TL;DR;

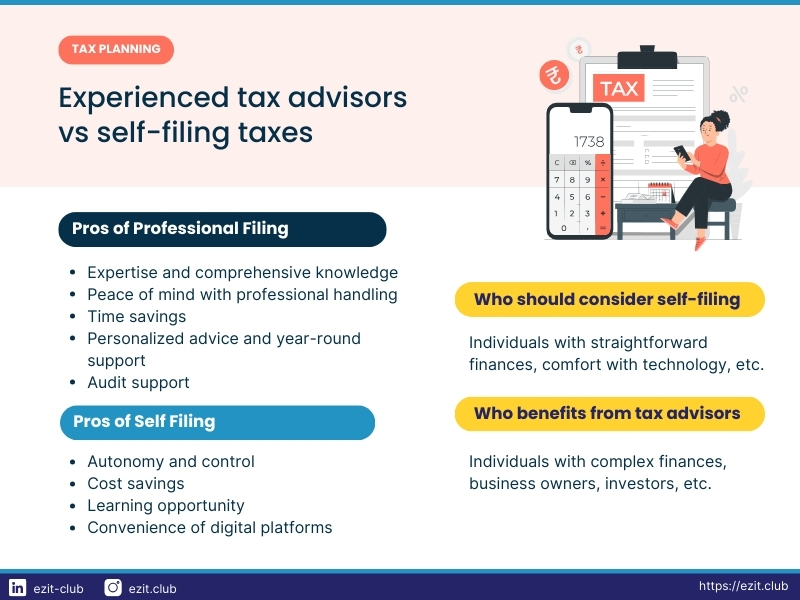

Choosing between self-filing and experienced tax advisors depends on your financial situation and comfort level with tax laws. Self-filing offers control and cost savings but can be complex and time-consuming. Experienced tax advisors provide expertise, peace of mind, and support, especially for complicated tax scenarios. Evaluate your needs and decide which option suits you best for a stress-free tax season.

Introduction to Tax Filing Options

Tax season can feel overwhelming, but understanding your options can make it more manageable. Think of it like choosing how to travel: you can drive yourself or hire someone else to do it for you.

Self-filing is when you do your taxes on your own. It’s like driving yourself – you have control over where you go and can save money. But, just like driving, you need to know the rules of the road (or in this case, tax laws) to avoid getting lost.

Hiring an experienced tax advisor, like EZIT Club, is like hiring a chauffeur. They know all the routes and can make sure you get where you need to go smoothly. Even though it costs more, it can be worth it, especially if your taxes are complicated.

Before deciding, think about whether you feel comfortable doing your taxes alone or if you’d prefer someone to help you. Consider the pros and cons of each option to make the best choice for you. And remember, tax season doesn’t have to be stressful if you approach it the right way.

Pros and Cons of Self-Filing

When it comes to filing taxes, self-filing can be both empowering and challenging. Let’s break down the pros and cons to help you decide what’s best for you.

Pros

- Autonomy: Self-filing gives you control over your finances. You can do it on your own schedule and make decisions without relying on anyone else.

- Cost Savings: Self-filing can save you money because you won’t need to pay for professional tax services.

- Learning Opportunity: Doing your taxes yourself can be a valuable learning experience. You understand what goes into your financial situation and how tax laws apply to you.

- Convenience: With tax software and online options available, self-filing is more convenient than ever. You can do it from home, anytime that suits you.

Cons

- Complexity: Tax laws can be complex and ever-changing. Without expertise, you might struggle to navigate the process effectively, leading to mistakes or missed opportunities.

- Time-Consuming: Self-filing can take a lot of time, especially if your taxes are complicated. You’ll need to gather all the necessary documents and fill out forms accurately.

- Risk of Errors: Without professional guidance, there’s a higher chance of making mistakes in your tax return. These mistakes could mean delays in getting your refund or getting audited by the IRS.

- Limited Support: While tax software and online resources can help, they might not offer the same level of support as an experienced tax advisor.

Learn about the differences in the New Tax Regime vs Old Tax Regime and file taxes at your own pace.

Benefits of hiring Experienced Tax Advisors

Tax season can feel like trying to solve a puzzle in the dark, but turning to experienced tax advisors can be like flipping on a light switch. Let’s explore why getting help from a tax pro can make things easier.

- Expertise and Knowledge: Experienced tax advisors are experts who know all the ins and outs of tax laws and regulations. They can optimize your tax situation to get the best outcome.

- Peace of Mind: Handing over your taxes to an experienced advisor means you can relax knowing that someone with in-depth knowledge is taking care of everything accurately and efficiently.

- Time Savings: Tax preparation can be time-consuming, but with an experienced tax advisor handling it, you can focus on other priorities while they take care of the paperwork.

- Personalized Advice: An experienced tax advisor can offer tailored advice based on your financial circumstances and goals, helping you make informed decisions.

- Audit Support: If you face an IRS audit, having an experienced tax advisor by your side can provide invaluable support, ensuring you have the documentation and explanations needed to resolve any issues.

- Year-Round Support: Experienced tax advisors are available beyond tax season to answer questions and assist with tax-related matters, providing ongoing support whenever you need it.

Who Should Consider Self-Filing?

Self-filing your taxes can be like taking the wheel on a road trip—it’s a hands-on approach that suits some people just fine. Let’s explore why self-filing might be the right choice for you:

- Simplicity: If your financial situation is straightforward, with just one source of income and minimal deductions, self-filing can be efficient and hassle-free.

- Comfort with Technology: Self-filing often involves using tax software or online platforms. If you’re comfortable with technology and can follow instructions, self-filing can be a convenient option.

- Budget-Conscious Individuals: Self-filing can save you money on tax preparation fees, making it appealing for those looking to minimize expenses during tax season.

- Educational Opportunity: Doing your taxes yourself can provide valuable insights into your finances and tax obligations. It’s a chance to learn more about how taxes work and how different deductions and credits apply to your situation.

- Organized Individuals: Self-filing requires gathering and organizing tax documents. If you’re good at keeping your financial records in order, self-filing can be a straightforward process.

Who Gains from Experienced Tax Advisors?

Experienced tax advisors can be like having a financial superhero by your side, especially if your situation is a bit more complicated. Here’s why getting help from an advisor might be a smart move:

- Complex Financial Situations: If your finances are complicated, like having multiple sources of income or owning a business, an experienced tax advisor can help you navigate the tricky tax laws and find ways to save money.

- Self-Employed Individuals: Being self-employed comes with its own tax challenges. An experienced tax advisor can help you figure out which deductions apply to you and make sure you’re paying the right amount of taxes.

- Investors and Property Owners: If you have investments or rental properties, your taxes can get complicated fast. An experienced tax advisor can help you understand all the tax rules and make sure you’re taking advantage of any tax breaks available to you.

- Life Changes: Big life events like getting married or having a baby can affect your taxes. An experienced tax advisor can help you understand how these changes impact your taxes and make sure you’re getting all the tax benefits you’re entitled to.

- High-Net-Worth Individuals: Having a lot of money can mean dealing with complex tax issues. An experienced tax advisor can help you navigate these issues and make sure you’re not paying more taxes than you need to.

- Tax Planning and Strategy: An experienced tax advisor can help you come up with a plan to minimize your taxes and achieve your financial goals. Whether you’re saving for retirement or investing in the stock market, an experienced tax advisor can help you make smart decisions.

Conclusion

In the end, deciding whether to do your taxes yourself or seek help from experienced tax advisors comes down to what works best for you. Self-filing gives you control and a chance to learn, like driving your own car and exploring new routes. On the other hand, getting professional help is like having a skilled navigator guide you through the journey, ensuring you reach your destination smoothly.

Think about what you need and what resources you have available. If you’re comfortable with numbers and technology, self-filing might be a good fit, giving you the freedom to manage your finances your way. But if taxes make your head spin or your situation is complicated, an experienced tax advisor can provide the expertise and assurance you need to navigate the tax maze without stress.

Hassle-free tax filing experience with EZIT

For a hassle-free tax filing experience, consider using the EZIT app. Whether you choose to self-file or seek assistance from experienced tax advisors, EZIT offers comprehensive solutions to meet your needs. Our expert advisors are available to provide personalized guidance, ensuring your taxes are filed accurately and efficiently. Download the EZIT app from the Google Play Store & App Store today and take the stress out of tax season!