TL;DR;

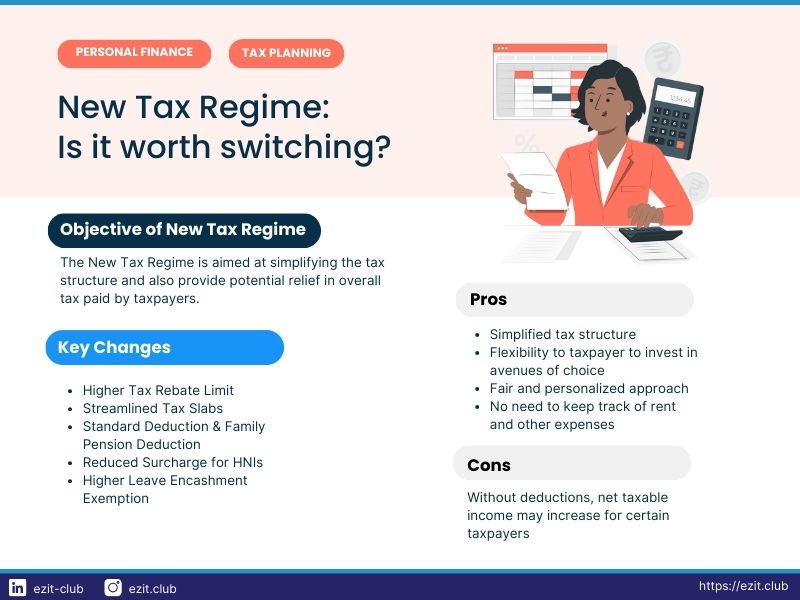

Explore the pros and cons of shifting to the New Tax Regime. While it simplifies tax brackets and increases deduction limits, it may also eliminate certain exemptions, as outlined in the New Tax Regime Exemption List, resulting in a higher taxable income. Use our comparison table to help you decide which system aligns best with your financial needs. For personalized guidance, reach out to our tax advisors via the EZIT Guardian App. Keep reading to gain further insights into the transition to the New Tax Regime.

Overview of the New Tax Regime

The New Tax Regime in India offers taxpayers a choice between two options: the old way of doing taxes and the new way. It’s like having two menus to pick from at a restaurant.

Under the new system, tax rates are lower, potentially reducing overall tax payments. However, taxpayers must give up many special deductions and exemptions available in the old regime. It’s similar to choosing a pizza with fewer toppings but a lower price.

Deciding which option is best depends on your situation. If you prefer simplicity and don’t rely heavily on deductions, the new regime might be a good fit. But if you count on those deductions to save money, sticking with the old regime could be better.

Ultimately, the goal of the New Tax Regime is to simplify tax payments and create a fairer system for everyone. It’s like tidying up your room to make it more organized and efficient – a change that benefits everyone in the long run.

Key Features and Changes

In the Budget 2023, changes were made to the tax system to make it easier for people to consider the new tax rules. These changes remained the same for FY 2024-2025, showing consistency in the approach. Here are the five main changes:

- Higher Tax Rebate Limit: Under the new tax rules, if you earn up to ₹7 lakhs, you won’t have to pay any taxes. This is higher than the previous limit of ₹5 lakhs. So, if your income is ₹7 lakhs or less, you won’t owe any taxes.

- Streamlined Tax Slabs: Now, if your income is below ₹3 lakhs, you won’t owe any taxes. This makes it simpler to figure out how much tax you owe.

- Standard Deduction and Family Pension Deduction: You can now deduct ₹50,000 from your salary as a standard deduction. If you receive a family pension, you can deduct ₹15,000 or 1/3rd of the pension, whichever is lower. This means if your pension is ₹45,000, you can deduct ₹15,000 from your taxable income.

- Reduced Surcharge for High Net Worth Individuals: The extra tax rate for people earning over ₹5 crores has been reduced from 37% to 25%. This means that high-income earners will pay less tax compared to before. For example, if someone earns ₹6 crores, their tax rate will be 25% on the amount over ₹5 crores, instead of the previous 37%.

- Higher Leave Encashment Exemption: If you’re not a government employee and receive money for unused leave, you can now exclude up to ₹25 lakhs from your taxable income. Consequently, under Section 10(10AA), leave encashment of up to ₹25 lakhs is now tax-free at the time of retirement. Previously, you could only exclude up to ₹3 lakhs. This change benefits individuals who receive large sums for their unused leave, allowing them to keep more of their money.

New Tax Regime : Tax Slab Rates and Rebates for FY 2023-24 (Effective from April 2023)

| Income Range (₹) | Tax Rate | Rebate (Section 87A) |

|---|---|---|

| 0 - 3,00,000 | Nil | - |

| 3,00,001 - 6,00,000 | 5% | - |

| 6,00,001 - 9,00,000 | 10% | 100% rebate on tax liability up to ₹25,000 |

| 9,00,001 - 12,00,000 | 15% | - |

| 12,00,001 - 15,00,000 | 20% | - |

| Above 15,00,000 | 30% | - |

Please note that there is an additonal Health & Education Cess of 4% on the taxable income in both Old & New tax regimes.

Default Tax Regime

Starting from the financial year 2023-24, the new income tax regime will be the primary choice for taxpayers. If you wish to switch back to the old regime, you’ll have to submit Form 10-IEA while filing your return. How often you can switch between the old and new regimes depends on your income type. For those with business or professional income, switching is allowed only once in a lifetime. However, if your income comes from sources like salary, you can switch between the regimes every year.

Pros of the New Tax Regime

The current tax system remains unchanged, giving you, the taxpayer, the freedom to choose between the old tax regime and the new one. The government hasn’t made it mandatory to switch to the new regime.

Under the new tax scheme, you have the flexibility to invest your money as you see fit. Unlike before, there’s no pressure to invest in specific tax-saving schemes or insurance plans that might not align with your financial goals.

With multiple tax slabs in place, you’ll fall into the tax bracket that best suits your annual income. This means your taxes will be calculated based on your earnings, ensuring a fair and personalized approach to taxation. For instance, if your income is on the lower side, you’ll be placed in a lower tax slab, reducing your tax burden.

Additionally, under the new tax regime, you don’t need to keep track of rent receipts, travel tickets, and complicated tax planning. The new tax regime offers lower tax rates and fewer deductions, simplifying the tax filing process and potentially resulting in tax savings.

Cons of the New Tax Regime

According to experts, changes are underway in the current tax system, gradually phasing out the exemptions that taxpayers previously enjoyed. This means that deductions and benefits like those for house rent or medical bills may no longer be available in the future.

Without these exemptions, the amount of income subject to tax will increase compared to before. For instance, if you used to deduct expenses like rent or medical costs from your taxable income, you won’t be able to do so anymore. As a result, your overall taxable income could rise.

Despite having six tax slabs in the new system, it might not benefit every taxpayer if the old tax system is completely eliminated. Some may find themselves paying more taxes overall without the exemptions they relied on.

Difference Between Old Vs New Tax Regime

When you’re deciding between the old and new tax systems, think about your salary and the deductions and exemptions you can claim. Imagine the breakeven threshold as a balancing point – it’s where your tax stays the same no matter which system you use.

If the deductions and exemptions you can get under the old system are higher than this breakeven point, it’s probably better to stick with the old way. But if the breakeven point is higher than what you can claim, switching to the new system might be smarter.

Old vs New Tax Regime Deductions

| Income Level | Less: Standard Deduction | Net Income | Tax under both regimes | Additional Deductions required in Old Regime to Break Even | Old vs New |

|---|---|---|---|---|---|

| ₹7,00,000 | ₹50,000 | ₹6,50,000 | ₹0 | ₹1,50,000 | New |

| ₹8,00,000 | ₹50,000 | ₹7,50,000 | ₹36,400 | ₹1,38,500 | Old regime: if deductions > ₹ 1,38,500 |

| ₹9,00,000 | ₹50,000 | ₹8,50,000 | ₹41,600 | ₹2,12,500 | Old regime: if deductions > ₹ 2,12,500 |

| ₹10,00,000 | ₹50,000 | ₹9,50,000 | ₹54,600 | ₹2,50,000 | Old regime: if deductions > ₹ 2,50,000 |

| ₹12,50,000 | ₹50,000 | ₹12,00,000 | ₹93,600 | ₹3,12,500 | Old regime: if deductions > ₹ 3,12,500 |

| ₹15,00,000 | ₹50,000 | ₹14,50,000 | ₹1,45,600 | ₹3,58,000 | Old regime: if deductions > ₹ 3,58,000 |

| ₹15,50,000 | ₹50,000 | ₹15,00,000 | ₹1,56,000 | ₹3,75,000 | Old regime: if deductions > ₹ 3,75,000 |

| ₹16,00,000 | ₹50,000 | ₹15,50,000 | ₹1,71,600 | ₹3,75,000 | Old regime: if deductions > ₹ 3,75,000 |

New Tax Regime Exemption List

- Salaried individuals can claim a standard deduction of up to Rs 50,000.

- Pensioners can deduct either Rs 15,000 or one-third of their pension amount, whichever is lower.

- Interest paid on home loans for let-out properties is deductible under Section 24b.

- Employer contributions to the National Pension System (NPS) are eligible for deduction.

- Contributions to the Agniveer Corpus Fund are deductible under Section 80CCH.

- Leave encashment received at retirement or resignation is exempt from tax under Section 10(10AA).

- Gratuity received by an employee is exempt from tax under Section 10(10).

- Transport allowances for persons with disabilities are tax-exempt.

- Amounts received under Voluntary Retirement Schemes (VRS) are exempt from tax under Section 10(10C).

- Gifts up to Rs 50,000 received by an individual are exempt from tax.

Using Tax Calculators

To assist in making an informed decision, use the following calculators to compare your tax liability under both regimes:

These tools provide a clear comparison based on your specific financial situation and help you understand the potential tax outlay under each regime.

Conclusion

When you’re deciding between tax regimes, think about the deductions and exemptions you can get under the old system. First, figure out your net taxable income after deducting these exemptions. Then, compare how much tax you’d owe under the old and new regimes. If the old regime results in lower taxes, it’s the better choice. Make sure to tell your employer so they deduct the right amount of Tax Deducted at Source (TDS) from your salary. Also, don’t forget to consider any losses from property, capital gains, or business. These losses might affect your future taxes because they could expire if not used up.

Achieve Tax Efficiency with EZIT's Smart Solutions

Discover the nuances of the New Tax Regime with the EZIT Guardian App. Our expert guidance empowers you to compare regimes, leverage deductions, and strategize your taxes effectively. Download now from the Google Play Store to make informed financial decisions.