate entity for insurance purposes, effectively multiplying the coverage. For example, a joint account with ₹10 lakh held by two individuals would be fully insured (₹5 lakh per person). Moreover, if you have both individual and joint accounts in the same bank, you’re covered for up to ₹5 lakh in each account type.

- Different types of accounts: The DICGC coverage applies collectively to all types of deposits in a bank, including savings, current, fixed, and recurring deposits. However, maintaining different types of accounts doesn’t increase your total coverage beyond the ₹5 lakh limit per bank.

By strategically distributing your deposits across multiple banks and utilizing joint accounts, you can significantly increase your total DICGC coverage, providing greater protection for your hard-earned money.

Step 3: The DICGC Claim Process

When DICGC Intervenes

The DICGC becomes active when a bank goes into liquidation, reconstruction, or amalgamation.

Claim Process Steps

Understanding the DICGC claim process is crucial for depositors, especially in the event of a bank failure. Here’s a detailed look at each step:

- Bank closure: The process begins when the Reserve Bank of India or the Central Government orders a bank’s closure. This decision is typically made when a bank is no longer financially viable or has committed severe regulatory violations.

- Liquidator appointment: Following the closure order, a liquidator is appointed, usually within three months. The liquidator’s role is to manage the bank’s assets and liabilities during the winding-up process.

- Preparation of depositor claims list: The liquidator meticulously prepares a comprehensive list of all depositor claims. This involves verifying account details, deposit amounts, and ensuring all eligible depositors are included.

- Submission to DICGC: Once the claims list is prepared, the liquidator submits it to the DICGC. This submission must occur within three months of the liquidator receiving the claim list form from the DICGC.

- DICGC verification: Upon receiving the claims list, the DICGC conducts a thorough verification process. This involves cross-checking the submitted information against the bank’s records and ensuring all claims comply with DICGC regulations.

- Payment to liquidator: After verification, the DICGC pays the claim amount to the liquidator. This payment is typically made within two months of receiving the verified claim list.

- Disbursement to depositors: In the final step, the liquidator disburses the received funds to individual depositors. The timing of this disbursement can vary depending on the complexity of the bank’s situation and the number of depositors involved.

New Expedited Process

Recent changes allow for interim payments:

- Up to ₹5 lakh within 90 days of bank closure

- Process starts before bank liquidation or restructuring

Depositor Responsibilities

- Keep contact information updated with the bank

- Maintain proper deposit documentation

- Stay informed about bank’s financial health

Step 4: DICGC's Impact on Banking and Economy

Financial Stability

The DICGC:

- Prevents bank runs

- Maintains public confidence in banking

- Supports effective monetary policy implementation

Influence on Banking Practices

- Encourages effective risk management

- Creates competitive equality among banks

- Promotes consumer protection

Economic Effects

- Encourages savings

- Supports credit availability

- Promotes financial inclusion

Step 5: Maximizing DICGC Protection

Strategies for Depositors

To maximize DICGC protection and ensure financial security, depositors should consider the following strategies:

- Spread deposits across multiple banks: By distributing your savings among different banks, you can significantly increase your total DICGC coverage. Each bank account is insured separately up to ₹5 lakh, so having accounts in multiple banks multiplies your protection.

- Utilize joint accounts to increase coverage: Opening joint accounts with family members can effectively double or triple your coverage within a single bank. Each joint account holder is entitled to separate ₹5 lakh coverage, providing an excellent way to protect larger deposits.

- Monitor bank health regularly: While your deposits are insured, staying informed about your bank’s financial health can help you avoid potential inconveniences. Pay attention to news about your bank’s performance, regulatory compliance, and any RBI directives issued to the bank.

- Maintain a mix of account types: Although the ₹5 lakh limit applies collectively to all your deposits in a bank, maintaining a mix of savings, fixed deposits, and recurring deposits can offer flexibility in managing your funds while ensuring they’re all protected.

- Keep documentation updated: Ensure all your bank accounts have up-to-date Know Your Customer (KYC) information and nominee details. This can expedite the claim process in case of a bank failure.

- Stay informed about DICGC policy changes: The DICGC periodically reviews and updates its policies. Stay informed about any changes in coverage limits or claim processes to ensure you’re always maximizing your protection.

- Consider the nature of your deposits: Remember that certain types of deposits, like foreign currency accounts or deposits in overseas branches of Indian banks, are not covered by DICGC. Plan accordingly if you hold such deposits.

By implementing these strategies, you can significantly enhance your financial security and make the most of the protection offered by the DICGC.

Handling Bank Failures

- Stay calm – your deposits are insured

- Follow official communications

- Keep banking documents accessible

- Be patient during the claim process

Conclusion: The Shield of Financial Confidence

The DICGC plays a crucial role in protecting your money and stabilizing India’s banking system. Understanding the DICGC helps you make informed financial decisions and bank with confidence. As India’s financial landscape evolves, the DICGC’s role may change. Stay informed about these changes to maximize your financial protection.

Remember, the DICGC is one part of your financial security. Combine this knowledge with sound financial practices for a stable financial future.

🚀 Enhance Your Financial Security with EZIT

Understanding DICGC coverage is just the beginning of your financial journey. To further secure your financial future, consider EZIT’s comprehensive financial services. Don’t leave your financial security to chance. Contact EZIT today for a free consultation and take the next step towards a more secure financial future. Download the EZIT Guardian app from the Google Play Store & App Store today.