TL;DR;

Discover the essential steps of creating a will in India, including legal obligations, key components, and various types of wills. Utilize the expertise of the EZIT Guardian App to ensure adherence to Indian legal standards, protecting your assets effectively. Keep reading to uncover the intricacies of crafting a will that suits your needs and safeguards your assets for the future.

The Fundamentals of a Will

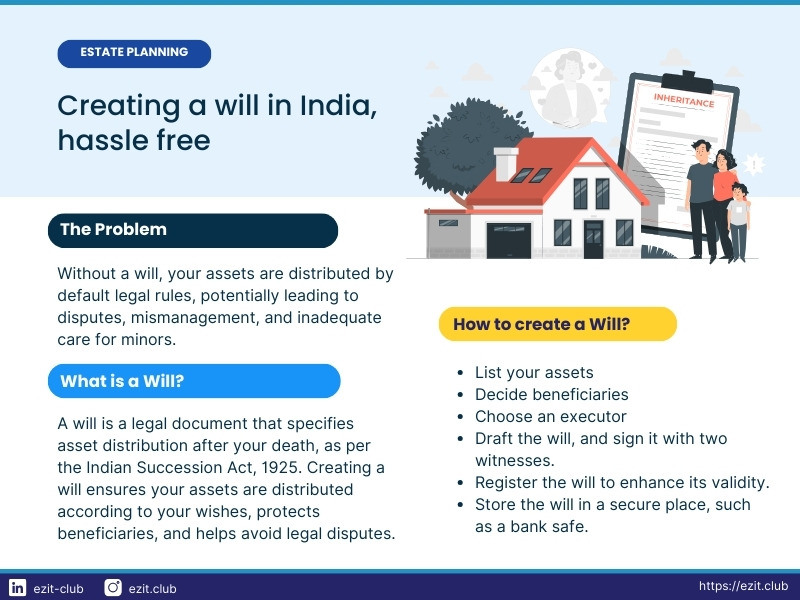

In India, a will is defined under the Indian Succession Act, 1925. Creating a will in India allows you to specify who will receive your property, possessions, and other assets after you pass away. The main purpose of a will is to ensure that your estate is distributed according to your wishes, rather than by the default rules of inheritance.

Why It Is Important to Create a Will

Creating a will in India is crucial for several reasons:

- Control Over Asset Distribution : A will ensures that your assets are distributed according to your wishes, rather than by the default rules of inheritance.

- Protecting Beneficiaries : A will can safeguard the financial future of your beneficiaries, including minor children, by appointing guardians and allocating resources.

- Avoiding Disputes : Clearly outlining your wishes can help prevent family disputes and legal challenges over your estate.

- Efficient Estate Management : Appointing an executor through a will ensures that your estate is managed efficiently and according to your instructions.

- Charitable Donations : If you wish to leave part of your estate to charity, a will allows you to specify these bequests.

Types of Wills in India

- Privileged Will : A simplified version for individuals like soldiers, airmen, and mariners during expeditions or warfare.

- Unprivileged Will : The most common type of will, applicable to civilians.

- Joint Will : A single document created by two or more persons, typically a married couple, to dispose of their property.

- Mutual Will : Created by multiple persons with an agreement that the survivor will adhere to its terms.

- Conditional Will : Made to become effective only if a specific condition is met.

- Concurrent Will : Entails multiple wills created by one person for assets in different jurisdictions.

- Holographic Will : Entirely handwritten and signed by the testator.

- Nuncupative Will : An oral will.

Legal Requirements for Creating a Will in India

- Sound Mind : Ensure you are of sound mind and understanding.

- Age : You must be at least 18 years old to create a will.

- Voluntary Creation : Your will should be created voluntarily and freely, without undue influence.

- Written Form : The will must be in written form, whether handwritten, typed, or printed.

- Signature : You must sign the will at the end or affix your mark.

- Witnesses : At least two witnesses must be present and sign the will to attest its validity.

- Executor : While not mandatory, it’s advisable to appoint an executor to carry out the will’s instructions.

- Clear Intent : Ensure the will clearly expresses your wishes regarding asset distribution.

- Revocability : A will is revocable during your lifetime, allowing amendments or revocation.

Simplified Steps to Creating a Will in India

- Compile Details of Assets : Include property, bank accounts, investments, and personal belongings.

- Decide Asset Distribution : Reflect on how you want your assets to be distributed among your beneficiaries.

- Choose an Executor : Select a trustworthy person to execute your will.

- Write Your Will : Use clear and unambiguous language to detail your assets, beneficiaries, and any specific instructions.

- Seek Legal Advice : Ensure your will complies with all legal requirements and is enforceable.

- Sign the Will : Sign the will in the presence of two witnesses who must also sign to attest its validity.

- Secure Storage : Keep the original copy of your will in a secure location, such as a bank locker or with a trusted individual.

- Review Periodically : Update your will to reflect any changes in your circumstances or wishes.

Key Elements to Include in a Will

- Personal Information : Provide your full name, address, and other identifying details.

- Declaration : Clearly state that the document is your last will and testament, revoking any previous wills or codicils.

- Executor Appointment : Designate a trustworthy individual to administer your estate.

- Beneficiaries : Specify the individuals or entities to whom you wish to leave your assets.

- Asset List : List all your assets and liabilities, including property, bank accounts, investments, and debts.

- Specific Bequests : Outline any specific gifts or bequests to particular individuals or organizations.

- Residual Clause : Include a clause to distribute any remaining assets not covered by specific bequests.

- Guardians for Minors : If you have minor children, appoint guardians to care for them.

- Signatures : Sign the will in the presence of at least two witnesses who are not beneficiaries.

- Date and Place : Mention the date and place where you are executing the will.

Registration of a Will

- Legal Validity : Registering your will ensures its legal validity and authenticity, providing protection against disputes.

- Tamper-proof : Registration deters tampering or alterations to the will after its creation.

- Authority : Wills are typically registered with the office of the Sub-Registrar or Registrar of Assurances.

- Documentation : Present the original copy of the will and supporting documents during registration, along with witnesses.

- Witness Attestation : Witnesses attest that the testator signed the will voluntarily.

- Stamp Duty : A nominal stamp duty fee may be required based on the value of assets mentioned in the will.

- Certification : Upon completion, a certificate confirming the will’s registration is provided.

- Storage : Registered wills are stored in the records of the registering authority for easy access.

- Amendments : Any changes or amendments to the will must follow the same registration process for legal validity.

- Peace of Mind : Registering your will offers peace of mind, simplifies the process for beneficiaries, and ensures assets are distributed as desired.

Heirs and Nominees: Understanding Their Roles

In the context of Indian inheritance law, understanding the distinction between heirs and nominees is crucial.

Heirs:

- Definition: Heirs are individuals who are legally entitled to inherit a deceased person’s assets according to the laws of succession.

- Legal Entitlement: In the absence of a will, assets are distributed among the heirs based on the Indian Succession Act, 1925.

- Types of Heirs: Heirs can include spouses, children, parents, and other close relatives.

- Inheritance Hierarchy: The hierarchy and share of inheritance can vary based on the deceased’s religion and personal law.

Nominees:

- Definition: Nominees are individuals appointed by the asset holder to manage the assets after their death.

- Role: Nominees are not the ultimate beneficiaries but are responsible for ensuring the assets are transferred to the rightful heirs.

- Bank Accounts and Investments: Nominees are commonly appointed for bank accounts, insurance policies, and other financial instruments.

- Legal Standing: Nomination ensures smooth transfer of assets but does not override the legal heirs’ rights.

Default Roles and Asset Distribution:

- Without a Will: If a person dies intestate (without a will), the assets are distributed according to the default rules of succession applicable to their religion.

- Hindu Succession Act: For Hindus, the assets are divided among Class I heirs (e.g., spouse, children, mother). If no Class I heirs exist, Class II heirs (e.g., siblings, grandparents) inherit the assets.

- Muslim Law: In Islam, the inheritance is distributed based on the Quranic principles, giving fixed shares to specific relatives.

- Christian and Parsi Law: Governed by the Indian Succession Act, the assets are divided among the spouse and lineal descendants, or other relatives if no direct descendants exist.

What Are the Laws Governing a Will?

- The Indian Succession Act of 1925

- The Code of Civil Procedure, 1908

- The Indian Registration Act of 1908

- The Indian Stamp Act, 1899

Digital Wills in India

In India, digital wills are emerging, but legal clarity is still evolving. To ensure a secure digital will, use authentication methods and comply with the Information Technology Act, 2000. Witnesses and notarization, like traditional wills, may also be necessary. Store your digital will securely, considering encrypted storage or digital vaults. Seeking legal advice is advisable to navigate complexities and ensure compliance.

Conclusion

Creating a will in India is a vital step in ensuring that your assets are distributed according to your wishes and that your loved ones are taken care of after your passing. From legal requirements to key elements, equip yourself with the knowledge needed to draft a comprehensive will. Consult legal experts on the EZIT platform to ensure compliance with Indian laws, securing your assets for the future.

Secure Your Legacy with EZIT

To ensure your will is comprehensive and legally sound, consult our expert advisors on the EZIT Guardian App. Our personalized guidance helps you navigate the complexities of will creation, ensuring your assets are protected and your wishes are honored. Don’t leave your legacy to chance—secure it with EZIT today! You can download the app from the Google Play Store.