TL;DR;

Your credit score acts as a vital indicator of your credit worthiness and impacts your access to financial products. By understanding the factors that shape your score and utilizing tools like secured credit cards, you can take proactive steps to improve your financial standing. Connect with our advisors via the EZIT Guardian App for tailored guidance. Keep exploring to gain further insights into optimizing the use of a secured credit card to build credit score.

Decoding Credit Scores

Understanding credit scores is essential for managing your finances effectively. In India, credit scores range from 300 to 900. Higher scores indicate better creditworthiness. For instance, a score of 750 or above is considered excellent, while lower scores may limit access to financial products.

Your credit score reflects how well you handle debts, influencing lenders’ decisions when offering credit cards, loans, and other financial services. Several factors determine your credit score, including payment history, credit card usage, credit history length, types of credit accounts, and recent credit inquiries.

Factors Influencing Credit Score:

- Payment History: Consistently paying bills on time boosts your score.

- Credit Utilization: Keeping credit card balances low is beneficial.

- Credit History Length: Longer credit history generally improves your score.

- Types of Credit Accounts: A mix of credit types can positively impact your score.

- Recent Credit Inquiries: Multiple inquiries can lower your score.

For example, consistently paying bills on time and keeping credit card balances low can boost your score. Conversely, missing payments or maxing out credit cards can lower it. It’s crucial to regularly check your credit report for errors and fix them promptly.

Some lenders may charge higher interest rates to individuals with lower credit scores. While repaying existing loans or credit cards responsibly can improve your score, taking out a new loan just to build credit may not be wise due to interest costs. Obtaining a regular credit card can be challenging for those new to credit or with poor scores, especially if they have low income or work in specific occupations. In such cases, a secured credit card to improve credit score may be a better choice.

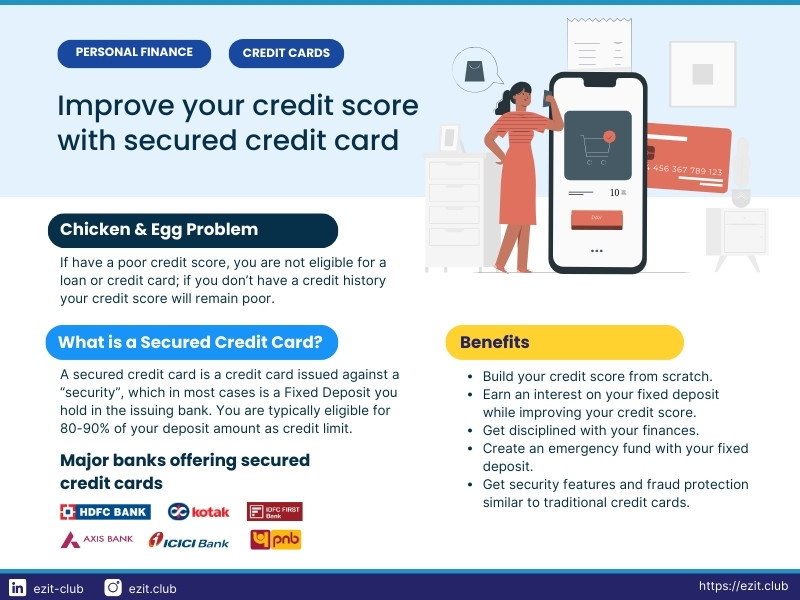

What is a Secured Credit Card?

A secured credit card is a type of credit card that requires a fixed deposit to open the account. This fixed deposit acts as collateral and reduces the risk for the lender, making it easier for individuals with limited credit history or poor credit scores to qualify.

Here’s how to use a secured credit card to build credit score:

Let’s say you want to open a secured credit card account. You will need to deposit a certain amount of money, typically equivalent to the credit limit you’re seeking. For example, if you deposit ₹10,000, your credit limit will likely be ₹10,000. This deposit serves as security for the card issuer. If you fail to make payments, the issuer can use the deposit to cover the outstanding balance. However, if you use the card responsibly and make timely payments, the deposit remains untouched.

These fixed deposits are lien-marked by the bank, meaning you cannot close them until you surrender your secured credit card. Additionally, in the event of default, the issuer bank reserves the right to close the fixed deposits. A secured credit card functions similarly to traditional credit cards. You can use it to make purchases, pay bills, and build credit history. Each month, your payment activity is reported to credit bureaus, helping you establish a positive credit history over time.

Benefits of Secured Credit Card

Secured credit cards offer numerous advantages that can significantly aid in improving your credit score and financial management.

Accessibility:

Available to individuals with limited or poor credit history, offering a pathway to credit that may otherwise be denied.

Credit Building:

Responsible use can improve your credit score over time, demonstrating your creditworthiness to lenders.

Financial Flexibility:

Functions like a traditional credit card, enabling you to manage everyday expenses conveniently.

Interest-Earning Security Deposit:

The fixed deposit earns interest, increasing your liquidity without having to prematurely close your fixed deposit.

Rewards and Incentives:

Some cards offer rewards programs, such as cashback or reward points, providing additional value for your spending.

Emergency Fund:

The deposit can serve as an emergency fund without affecting your credit card balance.

Security and Fraud Protection:

Includes security features and fraud protection similar to traditional cards, ensuring you are protected against unauthorized transactions.

10 Tips to Utilize Secured Credit Card to build Credit Score

Here are some practical tips to make the most out of your secured credit card to build your credit score:

Understand Your Credit Score:

Know your current score to gauge your financial standing.

Optimize Credit Limit Usage:

Keep usage below 30% of your limit. Consider topping up your limit if usage reaches 75%.

Convert Dues into EMIs:

If you’re unable to repay the outstanding balance by the due date, consider converting it into Equated Monthly Installments (EMIs) to manage your debt effectively and avoid default.

Avoid Multiple Credit Cards:

Refrain from applying for multiple secured or unsecured credit cards within a short period, as this may negatively impact your credit score and indicate financial instability.

Monitor Your Spending:

Use your secured credit card for essentials like groceries or utilities, not luxury items. Stick to your budget to avoid overspending.

Pay Your Bills on Time:

Timely bill payments are crucial. Set up reminders or automatic payments to avoid late fees. For instance, if your bill is due on the 15th, schedule payment in advance.

Track Your Credit Score:

Regularly monitor your score for progress. Many banks offer free monitoring, making it easy to stay updated. If your score drops suddenly, investigate and take action.

Stay Patient and Persistent:

Improving your credit score takes time. Consistently follow good credit habits with your secured credit card. Don’t get discouraged by slow progress.

Review Your Credit Report:

Periodically check for errors or inaccuracies. Dispute any discrepancies promptly. For example, if you spot a loan that’s not yours, take steps to remove it and protect your score.

Use the Card Regularly but Responsibly:

Regular use of your secured credit card can help build a positive credit history. Make small, manageable purchases and pay them off in full each month to show consistent, responsible credit behavior.

Conclusion

Using a secured credit card responsibly is an effective strategy to improve your credit score. By maintaining good financial habits and staying committed to your goal, you can gradually enhance your credit profile. This improvement will open up more opportunities for you in the financial world, ensuring better loan terms and interest rates in the future. Stay focused, and your credit score will reflect your dedication. For more information on financial protection, check out our article on credit card insurance in case of death.

Build a Stronger Credit Profile with EZIT

Take charge of your credit journey with the EZIT Guardian App. Whether you’re new to secured credit cards or seeking to enhance your financial profile, our experts provide the guidance you need. Download now and embark on a path towards financial success.