TL;DR

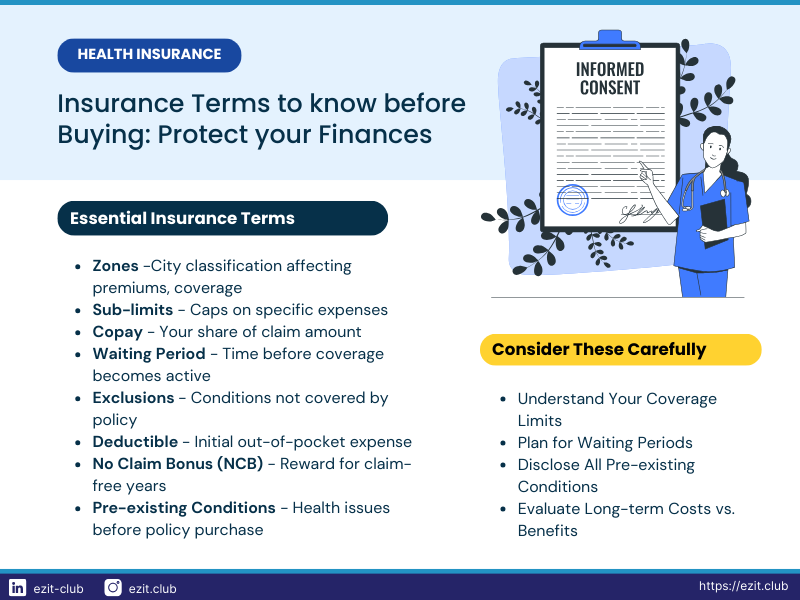

Understanding key insurance terms is crucial before purchasing a policy. This article explains eight essential insurance terms to know before buying: Zones, Sub-limits, Copay, Waiting Period, Exclusions, Deductible, No Claim Bonus, and Pre-existing Conditions. Knowing these terms can help you choose the right policy and avoid potential financial losses.

Introduction: The Importance of Understanding Insurance Language

When purchasing insurance, the complex terminology in policies can often lead to misunderstandings. These misinterpretations of insurance terms before buying could potentially cost you lakhs of rupees in unexpected expenses or rejected claims. This article explores eight essential insurance terms to know before buying any policy, helping you make informed decisions and avoid costly surprises.

By familiarizing yourself with these insurance terms, you’ll be better equipped to choose the right policy and understand your coverage. Let’s delve into these terms and their potential financial implications.

1. Zones: Understanding Geographic Pricing in Health Insurance

What Zones Mean in Your Policy

In health insurance, zones refer to the geographic classification of cities based on medical costs. Insurance companies typically divide cities into Zone 1 (metros), Zone 2 (tier-1 cities), and Zone 3 (other cities).

| Zone | Cities |

|---|---|

| Zone 1 | Delhi (including Faridabad), Mumbai, Surat, Thane, Gurgaon, Ghaziabad, Noida, Ahmedabad, Baroda |

| Zone 2 | Pune, Bangalore, Nasik, all the cities of Gujarat |

| Zone 3 | Rest of the cities of India |

Financial Impact of Zone Selection

Your premium is partly determined by your zone, and treatment in a higher zone than your policy covers may lead to additional out-of-pocket expenses. For instance, if you’re insured for Zone 2 but require treatment in a Zone 1 hospital, you might have to pay the difference in costs, which could amount to lakhs for major treatments.

Making the Right Zone Choice

When selecting a policy, understand which zone your city falls under and consider your potential travel and treatment preferences. If you frequently travel or prefer flexibility in hospital choice, you might want to opt for zone-free policies.

2. Sub-limits: The Hidden Caps in Your Coverage

Decoding Sub-limits in Insurance Policies

Sub-limits are caps on specific expenses within your overall sum insured, such as room rent, doctor fees, or specific treatments. These limits restrict how much you can claim for certain expenses, even if your total claim is within the sum insured.

How Sub-limits Can Affect Your Claim

If your policy has a room rent sub-limit of ₹5,000 per day, but you opt for a room costing ₹10,000, you might have to pay the difference plus a proportionate deduction on other expenses. This could potentially cost you lakhs in out-of-pocket expenses.

Navigating Policies with Sub-limits

When reviewing policies, carefully examine the sub-limits in the policy document. Consider policies with fewer or no sub-limits, even if they come at a higher premium. If sub-limits exist, ensure they align with the current healthcare costs in your area.

3. Copay: Your Share of the Medical Bill

Understanding the Copay Concept

Copay is the percentage of the claim amount that you agree to pay out of pocket, with the insurer covering the rest. It’s one of the crucial insurance terms to know before buying a policy.

The Financial Implications of Copay

A 20% copay on a ₹5 lakh treatment means you pay ₹1 lakh out of pocket. Misunderstanding or forgetting about copay could leave you unprepared for this significant expense.

Evaluating Copay in Your Policy

When choosing a policy, understand the copay percentage and assess whether the premium savings justify the potential out-of-pocket expense. Consider your financial capacity to handle copay amounts in case of major treatments.

4. Waiting Period: The Countdown to Full Coverage

Demystifying the Waiting Period in Insurance

The waiting period is the time you must wait after purchasing a policy before certain coverages become active. Different conditions or treatments may have different waiting periods.

The Cost of Ignoring Waiting Periods

If you need treatment for a pre-existing condition during its waiting period (typically 2-4 years), your claim will be rejected, potentially costing you lakhs in medical expenses.

Strategies for Managing Waiting Periods

When buying insurance, understand the various waiting periods in your policy (initial, disease-specific, pre-existing conditions). Plan your insurance purchase well in advance of anticipated healthcare needs and consider policies with shorter waiting periods, especially if you have known health conditions.

5. Exclusions: What Your Insurance Won't Cover

Identifying Policy Exclusions

Exclusions are specific conditions, treatments, or circumstances that your insurance policy does not cover. They define the boundaries of your insurance coverage.

The Financial Risk of Overlooking Exclusions

If you’re unaware that your policy excludes certain high-cost treatments (e.g., cancer treatment in some policies), you could end up paying lakhs out of pocket.

Mastering the Exclusions in Your Policy

Before buying insurance, carefully read the exclusions section of the policy document. Ask your insurance provider to clarify any unclear terms and consider additional coverage or riders for commonly excluded but essential items.

6. Pre-existing Conditions: Your Health History Matters

Defining Pre-existing Conditions

Pre-existing conditions are health issues you had before purchasing the insurance policy. They often have longer waiting periods before coverage begins.

The Risk of Non-Disclosure

If you fail to disclose a pre-existing condition, your claim might be rejected even years later, potentially costing you lakhs in treatment expenses.

Managing Pre-existing Conditions in Your Policy

When applying for insurance, disclose all known health conditions. Understand the waiting period and coverage terms for your specific pre-existing conditions and consider policies with shorter waiting periods if needed.

7. No Claim Bonus (NCB): The Reward for Staying Healthy

Unveiling the No Claim Bonus

NCB is a reward for not making any claims during a policy year, usually in the form of increased sum insured or discount on renewal premium.

The Long-Term Value of NCB

Failing to understand NCB might lead you to make small claims that reset your bonus, potentially losing out on lakhs of additional coverage over time.

Maximizing Your NCB Benefits

When buying and maintaining your policy, understand how NCB accumulates. Consider paying small medical expenses out of pocket to preserve your NCB and factor in the potential long-term NCB benefits when comparing policies.

8. Deductible: Your Initial Out-of-Pocket Expense

The Role of Deductibles in Insurance

A deductible is a fixed amount you agree to pay out of pocket before your insurance coverage kicks in. It’s an important insurance term to know before buying a policy.

How Deductibles Affect Your Finances

If you opt for a high deductible to lower premiums without understanding the implications, you might face a significant out-of-pocket expense during a claim.

Choosing the Right Deductible

When selecting a policy, choose a deductible amount that you can comfortably afford in case of a claim. Weigh the premium savings against the potential out-of-pocket cost and consider your overall financial situation and risk tolerance.

Conclusion: Empower Your Insurance Decisions

Understanding these eight essential insurance terms to know before buying is crucial for making informed decisions about your coverage. Misinterpreting or overlooking these terms could potentially cost you lakhs of rupees in unexpected expenses, inadequate coverage, or rejected claims.

Remember, the true value of insurance lies not just in having a policy, but in fully understanding its terms and conditions. By familiarizing yourself with these insurance terms to know before buying, you’re taking a vital step towards ensuring that your insurance truly serves its purpose when you need it most.

🚀Secure Your Future with EZIT

Navigating these insurance terms to know before buying can be challenging, but you don’t have to do it alone. EZIT offers expert guidance to ensure you make the best decisions for your financial future.

Don’t let complex insurance terminology jeopardize your financial security. Contact EZIT today for a free consultation and take control of your insurance planning. Download the EZIT Guardian app from the Google Play Store & App Store today to schedule your appointment now. Let’s ensure your insurance truly protects what matters most to you!