TL;DR

Debating buying vs renting a house in India? Buying offers long-term investment benefits and stability, but comes with high upfront costs and reduced flexibility. Renting is more affordable in the short term and offers greater mobility, but lacks asset-building potential. Use our comprehensive financial comparison to make an informed decision.

Introduction

If you’re constantly debating whether to buy a house or continue renting and saving in India, you’re not alone. This is a common dilemma many face as they navigate the complexities of financial planning and long-term commitments.

Owning a home is often seen as a dream—a place to create memories, build a family, and enjoy the pride of ownership. But this path comes with significant responsibilities and financial obligations.

Renting offers flexibility and lower upfront costs, but lacks the security and long-term benefits of owning property. Each choice has its own set of advantages and challenges. Let’s explore the emotional and financial aspects of buying vs renting a house to help you make an informed decision.

Emotional Factors: Buying vs Renting a House

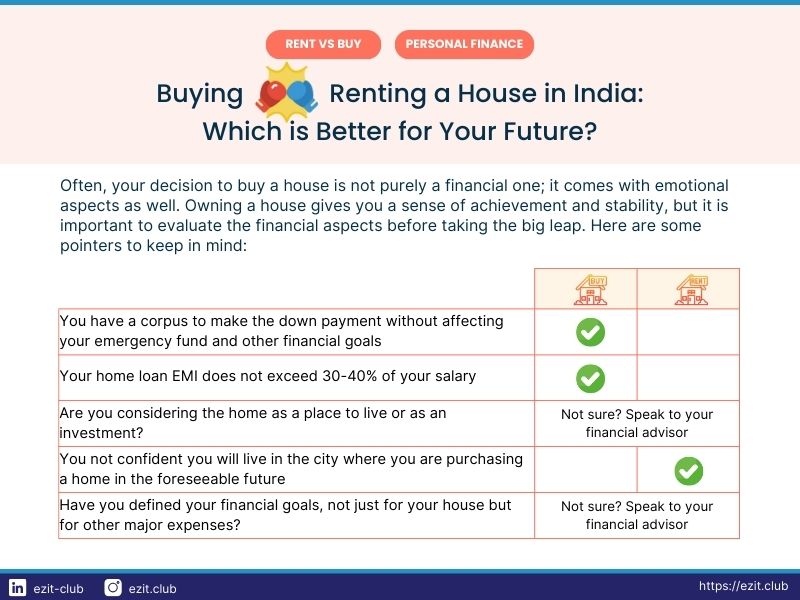

Buying a house often brings a sense of achievement and long-term stability. It can provide a permanent place to call home, create a legacy for future generations, and allow you to make any modifications you desire. However, it also means taking on the burden of property maintenance and potentially feeling pressured by societal expectations.

Renting, on the other hand, offers flexibility and freedom from the burdens of property ownership. It allows you to move easily and live in desirable locations without the long-term commitment. However, renting may also feel less secure, and the constant reminder that you’re paying for something you don’t own can be disheartening.

Emotional aspects of Buying vs Renting a House

| Aspect | Emotional Impact of Buying | Emotional Impact of Renting |

|---|---|---|

| Sense of Achievement | High personal satisfaction from owning a home. | Satisfaction from living in desirable areas. |

| Stability | Permanent, secure living arrangement. | Temporary, with ease of moving to different places. |

| Legacy | Creating a long-term asset for future generations. | Focus on personal experiences without asset burden. |

| Social Pressure | Viewed as a conventional life milestone. | Less pressure, more freedom to choose lifestyle. |

| Flexibility | Reduced, as selling property is a long process. | Increased, with the ability to relocate easily. |

| Maintenance | Full responsibility, including costs and labor. | Minimal responsibility; major repairs handled by landlord. |

Financial Factors: Buying vs Renting a House

From a financial perspective, buying a home can be a significant investment that may appreciate over time, offering a substantial long-term benefit. It also provides tax benefits and helps build equity. However, it involves high upfront costs and ongoing expenses like maintenance and property taxes, and is subject to market risks.

Renting requires lower initial outlay and monthly payments, which can free up cash flow for other investments. It also reduces the risk of property value fluctuations. However, rent payments do not build equity and provide no tax benefits, making it less advantageous in the long term.

Financial aspects of Buying vs Renting a House

| Aspect | Financial Impact of Buying | Financial Impact of Renting |

|---|---|---|

| Upfront Costs | High, including down payment and fees. | Low, mainly security deposit and rent. |

| Monthly Costs | High EMIs and maintenance expenses. | Lower rent payments, but no equity building. |

| Long-Term Investment | Property appreciation can lead to significant returns. | No returns from rent payments. |

| Tax Benefits | Significant, with deductions on loan payments. | None, no tax relief on rent paid. |

| Market Risk | Subject to property value fluctuations. | Risk of rent increases, but no property market exposure. |

| Maintenance Costs | Full responsibility for repairs and upkeep. | Landlord handles major repairs, reducing tenant costs. |

Comparing Buying vs Renting a House Over 15 Years

To illustrate the long-term financial implications of buying vs renting a house, let’s consider the following scenario:

- Renting a Home: Monthly rent of ₹30,000, with an annual increase of 5%. Investing the down payment amount (₹30,00,000) in an alternative investment yielding 7.2% per annum.

- Buying a Home: Purchasing a home for ₹1,00,00,000 with a down payment of ₹30,00,000. Taking a loan for ₹70,00,000 at an interest rate of 7.5% per annum for 15 years. Assuming an annual property appreciation rate of 5%.

Renting Over 15 Years

| Component | Details |

|---|---|

| Monthly Rent | ₹30,000 |

| Annual Rent Increase | 5% |

| Total Rent Paid Over 15 Years | ₹77,70,000 |

| Investment Amount (Initial) | ₹30,00,000 |

| Annual Return on Investment | 7.2% |

| Value of Investment After 15 Years | ₹2,07,00,000 |

| Total Asset Value | ₹2,07,00,000 |

Buying Over 15 Years

| Component | Details |

|---|---|

| Home Price | ₹1,00,00,000 |

| Down Payment | ₹30,00,000 |

| Loan Amount | ₹70,00,000 |

| Loan Tenure | 15 years |

| Interest Rate | 7.5% |

| EMI | Approx. ₹64,950 |

| Total EMI Paid Over 15 Years | ₹1,16,91,000 |

| Total Amount Paid to the Bank | ₹1,46,91,000 (including interest) |

| Annual Maintenance and Property Tax | ₹20,000 (combined) |

| Total Maintenance and Property Tax Over 15 Years | ₹3,00,000 |

| Total Outflow (Including Down Payment) | ₹1,79,91,000 |

| Home Value After 15 Years (5% Appreciation) | ₹2,08,00,000 |

| Total Asset Value | ₹2,08,00,000 |

| Net Financial Position After 15 Years | +₹63,800 |

Analysis : Buying vs Renting a House

- Total Cost of Renting: Renting for 15 years results in a total outflow of ₹77.7 lakh, with an investment growing to ₹2.07 crore.

- Total Cost of Buying: Buying a home leads to a total expenditure of ₹1.79 crore, with the home value appreciating to ₹2.08 crore.

- Net Financial Benefit: Owning a home provides a slight financial edge with a net benefit of ₹63,800 over renting when accounting for property appreciation.

Use our Home Rent vs Buy Calculator to analyze which is better for your current scenario depending on the rents, rental increase year on year & current property values.

Risks of Buying a Home

While buying a home offers numerous benefits, it also comes with risks, particularly related to financial stability and job security. Economic downturns or job losses can make it challenging to meet mortgage payments, potentially leading to financial strain or foreclosure. Additionally, the real estate market can be volatile, and property values may not always appreciate as expected, which could affect your investment.

- Job Security and Income Fluctuations: If you face job loss or a significant reduction in salary, keeping up with mortgage payments can become difficult, leading to financial stress.

- Market Volatility: Real estate markets can be unpredictable, and a downturn can decrease property values, affecting your investment.

- Liquidity Issues: Real estate is not a liquid asset, and selling a property quickly in times of need can be challenging.

- Maintenance and Unexpected Costs: Homeownership requires ongoing maintenance and unexpected repairs, which can add to financial burdens.

Frequently Asked Questions : Buying vs Renting a House

Yes, buying a house in India can be a good investment due to potential property appreciation and tax benefits. However, consider market trends, location, and your financial stability. Use our Home Rent vs. Buy Calculator for a detailed comparison.

Ideally, your housing costs should be no more than 30-40% of your monthly income. If you earn ₹50,000 per month, aim for housing costs between ₹15,000 and ₹20,000. Check your affordability with our Home Loan EMI Calculator.

The best age to buy a house is typically between your late 20s and mid-30s, when you likely have a stable income and can benefit from long-term asset building.

Yes, if the property is in good condition and in a desirable location. Assess maintenance needs and renovation costs before deciding.

Save at least 20-30% of the property’s value for the down payment, plus additional funds for other expenses like registration and maintenance. Ensure you have an emergency fund as well.

If your EMI doesn’t exceed 30-40% of your salary (₹12,000 to ₹16,000), and you have enough for a down payment and other costs, buying a house could be feasible.

Renting offers flexibility and lower upfront costs, but you miss out on building equity and property appreciation. Evaluate your needs using our Home Rent vs. Buy Calculator.

Conclusion: Making the Best Choice for Your Future

Deciding whether to buy a house or continue renting in India is a personal decision that depends on your financial situation, lifestyle, and long-term goals. Buying a home offers stability, potential for property appreciation, and significant financial benefits. Renting provides lower initial costs, greater flexibility, and reduced maintenance responsibilities, but it does not contribute to building an asset.

Consider consulting a financial advisor to help evaluate your options and make an informed choice that aligns with your aspirations. The EZIT Guardian App is a great resource for personalized guidance based on your financial situation and goals.

Make Informed Housing Decisions with EZIT

Need help deciding between buying a house or renting? Use the EZIT Guardian App to consult with expert real estate advisors. Get personalized guidance tailored to your financial situation and long-term objectives. Start your journey to making the best choice for your future by downloading the EZIT app from the Google Play Store & App Store today.