TL;DR

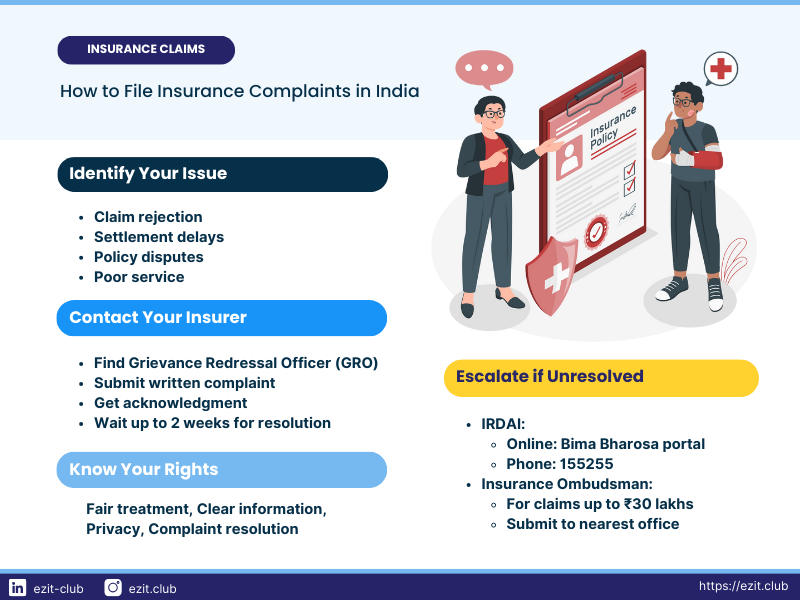

Filing an insurance complaint in India involves a structured process. Start by contacting your insurer’s Grievance Redressal Officer, then escalate to IRDAI if needed, and consider reaching out to the Insurance Ombudsman for further assistance. This guide provides a comprehensive overview of how to file insurance complaints in India, ensuring you’re well-equipped to address any issues with your insurance provider. For personalized assistance in filing your insurance complaint, consider using the EZIT Guardian App.

Introduction to Insurance Complaints in India

Before diving into the process of how to file insurance complaints in India, it’s crucial to understand what constitutes a valid complaint. Insurance complaints typically arise when policyholders feel their rights have been violated or when they’re dissatisfied with the services provided by their insurance company.

Common reasons to file insurance complaints in India include:

- Claim rejections

- Discrepancies in policy terms

- Delays in claim settlement

- Poor customer service

- Mis-selling of insurance products

- Premium-related issues

Understanding these common issues can help you better navigate the complaint filing process and ensure you’re addressing the right concerns when you file your insurance complaint.

Identify the Issue

When filing a complaint against an insurance company in India, the first step is to clearly identify the issue. This helps you articulate your problem effectively and prepares you for the complaint process.

Common Reasons for Claim Rejection

Understanding these common reasons can help you avoid potential pitfalls when filing an insurance claim or complaint in India.

- Incomplete Documentation: Missing or incomplete documents can lead to claim rejection.

- Non-Disclosure of Facts: Failure to disclose relevant information at the time of policy purchase.

- Policy Exclusions: Claims for services or conditions excluded from the policy coverage.

- Delayed Claim Filing: Submitting claims after the stipulated time frame.

- Incorrect Information: Errors or inaccuracies in the claim information provided.

- Premium Payment Issues: Unpaid premiums leading to policy lapse.

How to Avoid Common Issues

To minimize the chances of having to file an insurance complaint, consider these preventive measures:

- Organize Documents: Keep all necessary documents ready for claims.

- Honesty in Disclosure: Provide accurate and complete information when purchasing a policy.

- Coverage Understanding: Familiarize yourself with what’s covered and excluded in your policy.

- File Claims Promptly: Submit claims within the specified time frame.

- Verify Accuracy: Double-check all details before submitting any information.

- Timely Premiums: Pay your premiums on time to ensure continuous coverage.

When to File an Insurance Complaint

Knowing when to file an insurance complaint in India is crucial. Here are some situations that warrant filing a complaint:

- Claim Issues: If your claim is denied without valid reasons or if there’s an unreasonable delay in settlement.

- Policy Disputes: When you disagree with how the insurer is interpreting policy terms or conditions.

- Customer Service Problems: If you consistently receive poor or unsatisfactory service from your insurance provider.

- Mis-selling: If you believe you were sold a policy under false pretenses or without full disclosure of terms.

Remember, it’s your right as a policyholder to file an insurance complaint in India if you feel you’ve been treated unfairly or if your insurer isn’t honoring the terms of your policy.

Initial Steps to Resolve the Issue

Before you file a formal insurance complaint in India, it’s advisable to attempt resolution directly with your insurance provider. Here’s how:

- Initial Approach: Visit your insurer’s office or contact their Grievance Redressal Officer (GRO). Every insurance company in India is required to have a designated GRO. You can usually find their contact information on the company’s website.

- Submit a Written Complaint: Prepare a detailed written complaint outlining your issue. Include all relevant policy details, claim numbers, and any supporting documents.

- Obtain Acknowledgment: After submitting your complaint, make sure to get a written acknowledgment from the insurer. This acknowledgment should include the date of receipt and a unique complaint number.

- Follow Up: The insurer should resolve your complaint within two weeks. During this time, stay in touch with the GRO for updates on your case.

- Escalation: If your complaint is not resolved within two weeks or if you’re unsatisfied with the resolution, it’s time to escalate your insurance complaint to higher authorities.

How to File a Complaint with External Authorities

If you’re unable to resolve your issue directly with the insurance company, you can escalate your complaint to external regulatory bodies. Here’s how to file insurance complaints with these authorities:

Filing a Complaint with IRDAI

The Insurance Regulatory and Development Authority of India (IRDAI) is the primary regulatory body for the insurance sector. To file a complaint with IRDAI:

- Prepare Your Complaint: Gather all necessary details, including your policy information and a clear description of your issue.

- Use the Complaint Registration Form: Visit the IRDAI website and download the Complaint Registration Form from the policyholder section.

- Complete the Form: Fill out the form accurately, providing all requested information.

- Submit the Form: Send the completed form along with supporting documents to IRDAI’s address.

- Online Submission: Alternatively, you can file your insurance complaint online through the Integrated Grievance Management System (IGMS) on the IRDAI website.

- Follow-Up: Keep track of your complaint status by checking the IRDAI website or contacting their Grievance Redressal Cell.

Filing a Complaint with the Insurance Ombudsman

The Insurance Ombudsman is another avenue for resolving insurance complaints in India. If your complaint falls within their jurisdiction:

- Eligibility Check: Ensure your complaint is eligible. The Ombudsman typically handles claims up to ₹30 lakhs.

- Prepare Your Complaint: Gather all relevant documents and details related to your complaint.

- Contact the Ombudsman: Submit your complaint in writing to the nearest Insurance Ombudsman office. You can find their contact details on the IRDAI website.

- Attend Hearings: The Ombudsman may call for hearings. Attend these to present your case.

- Resolution: The Ombudsman will work towards a fair resolution of your insurance complaint.

Understanding the Role of Regulatory Bodies

Knowing the roles of regulatory bodies can help you navigate the process of filing insurance complaints in India more effectively.

How IRDAI Protects the Consumer

The IRDAI plays a crucial role in safeguarding the interests of insurance policyholders in India:

- Regulatory Oversight: IRDAI sets and enforces guidelines for insurance companies to ensure fair practices.

- Complaint Handling: It oversees the Grievance Redressal Cells within insurance companies and maintains its own Grievance Redressal Cell.

- Consumer Education: IRDAI educates policyholders about their rights and responsibilities through various initiatives.

- Policyholder Protection: It ensures that insurance products are transparently designed and that companies honor their commitments.

- Monitoring and Supervision: IRDAI regularly monitors insurance companies to ensure financial stability and regulatory compliance.

The Role of the Insurance Ombudsman

The Insurance Ombudsman plays a vital role in the insurance complaint resolution process in India:

- Dispute Resolution: They provide an independent platform to settle complaints that couldn’t be resolved directly with insurers.

- Jurisdiction: Ombudsmen handle various types of insurance complaints, including those related to claims, policy terms, and service issues.

- Accessibility: They ensure a straightforward process for policyholders to submit complaints.

- Impartiality: Ombudsmen aim to resolve complaints fairly and promptly, offering an alternative to lengthy legal proceedings.

Timeline for Resolution

When you file an insurance complaint in India, it’s helpful to understand the expected timeline for resolution:

- Insurer Level: The insurance company should acknowledge your complaint within 3 working days and resolve it within 15 days of receipt.

- IRDAI Level: If escalated to IRDAI, they typically forward your complaint to the insurer, who then has 15 days to respond.

- Ombudsman Level: The Ombudsman aims to resolve complaints within 3 months of receiving all requirements from the complainant.

Knowing these timelines can help you manage your expectations and follow up appropriately when you file an insurance complaint in India.

Digital Complaint Filing

In today’s digital age, filing insurance complaints in India has become more accessible through various online platforms:

- IRDAI Mobile App: Download the official IRDAI mobile app to file and track complaints on the go.

- Bima Bharosa Portal: This is IRDAI’s official portal for filing insurance complaints online.

- Insurer’s Online Grievance System: Most insurance companies in India now have their own online portals for complaint submission.

- Email: You can also send detailed complaints to the designated email addresses of IRDAI or your insurer.

These digital methods make it easier and more convenient to file insurance complaints in India, especially for tech-savvy consumers.

Consumer Rights in Insurance

As an insurance policyholder in India, you have several rights that you should be aware of:

- Right to Information: You’re entitled to clear, accurate information about your policy.

- Right to Fair Treatment: Insurers must treat you fairly and without discrimination.

- Right to Privacy: Your personal information should be kept confidential.

- Right to Grievance Redressal: You have the right to file complaints and seek resolution.

- Right to Surrender: For life insurance policies, you can surrender your policy under certain conditions.

Understanding these rights is crucial when you’re considering filing an insurance complaint in India.

Case Studies: Successful Complaint Resolutions

Let’s look at some real-life examples of successful insurance complaint resolutions in India:

- Health Insurance Claim: Mrs. Sharma’s health insurance claim was initially rejected due to a pre-existing condition not disclosed. She filed a complaint with her insurer’s GRO, providing evidence that the condition was diagnosed after policy inception. The GRO reviewed the case and approved the claim within 10 days.

- Life Insurance Mis-selling: Ms. Gupta was sold a life insurance policy under the pretext of it being a short-term investment. She filed a complaint with the Insurance Ombudsman, who ruled in her favor, directing the insurer to refund her premiums with interest.

Legal Recourse

If all other methods fail to resolve your insurance complaint satisfactorily, you have the option to approach consumer courts in India:

| Forum | Claims Amount |

|---|---|

| District Consumer Disputes Redressal Forum | Up to ₹20 lakhs |

| State Consumer Disputes Redressal Commission | Between ₹20 lakhs and ₹1 crore |

| National Consumer Disputes Redressal Commission | Exceeding ₹1 crore |

While this is a more time-consuming process, it provides a legal avenue for resolving complex insurance disputes.

Regional Language Support

To make the process of filing insurance complaints more accessible, IRDAI supports multiple regional languages:

- Call Center: The IRDAI call center (155255) offers support in 13 languages.

- Bima Bharosa Portal: Supports complaint registration in 13 regional languages.

- Written Complaints: You can submit written complaints in your preferred regional language.

This multi-lingual support ensures that language is not a barrier when you need to file an insurance complaint in India.

Conclusion

Filing a complaint against an insurance company in India requires understanding the process and your rights as a policyholder. By following the steps outlined in this guide – from identifying the issue to escalating to regulatory bodies if needed – you can effectively address your grievances and seek fair resolution.

Remember, persistence and proper documentation are key when you file an insurance complaint in India. Don’t hesitate to escalate your complaint if you’re not satisfied with the initial response. Your rights as a policyholder are protected by robust regulatory frameworks, and there are multiple avenues available for seeking redressal.

Let EZIT Assist You in Filing Your Insurance Complaint

Navigating the process of filing insurance complaints in India can be complex. That’s where EZIT comes in. Our EZIT Guardian App provides expert guidance to ensure your insurance complaint is handled efficiently and fairly.

Our team of advisors can assist you at every step:

- Helping you understand your policy terms

- Guiding you through the initial complaint process with your insurer

- Assisting in preparing documentation for IRDAI or Ombudsman complaints

- Providing updates on the status of your complaint

- Offering advice on further steps if needed

Remember, with the right guidance and persistence, you can successfully resolve your insurance complaints and ensure your rights as a policyholder are protected.

Don’t let unresolved insurance issues disrupt your peace of mind. Download the EZIT Guardian app from the Google Play Store & App Store today and let our experts help you navigate the insurance complaint process in India with ease and confidence.