TL;DR

Ensure your financial assets have designated nominees for smooth transfer. Verify nominations for bank accounts, mutual funds & stocks, insurance policies, retirement accounts, real estate, and digital assets. For personalized assistance, consult our advisors on the EZIT Guardian App. Understanding and updating nominations is crucial to safeguarding your assets and ensuring your family’s financial security.

Introduction

Designating nominees for your financial assets is a vital part of estate planning, ensuring that your assets are transferred to your intended beneficiaries without legal complications. This guide will help you check and add nominees for various financial assets (banks, mutual funds, stocks, insurances etc.), highlighting the importance of doing so regularly, especially after major life events.

Importance of Nomination

In India, ensuring that your financial assets have designated nominees is crucial for effective estate planning and safeguarding your family’s future. A nominee is a person you appoint to receive the benefits of your assets in the event of your demise. Here is why it’s important:

Smooth Asset Transfer: Nominating someone ensures prompt transfer of assets without legal complications, avoiding lengthy procedures. For example, if you have nominated your spouse for your savings account, they can access the funds immediately after your death without waiting for legal processes.

Financial Security: Nomination provides immediate access to funds, supporting your family during challenging times. Imagine a situation where your family needs to cover urgent medical expenses or daily living costs; having access to your financial assets can be critical.

Reduced Family Disputes: Clearly naming beneficiaries helps prevent conflicts among family members over asset distribution. For instance, specifying nominees for your properties can reduce disputes between heirs and ensure a fair and peaceful distribution of assets.

Simplified Legal Process: Nominees can bypass lengthy probate processes, streamlining asset transfer procedures. Without a nominee, your family might face a time-consuming legal process to claim your assets, adding stress during an already difficult time.

Compliance with Regulations: Financial institutions require nominations to comply with regulatory norms, maintaining account integrity. Nomination ensures that your financial dealings adhere to legal requirements, protecting the integrity of your assets.

Peace of Mind: Knowing your assets will be managed as per your wishes offers reassurance, safeguarding your family’s financial stability and honoring your legacy. Regularly updating your nominations can provide comfort that your loved ones will be cared for according to your plans.

Common Financial Assets Requiring Nomination

Bank Accounts:

- Types: Savings, fixed deposits, and recurring deposits.

- Why Nominate: Ensures easy access to funds for your nominee. For instance, if your savings account has a nominee, they can quickly access the funds without legal hurdles.

How to verify and add nominee to bank accounts :

- Visiting Your Bank Branch: Visit your bank branch to verify your nominee details. Provide your account number and request nominee information.

- Checking Through Internet Banking: Log in to your bank’s internet banking portal, navigate to ‘Account Details,’ and review your nominee information.

- Contacting Customer Service: Call your bank’s customer service, provide your account details, and ask them to confirm your nominee details.

- Reviewing Bank Statements and Account Documents: Check your bank statements and account opening documents for nominee details provided by the bank.

Investment Accounts:

- Types: Mutual funds, stocks, and bonds.

- Why Nominate: Facilitates smooth transfer of investments to your chosen person. For example, having a nominee for your mutual fund ensures that the investment is passed on directly to them.

How to verify and add nominee in mutual fund, stocks, bonds :

Check your mutual fund statements or log in to your account portal like CAMS or Karvy. For demat accounts, use NSDL or CDSL.

- Mutual Fund Statements and Account Portals: Review your mutual fund statements or log in to your mutual fund account portal to verify nominee details.

- Stock and Demat Account Nominations: Check your stock and demat account for nominee information.

- Bond Investments and Other Securities: For bond investments and securities, check your account statements or contact your brokerage.

Insurance Policies:

- Types: Life and health insurance.

- Why Nominate: Ensures direct payment to your beneficiary, providing financial security. For example, a nominee in a life insurance policy can receive the payout without legal delays.

How to verify and add nominee to Insurance Policies :

- Reviewing Your Policy Documents: Start by reviewing your insurance policy documents to find details about your current nominees.

- Contacting Your Insurance Agent or Company: Reach out to your insurance agent or company to verify and update nominee information.

- Checking Online Policy Management Tools: Use your insurer’s online portal to manage policy details.

Retirement Accounts:

- Types: EPF, PPF, and NPS accounts.

- Why Nominate: Simplifies transfer of accumulated funds to your nominee. For example, if you have nominated someone for your EPF account, they can claim the funds easily.

How to verify and add nominee to Retirement Accounts :

For EPF, log in to the EPFO website. For PPF, visit your bank or post office. For NPS, log in to your account via NSDL.

- EPF Nomination Process: Confirm your EPF nominees by logging in to the EPFO website. Navigate to ‘Manage’ and select ‘Nomination Details’ to view or update nominees.

- PPF Nomination Details: For your PPF account, visit your bank or post office. Fill out Form E and submit it with updated nominee details.

- NPS (National Pension System) Nomination Procedure: To confirm NPS nominees, log in to your NPS account via NSDL or visit a POP service provider.

Real Estate and Property:

- Why Nominate: Includes a nominee in property documents for hassle-free ownership transfer and to avoid legal disputes. For instance, specifying a nominee in your property documents can prevent family conflicts over inheritance.

How to verify and add nominee to Real Estate and Property :

- Understanding Legal Nomination and Will Preparation: Nomination in real estate designates individuals to inherit your property after your demise.

- Checking Property Documents and Registration Details: Review property documents like sale deeds and registration papers to verify ownership and nomination details.

- Consulting with a Legal Advisor: Seek advice from a property and estate planning lawyer to draft a clear will.

Digital Assets:

- Types: Cryptocurrencies and online accounts.

- Why Nominate: Ensures secure transfer of digital assets. For example, nominating someone for your cryptocurrency wallet can help in the seamless transfer of these assets.

How to verify and add nominee to Digital Assets :

- Cryptocurrency Wallets and Exchange Accounts: Designating beneficiaries for your cryptocurrency holdings ensures seamless transfer of digital assets during unforeseen circumstances.

- Nominating in Online Payment Platforms: Platforms such as PayPal and Google Pay enable users to assign beneficiaries for their accounts, ensuring assets are transferred according to their wishes.

Major Life Events Requiring Nomination Updates

- Marriage: After getting married, update your nominations to include your spouse for all your financial assets.

- Divorce: Post-divorce, ensure to remove your ex-spouse as a nominee from all accounts to avoid future disputes.

- Childbirth: Add your children as nominees to secure their future.

- Retirement: Update your nominations to reflect current beneficiaries and ensure your retirement savings are transferred according to your wishes.

Common Mistakes in Terms of Nomination

- Not Updating Nominees: Many people forget to update nominee details after major life events like marriage, divorce, or the birth of a child.

- Ignoring Digital Assets: Neglecting to nominate beneficiaries for digital assets such as cryptocurrency and online accounts.

- No Nominee for Joint Accounts: Assuming joint account holders don’t need nominees, which can lead to legal issues if one holder passes away.

- Incomplete Documentation: Failing to complete nomination paperwork properly, leading to invalid nominations.

- No Proof of Nomination: Not keeping proof of nomination documents, making it difficult for nominees to claim assets.

Rights of Nominee

- Access to Funds: A nominee has the right to claim the assets in case of the account holder’s death.

- Role as Custodian: Nominees act as custodians of the assets and may need to distribute them as per legal heirs’ rights if there’s no will.

- Limited Rights: Nominees do not have full ownership; the legal heirs still have the ultimate right to the assets.

Nominee vs. Legal Heirs

- Nominee: A caretaker of assets until the legal heirs claim them. The nominee does not have ownership rights unless specified by a will.

- Legal Heirs: Have ultimate rights to inherit assets according to succession laws or the deceased’s will. The legal heirs can claim the assets from the nominee.

Frequently Asked Questions : Adding a Nominee

Yes, a nominee can withdraw money from a bank account after the account holder’s death. However, the nominee acts as a custodian and not the owner. They are responsible for holding the funds until the legal heirs claim them. The bank will require the nominee to provide the death certificate of the account holder and complete necessary formalities before disbursing the funds.

No, it is not mandatory to add a nominee to a bank account, but it is highly recommended. Adding a nominee simplifies the process of transferring the account balance in the event of the account holder’s death, ensuring that the funds are quickly and efficiently passed to the intended person without legal complications.

If no nominee is registered for a bank account, the legal heirs of the deceased account holder will have to go through a potentially lengthy and complex legal process to claim the funds. This might involve presenting a succession certificate or a legal heir certificate to the bank to prove their entitlement to the assets.

Yes, the nominee will receive the money in the account upon the account holder’s death. However, the nominee is not the owner of the funds. They act as a trustee, holding the money on behalf of the legal heirs, who have the ultimate right to the assets according to the law or the deceased’s will.

No, a nominee is not the owner of the assets. The nominee acts as a custodian or trustee for the assets until the legal heirs claim them. The legal ownership of the assets is determined by the will or by the laws of succession, not by the nominee designation.

If there is no nominee in a mutual fund, the legal heirs will need to produce documents like a succession certificate or a probate of the will to claim the investments. This can lead to delays and additional legal costs. It’s advisable to add a nominee to ensure a smooth transfer of the fund’s value to the intended beneficiaries.

A nominee does not have the right to ownership of the property. The nominee holds the property in trust for the legal heirs, who have the ultimate right to the property based on the deceased’s will or applicable succession laws. The legal heirs can claim their share of the property from the nominee.

Yes, legal heirs can claim money from a nominee. The nominee is not the final owner of the assets but holds them in trust. Legal heirs, based on succession laws or a valid will, have the right to claim their share of the assets from the nominee, and the nominee is obligated to transfer the assets to the rightful heirs.

Conclusion

Verifying nominees for your financial assets is essential for smooth transfers and safeguarding your family’s future. Check and update nominations for bank accounts, investments, insurance policies, retirement funds, real estate, and digital assets. For expert advice and effective asset management, use the EZIT platform. Take action today to secure your financial legacy.

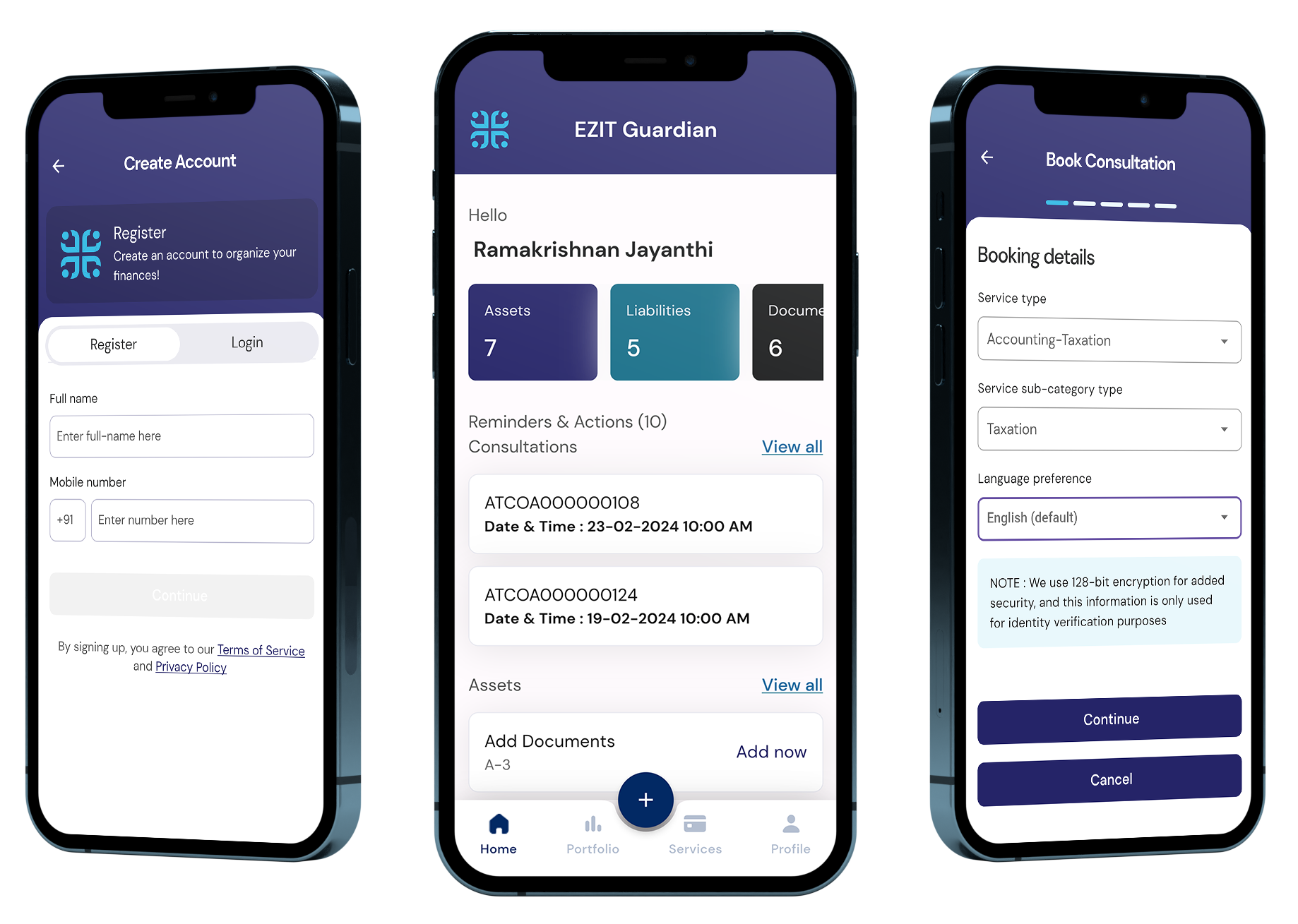

Protect your Future with EZIT

To ensure all your financial assets have designated nominees, consult our expert advisors on the EZIT Guardian App. Our personalized asset management services help you verify and update nominations, ensuring your family’s financial security. Don’t risk leaving your assets unprotected. Start your journey to making the best choice for your future by downloading the EZIT app from the Google Play Store & App Store today.