TL;DR

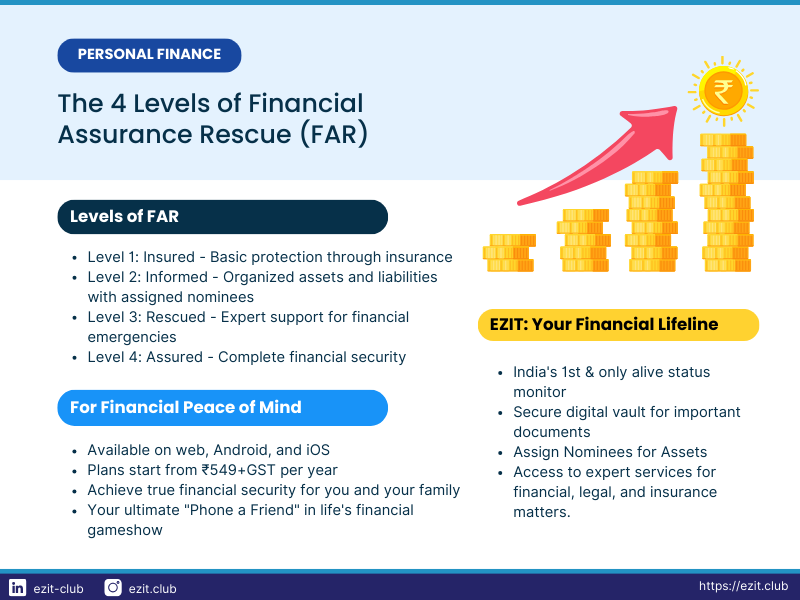

Financial Assurance Rescue (FAR) is a revolutionary 4-level framework for comprehensive financial preparedness, brought to life by EZIT Guardian. This unique app guides you from basic insurance (Level 1: Insured) through organized asset management (Level 2: Informed) and expert support (Level 3: Rescued), to complete financial security (Level 4: Assured). EZIT Guardian stands out with its alive status monitoring, secure DocVault, and nominee management features. At the highest level, it even helps uncover hidden assets like unknown insurance policies on credit cards and bank accounts. Available on multiple platforms from ₹549+GST yearly, EZIT Guardian serves as your ultimate “Phone a Friend” in life’s financial gameshow, ensuring no stone is left unturned in securing your family’s future.

Introduction

In the intricate gameshow of life, financial security often feels like the ultimate prize. But how do you ensure that your family is truly protected, come what may? Enter the concept of Financial Assurance Rescue (FAR) – an innovative approach to personal finance management introduced by EZIT Club. At the heart of this revolution is EZIT Guardian, India’s first and only alive status monitor, designed to be your ultimate “Phone a Friend” in this high-stakes game of financial preparedness.

Understanding Financial Assurance Rescue (FAR)

Financial Assurance Rescue is more than just a catchy acronym; it’s a comprehensive framework for achieving true peace of mind when it comes to your family’s financial future. The FAR concept breaks down financial preparedness into four distinct levels, each building upon the last to create a fortress of financial security around your loved ones.

Let’s dive into each level and explore how EZIT Guardian can help you progress through this financial gameshow called LIFE.

Level 1: Insured 🏥

At the foundation of financial security lies insurance. Being insured means you’ve taken the crucial first step in protecting your family from unforeseen circumstances. However, many people stop here, thinking they’ve done enough.

Example: Meet Rahul, a 35-year-old software engineer with a young family. He has a life insurance policy that would cover his family’s expenses for two years if anything were to happen to him. While this is a good start, Rahul is only at Level 1 of FAR.

How EZIT Guardian Helps

- The app provides a centralized platform to store all your insurance policy details securely.

- It offers expert consultations to help you optimize your coverage, ensuring you’re neither under-insured nor over-insured.

Tips for Level 1

- Review your insurance policies annually to ensure they still meet your needs.

- Consider a mix of term life, health, and disability insurance for comprehensive coverage.

- Use EZIT Guardian to store digital copies of your insurance documents for easy access.

Level 2: Informed 📚

Being informed goes beyond just having insurance. It’s about having a clear understanding of your complete financial picture – your assets, liabilities, and how they’re distributed among your family members.

Example: Priya, a 40-year-old entrepreneur, has multiple insurance policies and investments. However, she realizes that her spouse doesn’t know about all their assets or how to access them. Priya is at Level 2 of FAR – insured but not fully informed.

How EZIT Guardian Helps

- Securely organize your assets and liabilities in the digital vault.

- Assign nominees to specific assets, ensuring the right people have access to the right information.

- Tracks your “alive status” and notifies nominees in case of any unfortunate event.

Tips for Level 2

- Create a comprehensive inventory of all your financial accounts, properties, and valuable possessions.

- Regularly update your nominee information for all accounts and policies.

- Use EZIT Guardian’s nominee management feature to keep your beneficiary information current.

Level 3: Rescued 🚁

Being rescued means having a support system in place that can guide your family through complex financial processes in case of an emergency. This level is about ensuring that your family won’t be left struggling with paperwork and procedures during an already difficult time.

Example: Anjali, a 50-year-old teacher, has comprehensive insurance and has informed her family about their assets. However, when her spouse passed away unexpectedly, she found herself overwhelmed with the process of claiming insurance and transferring assets. Anjali was at Level 2 but needed the “rescue” aspect of Level 3.

How EZIT Guardian Helps

- Provides access to a panel of experts who can guide nominees through processes like insurance claims, asset transfers, and legal matters.

- Offers initial support in identifying potential hidden assets tied to various accounts and policies.

Tips for Level 3

- Familiarize yourself with the basic processes of insurance claims and asset transfers.

- Prepare a basic estate plan and store it securely in EZIT Guardian.

- Start exploring potential hidden assets tied to your accounts and policies.

Level 4: Assured 🏆

The pinnacle of financial preparedness, being assured means you have a comprehensive system in place that not only protects your family financially but also gives you peace of mind in your day-to-day life. At this level, you’re not just aware of your visible assets, but you’ve also uncovered and secured hidden assets that might otherwise be overlooked.

Example: Vikram, a 60-year-old retiree, has reached Level 4. He has optimal insurance coverage, a well-organized asset portfolio with updated nominee information, and a support system in place for his family. Moreover, he uses EZIT Guardian’s alive status monitoring feature and has worked with EZIT specialists to uncover hidden assets he wasn’t even aware of, such as insurance policies tied to his long-standing credit cards and bank accounts.

How EZIT Guardian Helps

- Combines all previous level features into one comprehensive platform.

- Provides regular reminders to update information and check in, ensuring your financial information stays current.

- Offers continuous peace of mind through its unique alive status monitoring feature.

- EZIT specialists help identify and claim not just visible assets, but also hidden assets such as insurance policies on credit cards and bank accounts that you might not be aware of.

Tips for Level 4

- Conduct annual financial “fire drills” with your family to ensure everyone knows what to do in case of an emergency.

- Regularly educate yourself and your family members about new financial products and strategies.

- Work with EZIT Guardian’s expert services to uncover and document all potential hidden assets tied to your accounts and policies.

- Stay updated on changes in tax laws, insurance regulations, and estate planning strategies that might affect your hidden assets.

The EZIT Guardian Advantage

EZIT Guardian isn’t just another financial app – it’s your comprehensive partner in achieving and maintaining FAR Level 4. Here’s how it stands out:

- Activity Monitor: Unique to EZIT Guardian, this feature tracks your app activity and alerts nominees if there’s no activity for a predefined period, ensuring your family is informed quickly in case of any unfortunate event.

- Secure Digital Vault(DocVault): Store all your important financial documents in one highly secure location, accessible only with your authentication.

- Nominee Management: Easily manage and update your list of nominees, assigning them to specific assets as needed.

- Expert Services: Get access to professional help for taxation, insurance claims, legal issues, and uncovering hidden assets right through the app.

- Hidden Asset Discovery: EZIT specialists help you identify and claim often-overlooked assets, ensuring no stone is left unturned in securing your family’s financial future.

Conclusion: Your Journey to FAR Level 4

Financial Assurance Rescue isn’t achieved overnight – it’s a journey. But with EZIT Guardian as your guide, you can navigate this journey with confidence, uncovering hidden assets along the way. Remember, in the gameshow of life, EZIT Guardian is your ultimate “Phone a Friend” option, helping you see the complete picture of your financial landscape.

🚀 Are you ready to level up your FAR score?

Are you ready to level up your FAR score and discover assets you might not even know you have? Start your journey today by downloading EZIT Guardian. Available on web, Android, and iOS, with plans starting from just ₹549+GST per year, it’s a small investment for immeasurable peace of mind.

Don’t wait for a financial emergency to strike. Take control of your family’s financial future now. With EZIT Guardian, you’re not just planning for the future – you’re assuring it, down to the last hidden asset.