TL;DR

Unclaimed insurance policies represent funds left unclaimed by policyholders or their beneficiaries. This guide explains why these funds remain unclaimed, how to find and claim them, and how to ensure your loved ones can access these funds. For assistance, consult our advisors on the EZIT Guardian App.

Introduction to Unclaimed Insurance Policies

Unclaimed insurance policies refer to funds that remain with insurance companies because policyholders or their beneficiaries have not claimed them. These unclaimed deposits can amount to significant sums, impacting many families. This guide will help you understand what unclaimed deposits are, why they occur, and how you can claim them.

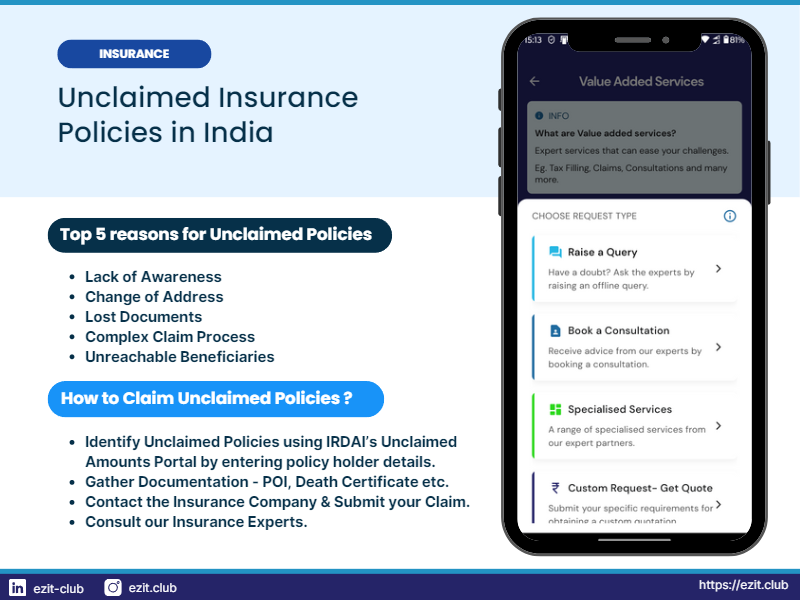

Top Reasons Why Insurance Policies go Unclaimed

Lack of Awareness: Many policyholders are unaware of the need to inform their beneficiaries about existing insurance policies. Without this crucial step, unclaimed deposits accumulate when the policyholder passes away. It is essential for policyholders to keep their loved ones updated about all their insurance policies to ensure that the benefits are claimed. Check out our article on how to add nominees & why is it important.

Change of Address: Policyholders often move without updating their address and contact information with their insurance provider. This oversight can lead to important communications about policy status and claims not reaching the intended recipients, resulting in unclaimed deposits in India. Regularly updating contact details with the insurance company is crucial.

Lost Documents: Important insurance documents might be misplaced or forgotten over time. Beneficiaries who are unaware of these policies or lack access to the necessary documentation cannot claim the funds, leading to unclaimed policy dues. It is important to store policy documents in a safe, accessible place and inform your family about their location.

Complex Claim Process: The process to claim insurance benefits can be lengthy and complicated, often discouraging beneficiaries from following through with their claims. Understanding how to claim unclaimed insurance money and preparing the necessary documents in advance can help streamline the procedure.

Unreachable Beneficiaries: Sometimes, beneficiaries may not be aware that they are listed on a policy or may have passed away without the policyholder updating the nominee information. It is crucial for policyholders to regularly check and update their beneficiary information to ensure that their benefits are directed to the right individuals.

Types of Unclaimed Insurance Policies

Life Insurance: Large sums often go unclaimed in LIC policies because beneficiaries are unaware of them. Life insurance typically involves significant financial benefits, which can be crucial for family support and future financial planning. Ensuring that your beneficiaries are aware of any life insurance policies you hold is essential to prevent unclaimed deposits.

Health Insurance: Unclaimed reimbursements and benefits are common, often because policyholders or their families are unaware of how to claim these benefits. Health insurance policies may cover a range of expenses, and missing out on these claims can lead to unnecessary financial strain.

General Insurance: Includes unclaimed amounts from vehicle and property insurance policies. These policies may cover significant costs related to accidents, theft, or damage, and failing to claim these benefits can result in substantial financial loss.

The Scale of the Unclaimed Deposits Problem in India

Unclaimed insurance deposits represent a significant financial resource that can be crucial for many families in India. According to the figures for Q1-2023-24:

Life Insurance Companies

| Company | Unclaimed Amount (in lakhs) |

|---|---|

| Life Insurance Corporation of India (LIC) | 15,75,334 |

| ICICI Prudential Life Insurance | 91,580 |

| Reliance Nippon Life Insurance | 29,940 |

| SBI Life Insurance | 25,573 |

| Max Life Insurance | 10,574 |

General Insurance Companies

| Company | Unclaimed Amount (in lakhs) |

|---|---|

| ICICI Lombard | 50,684 |

| United India Insurance | 21,715 |

| New India Assurance | 17,592 |

| National Insurance | 16,664 |

| Oriental Insurance | 10,636 |

These figures highlight the importance of regularly checking for unclaimed insurance policies and ensuring that your beneficiaries are aware of any policies that could benefit them.

How to Find and Claim Unclaimed Insurance Policies

Identify Potential Policies: Use the IRDAI’s Unclaimed Amounts Portal to check if you or your family members have any unclaimed insurance money. This portal allows you to search for unclaimed deposits by entering the policyholder’s details.

Gather Documentation: Collect proof of identity, the death certificate (if claiming for a deceased person), and any relevant policy documents. Ensure that you have all the necessary paperwork to substantiate your claim. Having a clear and complete set of documents will facilitate a smoother and quicker claims process.

Contact the Insurance Company: Reach out to the insurance company to initiate the claim. Contacting the insurer directly will provide you with detailed information on their specific claim process and any additional documents required. Each company may have a slightly different procedure, so it’s important to follow their guidelines.

Submit Your Claim: Follow the insurance company’s procedure to submit your claim, including completing any necessary forms and providing required documents. Ensure that you understand the claim process and adhere to any deadlines. Submitting a complete and accurate claim will help in avoiding delays and ensuring that the funds are disbursed promptly.

Ensure Financial Security: Adding a nominee guarantees that your family can access the funds quickly in times of need. This is especially crucial in emergencies when immediate financial support is required. Make sure that your nominee details are updated and that they are aware of their role in accessing these funds.

Avoid Legal Complications: It helps prevent lengthy legal processes and disputes over the distribution of assets. Legal heirs may face complications and delays if the insurance policies do not have a clear nominee. By designating a nominee, you ensure a straightforward process for transferring the benefits.

Stay Updated: Regularly update nominee information to reflect life changes like marriage, divorce, or having children. Life events can significantly impact your financial planning, and keeping your nominee details up to date ensures that your insurance benefits are directed to the right individuals.

Simplify Asset Transfer: It ensures a straightforward process for transferring your assets to your chosen beneficiaries. Having a designated nominee simplifies the process of asset distribution and ensures that your benefits are received by those you intend to support.

Maintain Records: Keep all policy documents in a secure and accessible place and inform your family members about them. Having a clear and organized record of your insurance policies and nominee details will help your family easily access and claim these benefits when needed.

Frequently Asked Questions : Unclaimed Insurance Deposits

An unclaimed deposit refers to funds from insurance policies that remain unclaimed by the policyholder or beneficiaries. This can include unpaid benefits from life, health, or general insurance policies due to various reasons such as lack of awareness or outdated contact information.

To find unclaimed insurance money, you can use the IRDAI’s Unclaimed Amounts Portal. This portal allows you to search for unclaimed deposits by entering the policyholder’s details.

Unclaimed insurance money remains with the insurance company and continues to accrue. Over time, if the amount is not claimed, it may be transferred to a designated unclaimed amount fund, but it can still be claimed by beneficiaries or legal heirs at any time.

To claim unclaimed insurance money, gather necessary documents such as proof of identity, the policyholder’s death certificate, and any policy documents. Contact the insurance company and follow their claims process to submit your claim.

Regularly checking for unclaimed deposits ensures that you do not miss out on benefits you are entitled to. It prevents potential financial loss and ensures that the funds are utilized effectively by the rightful beneficiaries.

To prevent your insurance deposits from becoming unclaimed, regularly update your contact and nominee information with your insurance provider. Inform your beneficiaries about the policies and maintain all relevant documents in an accessible place.

Unclaimed deposits in India are substantial. For example, the Life Insurance Corporation of India (LIC) alone has unclaimed deposits amounting to 15,75,334 lakhs as of Q1-2023-24, highlighting the importance of regularly checking and claiming these funds.

Yes, legal heirs can claim unclaimed money from life insurance policies. They must provide the necessary documentation, such as a succession certificate or legal heir certificate, to prove their entitlement to the funds.

Conclusion

Unclaimed insurance deposits are a significant issue in India, with large amounts of money potentially helping families if claimed. Regularly checking and updating your insurance policies can prevent these funds from remaining unclaimed, ensuring that your beneficiaries receive the benefits you intended for them.

Get timely help with EZIT Guardian App

For comprehensive guidance on managing your insurance policies and ensuring that your assets are properly transferred, consult our expert advisors on the EZIT Guardian App. Start your journey to making the best choice for your future by downloading the EZIT app from the Google Play Store & App Store today.