TL;DR

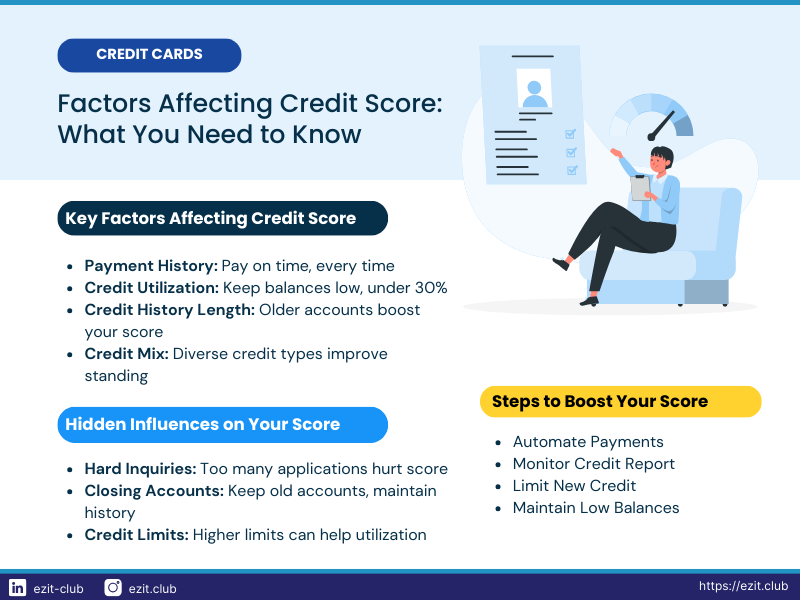

Your credit score is influenced by various factors beyond just payment history. This article explores seven surprising factors affecting credit score: credit utilization, closing old accounts, hard inquiries, credit mix, report errors, cosigning, and old debts. Understanding these factors can help you maintain and improve your creditworthiness.

Introduction: The Hidden Influences on Your Credit Score

Your credit score is more than just a number; it’s a key factor in your financial life. This three-digit score can influence everything from loan approvals to interest rates, and even job opportunities.

While most people are aware that payment history plays a significant role in determining their credit score, several less obvious elements can have a substantial impact on your creditworthiness.

Understanding these hidden factors affecting credit score is crucial for anyone looking to maintain or improve their financial standing. By recognizing these elements, you can take proactive steps to protect and enhance your credit score.

In this comprehensive guide, we’ll explore seven surprising factors affecting credit score that you might not be aware of. Let’s dive into these hidden influences and learn how to navigate them effectively.

1. Credit Utilization: A Key Factor Affecting Credit Score

Credit utilization refers to the percentage of your available credit that you’re currently using. It’s one of the most significant factors affecting credit score, typically accounting for about 30% of your score calculation. Many people don’t realize that high utilization can negatively impact their score, even if they pay their balance in full each month. Lenders often view high utilization as a sign of financial stress or overreliance on credit.

*In the context of a credit card, “balance” refers to the amount of money you owe to the credit card issuer at a given point in time. This includes any purchases, interest, fees, and other charges that have been added to your account but not yet paid off.

However, those with the highest credit scores often maintain utilization rates below 10%. Here are some strategies to manage this crucial factor affecting credit score:

- Keep your credit card balances low relative to your credit limits.

- Consider making multiple payments throughout the month to keep your utilization low.

- Request a credit limit increase, which can lower your utilization ratio if your spending remains the same.

- Use your credit cards for small, manageable purchases and pay them off quickly.

Remember, credit utilization is calculated both per card and across all your credit accounts. So, maxing out one card can hurt your score, even if your overall utilization is low.

2. Closing Old Credit Cards: An Unexpected Credit Score Factor

Many people believe that closing old or unused credit cards is good for their credit score. However, this common misconception can actually harm your creditworthiness.

Closing an old credit card can negatively affect your score in two ways:

- It reduces your total available credit, which can increase your overall credit utilization ratio.

- It can shorten your credit history length, which is another factor affecting credit score.

For instance, let’s say you have three credit cards:

Card A: 10 years old, ₹50,000 limit, Card B: 5 years old, ₹30,000 limit, Card C: 2 years old, ₹20,000 limit

Your average credit history length is (10 + 5 + 2) / 3 = 5.67 years. If you close the oldest card, your average drops to (5 + 2) / 2 = 3.5 years, potentially lowering your credit score.

Here are some best practices for managing old credit cards:

- Keep old credit cards open, even if you don’t use them regularly.

- Make small purchases on these cards occasionally to keep them active.

- If you must close a card, choose newer ones over your oldest accounts.

- Consider the impact on your credit utilization before closing any card.

Remember, a long credit history can be beneficial, showing lenders that you have experience managing credit over time, thereby improving credit score.

3. Hard Inquiries: A Subtle But Important Factor

Hard inquiries occur when a lender checks your credit report as part of a lending decision process. While a single hard inquiry usually has a minimal impact, multiple inquiries in a short period can be a red flag for lenders. Each hard inquiry can potentially lower your credit score by a few points. While this might seem insignificant, the effect can add up if you’re applying for multiple forms of credit in a short time.

For example, if you apply for several credit cards within a few months, each application results in a hard inquiry. This could signal to lenders that you’re in financial distress and seeking multiple credit lines to stay afloat. However, credit scoring models do make some allowances for rate shopping. If you’re shopping for a specific type of loan (like a mortgage or auto loan) and have multiple inquiries within a short period (typically 14-45 days), these are often treated as a single inquiry.

Here are some strategies for managing hard inquiries:

- Limit new credit applications to when you truly need them.

- When shopping for loans, do so within a short time frame to minimize the impact.

- Check your own credit report regularly. These “soft inquiries” don’t affect your score.

- Be cautious about allowing others to check your credit. Always ask if it will be a hard or soft inquiry.

Remember, hard inquiries typically stay on your credit report for about two years, but their impact on your score diminishes over time.

4. Credit Mix: Diversity Matters in Credit Scoring

Credit mix refers to the variety of credit accounts in your credit history. It’s a factor affecting credit score that many people overlook, but it can account for about 10% of your score. Lenders like to see that you can handle different types of credit responsibly. A diverse credit mix might include:

- Revolving credit (like credit cards)

- Installment loans (such as auto loans or personal loans)

- Mortgages

- Retail accounts

For example, someone with a well-managed credit card, car loan, and mortgage might have a better credit mix than someone with only credit cards, even if the total debt is the same. However, it’s important to note that you shouldn’t open new credit accounts solely for the purpose of diversifying your credit mix. This could backfire by resulting in hard inquiries and lowering your average account age.

Here are some tips for maintaining a healthy credit mix:

- Allow your credit mix to develop naturally as you encounter different financial needs over time.

- Manage all types of credit responsibly, making payments on time and keeping balances low.

- If you only have credit cards, consider a small installment loan if you need it, to diversify your credit mix.

- Don’t close old accounts of different types if it will negatively impact your credit mix.

Remember, while credit mix is a factor, it’s not as crucial as payment history or credit utilization. Focus on these areas first before worrying about optimizing your credit mix.

5. Credit Report Errors: An Overlooked Factor

Credit report errors are more common than many people realize, and they can significantly impact your credit score. These errors can range from minor inaccuracies to major issues like accounts falsely reported as delinquent.

For example, a credit report might show an account that doesn’t belong to you, incorrect payment statuses, or outdated personal information. Each of these errors could potentially lower your credit score.

Here's how you can address this often-overlooked factor affecting credit score:

- Regularly review your credit reports from all four major credit bureaus in India: CIBIL, Experian, Equifax, and CRIF High Mark.

- You’re entitled to one free credit report from each bureau annually through their respective websites.

- If you find errors, dispute them promptly and in writing with both the credit bureau and the financial institution that provided the information.

- Provide copies of documents that support your position when disputing errors.

- Follow up on your disputes to ensure errors are corrected.

- Consider using a credit monitoring service to alert you to changes in your credit report.

Remember, while the credit bureaus are required to investigate disputes, the process can take time. Be patient but persistent in ensuring your credit report accurately reflects your credit history.

6. Cosigning Loans: A Hidden Credit Score Risk

Cosigning a loan might seem like a harmless way to help a friend or family member, but it can be a significant factor affecting credit score. When you cosign, you’re equally responsible for the debt, and it appears on your credit report.

For instance, if you cosign a car loan for your child, and they miss payments, it will negatively impact your credit score, even if you weren’t aware of the issue. The impact can be substantial. Late payments or defaults on a cosigned loan can damage your credit score, potentially by 100 points or more for serious delinquencies.

Here are some considerations and strategies for managing cosigned loans:

- Think carefully before cosigning any loan. Consider whether you can afford to take on the debt if the primary borrower can’t pay.

- If you do cosign, monitor the account regularly to ensure timely payments.

- Set up alerts or request access to the account to stay informed about its status.

- Consider asking the primary borrower to refinance the loan in their name alone once their credit improves.

- If possible, make an agreement with the primary borrower that they’ll make payments to you, and you’ll make the loan payments to ensure they’re on time.

Remember, cosigning ties your credit score to someone else’s financial behavior. While it can be a generous act, it’s crucial to understand and prepare for the potential risks to your credit score.

7. Old Debts: A Lingering Factor in Credit Scores

Old, unpaid debts can continue to affect your credit score long after you’ve forgotten about them. Even if a debt is past the statute of limitations for legal collection, it can still appear on your credit report and impact your score.

For example, a credit card debt from five years ago that you never paid off could still be lowering your credit score, even if the credit card company can no longer sue you for payment. Negative information generally stays on your credit report for seven years, while some public record items, like bankruptcies, can remain for up to 10 years.

Here's how to handle old debts as a factor affecting credit score:

- Review your credit report for old, unpaid debts.

- Understand the statute of limitations for debt in your state, which is generally 3 years in India for most types of debt, but remember that this doesn’t remove the debt from your credit report.

- Consider settling old debts if possible, but be aware that this can sometimes restart the credit reporting clock.

- If you dispute the debt, do so in writing with both the credit bureaus and the creditor.

- Be cautious about making partial payments on old debts, as this can restart the statute of limitations in some cases.

- If a debt is close to falling off your credit report (typically 7 years old), it might be better to wait rather than taking action that could restart the clock.

Remember, while paying off old debts is generally good for your overall financial health, the impact on your credit score can vary. In some cases, it might cause a temporary dip before improving your score in the long run.

Conclusion: Mastering the Factors Affecting Credit Score

Your credit score is influenced by a complex interplay of factors, many of which operate silently in the background. By understanding these less obvious elements – from credit utilization and closing old accounts to managing credit mix and addressing report errors – you can take proactive steps to protect and improve your credit score.

Remember, maintaining a good credit score is an ongoing process that requires attention to detail and regular monitoring. By staying vigilant and addressing these factors affecting credit score, you can ensure that your credit score accurately reflects your financial responsibility and opens doors to better financial opportunities.

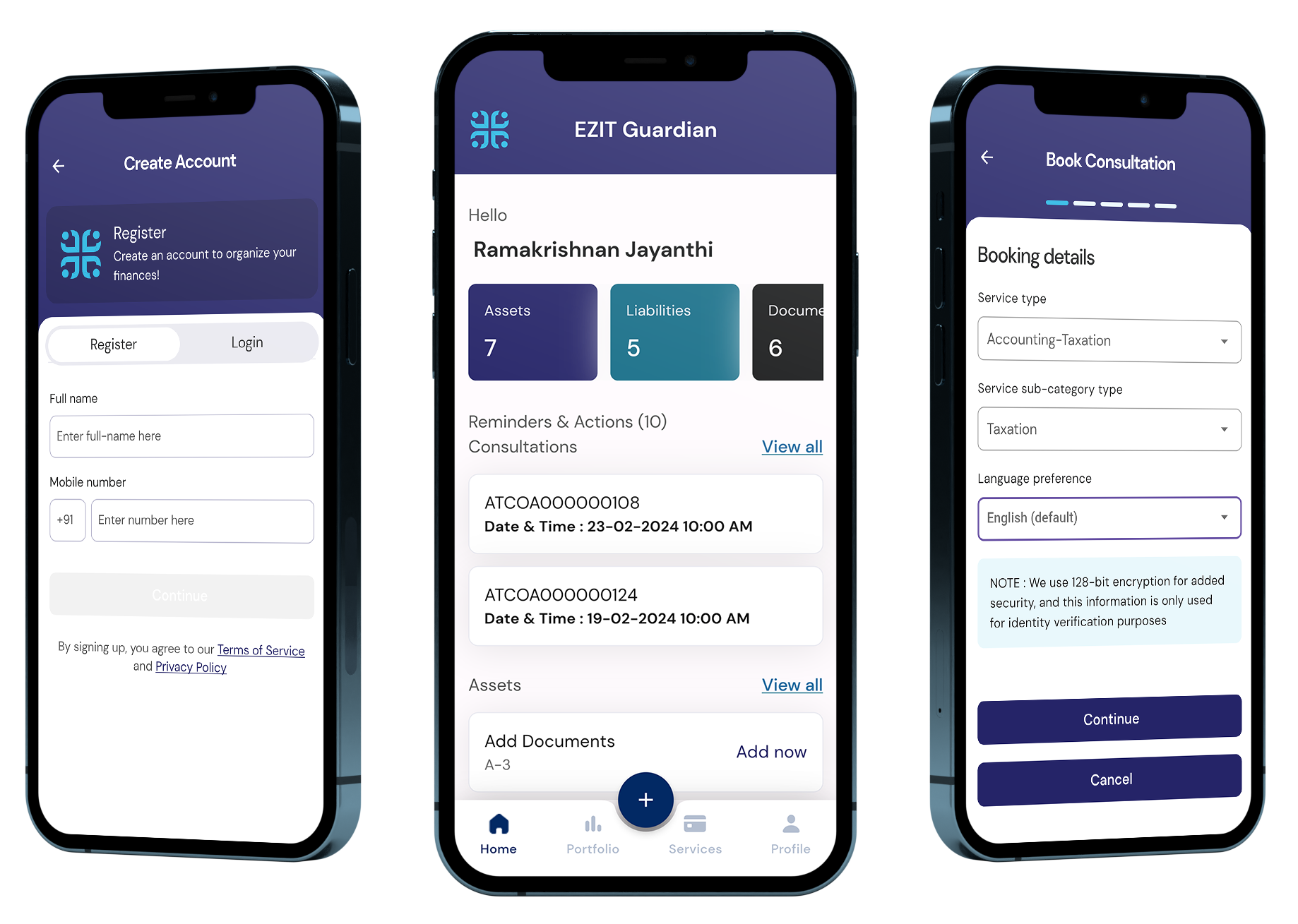

🚀Optimize Your Credit Score with EZIT

Understanding the factors affecting credit score is just the first step. To truly take control of your financial health, consider EZIT’s consultation services.

Don’t let hidden factors affecting credit score hinder your financial potential. Contact EZIT today for a free consultation and take the first step towards optimal credit health. Download the EZIT Guardian app from the Google Play Store & App Store today to schedule your appointment now. Let’s work together to master the factors affecting credit score and unlock your full financial potential!