TL;DR

Insurance policy surrender in India allows policyholders to terminate their policy before maturity and receive a surrender value. This right is subject to specific conditions, including lock-in periods and surrender value calculations. While surrendering can provide immediate liquidity, it often results in financial losses and should be considered carefully. Alternatives like policy loans or partial withdrawals may be more beneficial. Always consult with financial advisors and understand the implications before initiating an insurance policy surrender in India.

Introduction to Insurance Policy Surrender in India

In the complex landscape of Indian insurance, understanding your rights as a policyholder is crucial. One such important right is the ability to surrender your insurance policy. But what does insurance policy surrender in India entail, and how does it work?

Insurance policy surrender in India refers to the voluntary termination of an insurance policy by the policyholder before its maturity date. When you surrender a policy, you’re essentially ending the contract with your insurer and, in most cases, receiving a surrender value in return.

Understanding your right to surrender is vital for several reasons:

- Financial flexibility

- Informed decision-making

- Protection against mis-selling

- Better financial planning

- Changing Insurance needs

In India, insurance regulations, including those related to policy surrender, are governed by the Insurance Regulatory and Development Authority of India (IRDAI). The IRDAI sets guidelines for various aspects of insurance, including policy surrenders, to protect the interests of policyholders.

Understanding the Right to Surrender Insurance Policies in India

The right to surrender is a policyholder’s option to voluntarily terminate their insurance policy before its maturity date. This right is an essential feature of many life insurance policies in India, providing flexibility to policyholders whose financial situations or insurance needs may change over time.

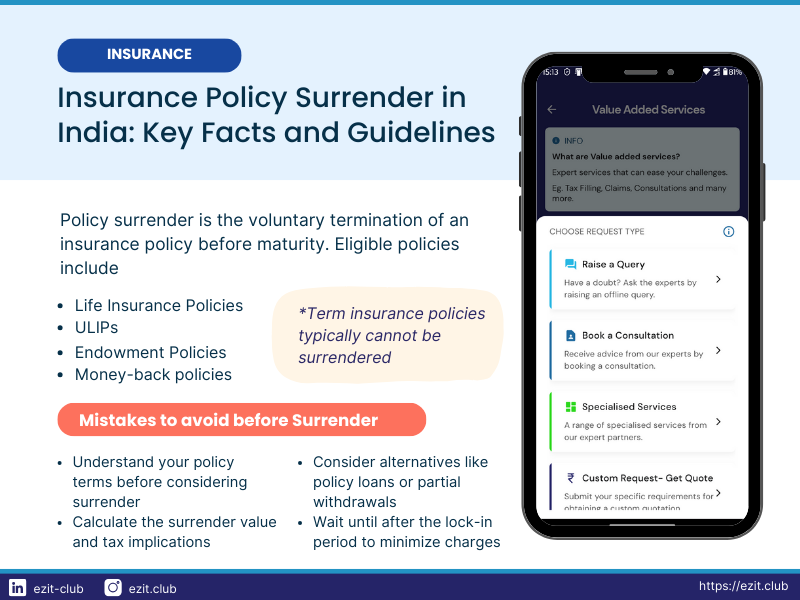

Types of Insurance Policies Eligible for Surrender in India

Not all insurance policies can be surrendered. Generally, the following types of policies are eligible for surrender in India:

- Traditional Life Insurance Policies

- Unit-Linked Insurance Plans (ULIPs)

- Money-Back Policies

- Endowment Policies

It’s important to note that term insurance policies typically do not have a surrender value and thus cannot be surrendered.

Legal Basis for Insurance Policy Surrender Rights in India

The right to surrender is protected under Indian insurance law and IRDAI regulations. Specifically, the Insurance Act, 1938, and subsequent IRDAI guidelines provide the legal framework for policy surrenders in India.

Key regulations include:

- IRDAI (Non-Linked Insurance Products) Regulations, 2019

- IRDAI (Unit Linked Insurance Products) Regulations, 2019

These regulations ensure that insurers provide fair surrender values and follow standardized procedures for insurance policy surrender in India.

When Can You Surrender an Insurance Policy in India?

While you have the right to surrender your policy in India, there are certain conditions and timeframes to consider.

Minimum Lock-in Periods for Insurance Policy Surrender in India

Different types of policies have different lock-in periods:

| Policy Type | Minimum Lock-in Period |

|---|---|

| Traditional Life Insurance | 2-3 years (varies by policy) |

| ULIPs | 5 years |

| Pension Plans | 5 years |

Source: IRDAI (Unit Linked Insurance Products) Regulations, 2019

Circumstances That Might Lead to Insurance Policy Surrender in India

People consider surrendering their policies for various reasons:

- Financial emergencies

- Change in financial goals

- Dissatisfaction with policy performance

- Found a better insurance or investment option

- Unable to continue premium payments

Considerations Before Deciding on Insurance Policy Surrender

Before surrendering your policy, consider:

- Financial implications (surrender charges, tax liability)

- Loss of insurance coverage

- Impact on long-term financial goals

- Alternatives to surrender (policy loans, partial withdrawals)

The LIC Policy Surrender Process in India

If you decide to surrender your policy in India, here’s what you need to do:

- Contact your insurance company

- Fill out a surrender request form

- Provide necessary documentation (ID proof, cancelled cheque, etc.)

- Submit the form and documents to the insurer

- Wait for the surrender value to be processed and paid

Required documentation typically includes:

- Original policy document

- ID and address proof

- Cancelled cheque or bank account details

- Surrender request form

The timeline for processing surrender requests can vary, but insurers in India are required to process surrenders within a reasonable timeframe, typically 7-15 days.

Financial Implications of Insurance Policy Surrender in India

Calculation of Surrender Value in Indian Insurance Policies

The surrender value is the amount you receive when you terminate your policy. In India, there are two types:

- Guaranteed Surrender Value (GSV): This is the minimum amount the insurer is obligated to pay. It’s typically a percentage of total premiums paid, minus any survival benefits already paid.

- Special Surrender Value (SSV): This is usually higher than GSV and is calculated based on the policy’s paid-up value and other factors.

The actual formula for calculating surrender value can vary by policy type and insurer. Always check your policy document or ask your insurer for the exact calculation method for insurance policy surrender in India.

Tax Implications of Insurance Policy Surrender in India

Surrendering a policy can have tax implications in India:

- If surrendered before completion of 2 years: The entire surrender value is taxable as income.

- If surrendered after 2 years: Tax implications depend on the policy type and the surrender value received.

It’s advisable to consult a tax professional to understand the specific tax implications of insurance policy surrender in India for your case.

Impact on Long-term Financial Planning

Insurance policy surrender in India can significantly impact your long-term financial plans:

- Loss of life cover

- Potential financial losses due to surrender charges

- Disruption of long-term savings or investment goals

- Need to reassess overall financial strategy

Alternatives to Insurance Policy Surrender in India

Before surrendering your policy, consider these alternatives available in India:

- Policy Loans: Many life insurance policies allow you to take a loan against the policy’s cash value.

- Pros: Lower interest rates, no credit check

- Cons: Reduces death benefit if not repaid

- Partial Withdrawals: Some policies, especially ULIPs, allow partial withdrawals after a certain period.

- Pros: Access to funds without terminating the policy

- Cons: Reduces the sum assured

- Reduced Paid-up Option: Convert your policy to a paid-up policy with a reduced sum assured.

- Pros: No more premium payments required

- Cons: Reduced insurance coverage

- Policy Revival: If the policy has lapsed, you might be able to revive it within a specified period.

- Pros: Continuity of the policy

- Cons: May require payment of all due premiums with interest

Rights and Protections for Policyholders in India

IRDAI has put in place several regulations to protect policyholders’ rights during the insurance policy surrender process in India:

- Mandatory Free Look Period: 15-30 days to review and return the policy if unsatisfied.

- Standardized Surrender Value Calculations: Ensures fair treatment across insurers.

- Disclosure Requirements: Insurers must clearly explain surrender terms in policy documents.

If you face issues during the surrender process in India, you can file a complaint through:

- Insurer’s Grievance Redressal Officer

- IRDAI’s Integrated Grievance Management System (IGMS)

- Insurance Ombudsman

Expert Advice on Insurance Policy Surrender in India

Financial experts suggest considering policy surrender in India when:

- The policy no longer meets your insurance needs

- You’ve found a significantly better insurance or investment option

- You’re facing severe financial hardship with no other recourse

To maximize benefits when surrendering an insurance policy in India:

- Wait until after the lock-in period to minimize surrender charges

- Understand the surrender value calculation for your specific policy

- Consider the tax implications and plan accordingly

Common mistakes to avoid in insurance policy surrender in India:

- Surrendering for short-term gains without considering long-term impact

- Not exploring alternatives like policy loans or partial withdrawals

- Failing to reassess overall insurance coverage after surrendering a policy

Conclusion

The right to surrender an insurance policy is an important flexibility offered to policyholders in India. However, it should be exercised judiciously, considering both short-term needs and long-term financial goals.

Key takeaways for insurance policy surrender in India:

- Understand your policy’s surrender terms before purchasing

- Consider alternatives to surrender for temporary financial needs

- Evaluate the financial and tax implications of surrendering

- Seek professional advice before making a decision

Let EZIT Assist You with your Insurance needs

Remember, an insurance policy is primarily a risk management tool. While the right to surrender provides flexibility, it’s crucial to ensure that your insurance needs are adequately met even if you decide to surrender a policy in India.

Don’t let unresolved insurance issues disrupt your peace of mind. Download the EZIT Guardian app from the Google Play Store & App Store today and let our experts help you navigate the insurance surrender process in India with ease and confidence.