TL;DR;

Credit card insurance can provide financial protection in case of accidental death, covering road and air accidents with varying amounts depending on the issuer. Benefits include no additional premiums and easy claims. Remember, it’s for primary holders only and offers smaller coverage compared to term insurance. To discover hidden insurance benefits with your cards, download the EZIT Guardian app from the Google Play Store. To know more about Credit card insurance in case of death, continue reading…

Introduction - Credit card insurance in case of death

Imagine you’re on a trip, enjoying the scenic views, when suddenly an accident occurs. It’s a frightening thought, but did you know that your credit card could offer financial protection in such situations? Credit card insurance provides coverage for a range of unfortunate events, including accidental death, travel-related losses, and damaged products. Many people aren’t aware that their credit cards can come with insurance benefits, often at no additional cost. However, it’s important to note that credit card insurance is an added benefit and should not replace a term or life insurance plan.

How Does It Work?

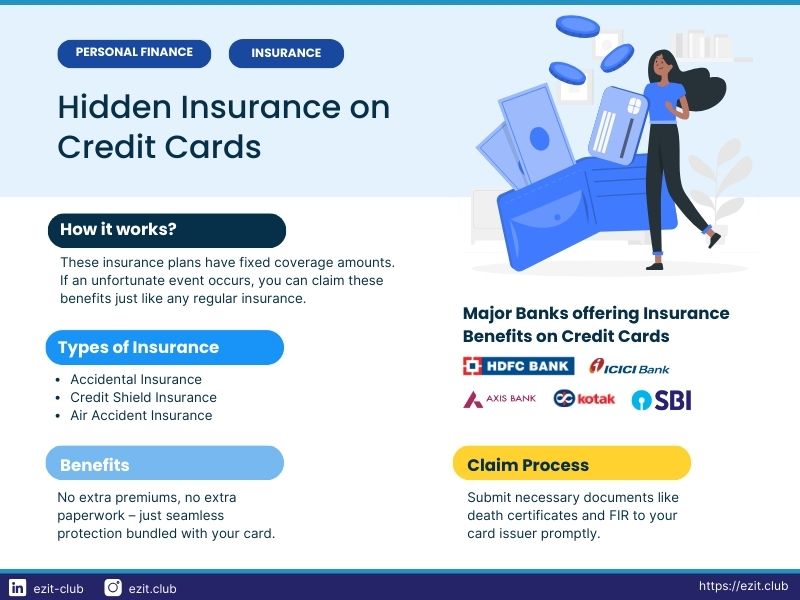

Credit card insurance works similarly to regular insurance products. These embedded insurance plans come with fixed coverage amounts that cardholders can claim if they experience any covered unfortunate events. For example, if you have a credit card that includes travel insurance and your luggage gets lost, you could be eligible for compensation.

Types of Credit Card Insurance: Accidental and Death

Credit cards may offer various types of coverage, such as card liability cover, purchase protection, travel insurance, and rental car insurance. In this article, we’ll focus on two main types: accidental insurance and credit shield insurance.

- Credit Card Accidental Insurance: Accidents are unpredictable and can happen to anyone at any time. Credit card accidental insurance can provide financial relief in such situations. For instance, if you’re involved in a road accident, you could claim between Rs. 2 lakh and Rs. 4 lakh, depending on your credit card’s terms. In the case of air accidents, the coverage might range from Rs. 10 lakh to Rs. 40 lakh. The exact coverage amount varies based on the type of credit card and the issuer.

- Credit Shield Insurance: The sudden demise of a cardholder can leave their family with the burden of repaying outstanding debts. Credit shield insurance helps mitigate this by covering debts resulting from credit card usage up to a pre-fixed limit. For example, if a cardholder passes away due to an accident, the insurance might waive off all outstanding balances up to Rs. 50,000. However, this amount can vary between credit card issuers. If the credit card is inactive at the time of death, a death certificate must be provided to make a claim.

- Air Accident Insurance: Some credit cards offer insurance coverage specifically for air travel accidents. If an unfortunate event leads to loss of life in an air accident, the card’s insurance policy might provide substantial compensation to the cardholder’s family.

Benefits

One of the significant advantages of credit card insurance is that it doesn’t require cardholders to pay additional premiums. These benefits are bundled with the card, eliminating the need for extra paperwork or enrollment processes. It’s a seamless way to have additional protection without any extra effort.

Claim Process

In the event of a claim, the nominee must ensure all necessary documents are submitted to the credit card issuer. These documents typically include a death certificate, accident FIR, police reports, hospital reports, post-mortem reports, and any other documentation requested by the issuer. Timely submission is crucial to ensure a smooth claims process to claim credit card insurance in case of death.

Points to Keep in Mind

- Insurance benefits are only for the primary account holder, not for add-on cardholders.

- The coverage amount for credit card accidental insurance is generally smaller compared to term insurance, usually around Rs. 2-4 lakh.

- If the credit card protection plan doesn’t cover credit insurance in the event of the primary cardholder’s death, the outstanding bill amount will be deducted from the final settlement received by the nominee.

- Report the claim within 90 days from the date of death, and submit documents within 60 days from the date of intimation.

Credit card insurance can provide a valuable safety net in times of need. It’s an often-overlooked benefit that can offer significant financial protection without additional costs. Remember to review the specific terms and conditions of your credit card’s insurance coverage to fully understand the benefits available to you. Hope you got a detailed understanding of credit card insurance in case of death.

Also, checkout our article on secured credit cards to improve your credit score with bonus tips.

Discover Hidden Insurance Covers with EZIT Guardian

To ensure you’re fully aware of all the insurance benefits available with your debit and credit cards, download the EZIT Guardian app from the Google Play Store. The “Prime” plan allows you to uncover hidden insurance covers, giving you peace of mind and enhanced financial protection. Don’t miss out on the benefits you deserve—get the EZIT Guardian app today!